Binance, the leading cryptocurrency exchange by volume has announced the launch of perpetual futures contracts for Blur, the governance token of the NFT marketplace. This development has led to mixed responses from large holders of the token, also known as whales. Binance revealed on April 27 that it would offer a perpetual futures contract for betting on the price of Blur against the stablecoin Tether, with up to 20x leverage. The Blur/USDT contract goes live today.

Whales’ contrasting moves on Blur tokens

Earlier today, one whale bought 1.39 million Blur governance tokens for one million USD Coin at an average price of $0.72 via decentralized exchange aggregator 1inch. On the other hand, another whale, identified as luggis.eth, sold 1.77 million BLUR for 1.2 million USDC at an average price of $0.68 per token, resulting in a loss of about $295,000, as noted by on-chain analyst Lookonchain on Twitter. Luggis.eth currently holds no Blur governance tokens. The current market price for Blur’s governance token stands at $0.72, according to data from Etherscan.

Blur faces declining volumes and user-friendliness issues

In recent weeks, Blur has experienced a drop in volumes, leading to claims that the NFT marketplace, targeted at professional traders, is not particularly user-friendly for mainstream NFT traders. One Twitter user commented on the platform’s temporary incentive program, which encouraged bidding rather than organic trading, saying, “It’s just been degens PvP’ing each other all year.”

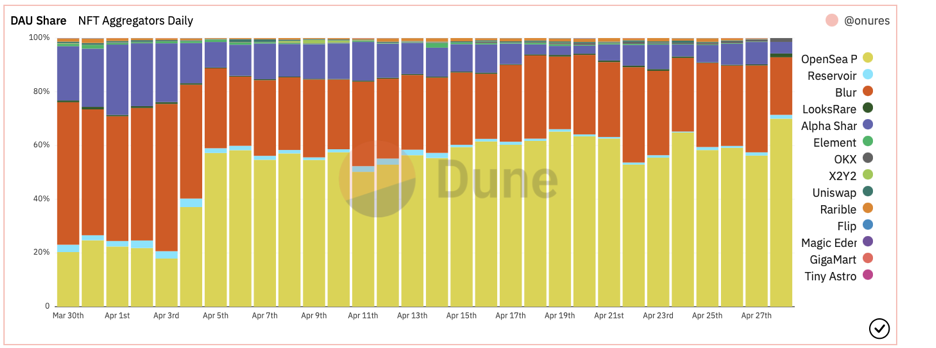

Rival NFT aggregator OpenSea Pro witnessed a significant increase in active addresses and transaction volumes following its launch, capturing the top share of transactions in a competitive market. OpenSea Pro’s share of daily active users has continued to grow since then, and data tracking platform Dune indicates it now accounts for 70% of the market.

Currently, Blur is ahead of OpenSea Pro in terms of daily volume share among NFT aggregators with a slight lead of 51% compared to OpenSea Pro’s 46%.