Bitcoin, the trailblazing digital currency, recently experienced a dip in value, coinciding with the World Economic Forum where Jamie Dimon, CEO of JPMorgan Chase, vocalized his perennial skepticism. Dimon’s remarks at Davos, describing Bitcoin as a “pet rock” and reinforcing his long-standing criticism, have stirred up the crypto community and market analysts alike.

Dimon’s Stance: A Blend of Skepticism and Indifference

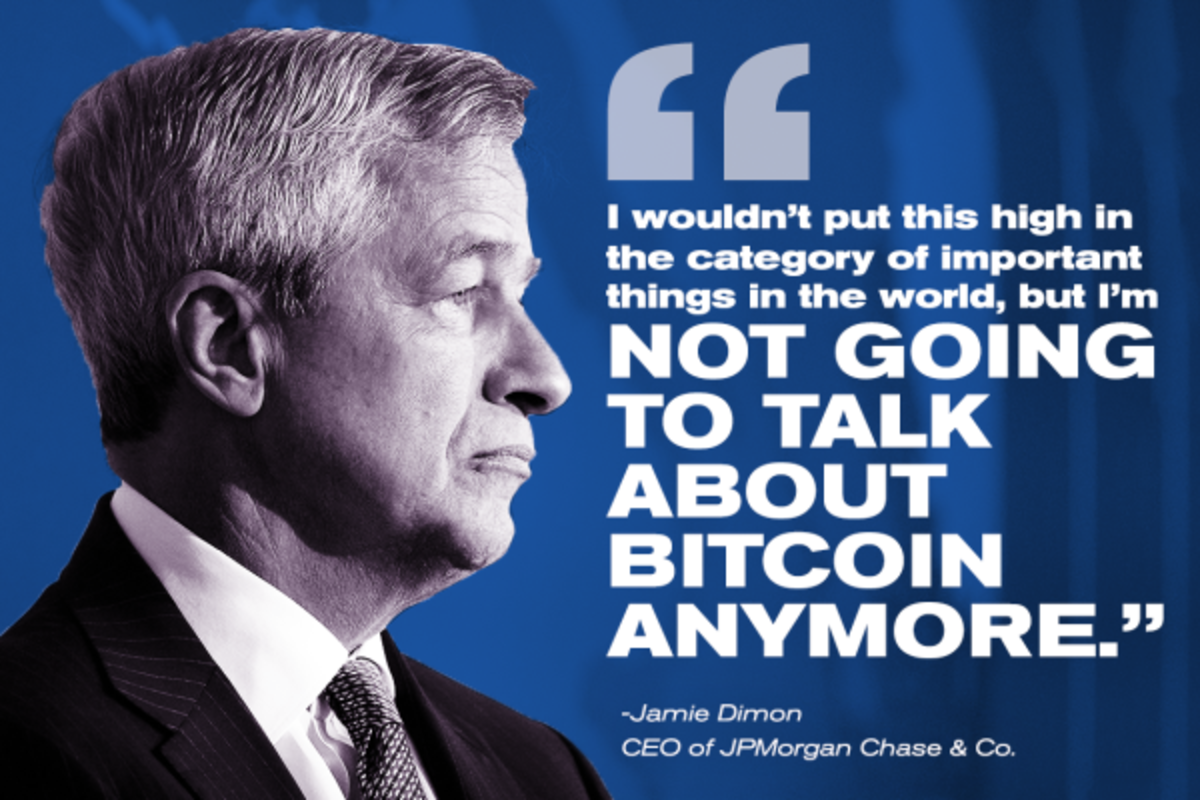

Dimon’s critical view of Bitcoin isn’t new. He has been a vocal critic for years, consistently questioning the cryptocurrency’s intrinsic value and utility. At Davos, Dimon reiterated his belief that Bitcoin’s primary uses are in activities like money laundering, tax evasion, and other illicit transactions. His assertion that Bitcoin “does nothing” reflects a deep-seated skepticism about its role as a legitimate financial asset.

While Dimon’s comments might seem harsh, they aren’t without a basis in the broader financial community’s concerns. Cryptocurrencies, in general, have faced scrutiny over their role in illegal activities due to the anonymity and lack of regulation that they offer. However, proponents of Bitcoin argue that these criticisms are outdated and ignore the cryptocurrency’s potential for innovation and financial inclusion.

Interestingly, Dimon’s indifference extends to the burgeoning sector of Bitcoin exchange-traded funds (ETFs). He expressed neutrality towards competitors embracing Bitcoin, suggesting that his disinterest is rooted not in fear of competition but in a genuine disbelief in Bitcoin’s utility. This stance places Dimon at odds with other financial leaders, like BlackRock’s Larry Fink, who have shown more openness to the potential of cryptocurrencies.

The Broader Implications of Dimon’s Critique

Dimon’s critique of Bitcoin goes beyond personal opinion; it reflects a larger debate in the financial world about the role and value of cryptocurrencies. While he acknowledges the reality of blockchain technology and its applications, he distinguishes sharply between cryptocurrencies that offer practical uses, like those enabling smart contracts, and Bitcoin, which he sees as lacking functional utility.

This debate touches on larger questions about the future of finance. Cryptocurrencies, led by Bitcoin, have introduced a paradigm shift, challenging traditional banking systems and offering a new form of asset. However, the volatility of Bitcoin and the regulatory uncertainties surrounding cryptocurrencies continue to fuel skepticism among established financial leaders like Dimon.

Dimon’s comments come at a time when Bitcoin and other cryptocurrencies are gaining institutional acceptance, evidenced by the launch of several Bitcoin ETFs by major asset management firms. This growing institutional interest contrasts sharply with Dimon’s dismissal, highlighting the divide in the financial sector over the legitimacy and future of cryptocurrencies.

In essence, Jamie Dimon’s issues with Bitcoin stem from a deep skepticism about its intrinsic value and utility, a stance that highlights the ongoing debate in the financial world about the role of cryptocurrencies. While Dimon remains unconvinced about Bitcoin’s merits, the cryptocurrency continues to gain traction in the broader market, indicating that this debate is far from settled. As the financial world evolves, the perspectives of industry leaders like Dimon will be critical in shaping the future of digital currencies and the global financial landscape.