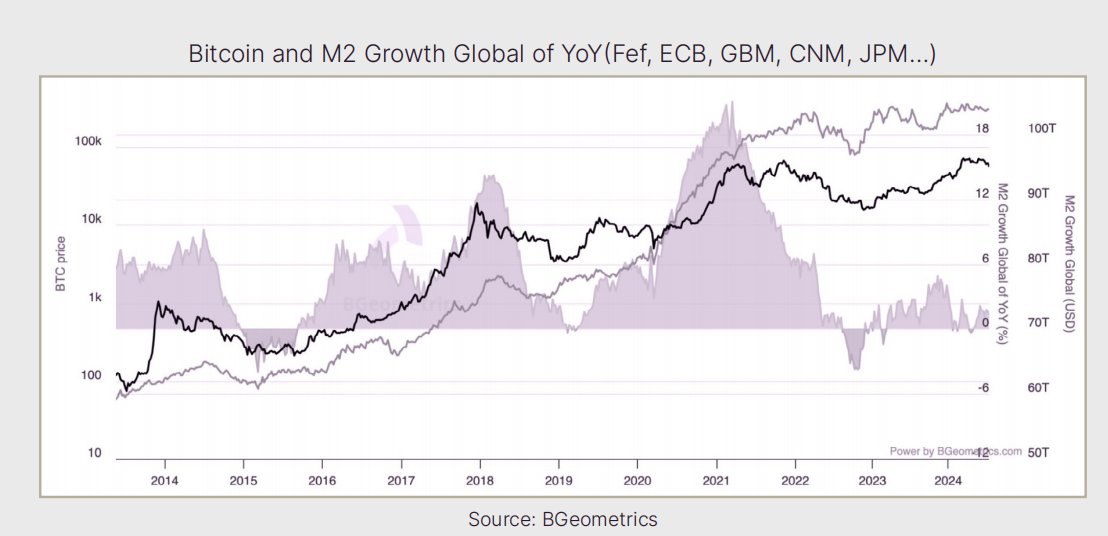

Bitcoin’s future is tied closely to global liquidity. M2 liquidity, which includes cash, public equities, government treasuries, and bonds, offers a good measure of this.

According to Two Prime’s Global Liquidity report, M2 liquidity trends help us understand Bitcoin’s price movements. Key contributors to M2 liquidity are US dollar liquidity, the People’s Bank of China (PBoC) liquidity, and bond volatility.

Two Prime’s report said that periods of M2 liquidity growth align with Bitcoin’s price increases, while drops in M2 liquidity correlate with price decreases.

The Pearson correlation coefficient between M2 liquidity and Bitcoin’s price is 0.854, with a p-value of .00162, showing a strong and significant correlation.

US and China

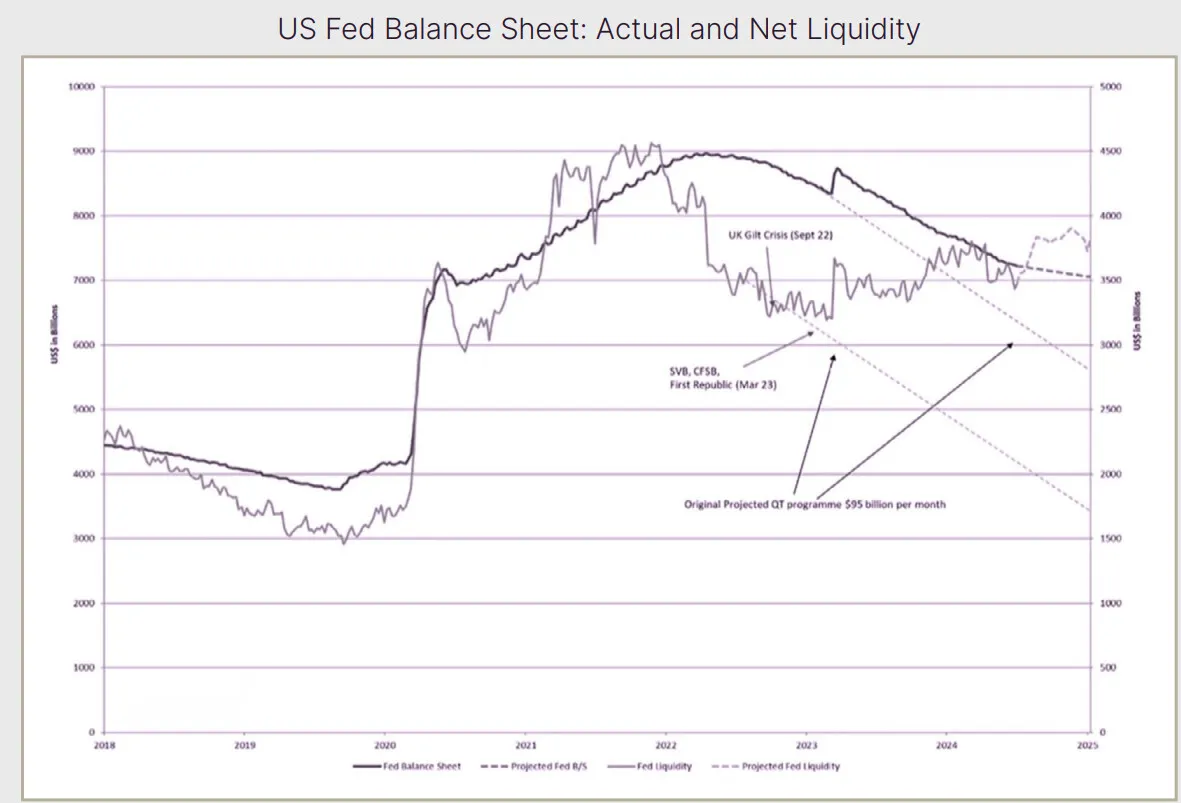

Looking at the US, M2 liquidity saw a slight dip in Q2 2024, from about $21 trillion to $20.8 trillion. This drop aligns with the Federal Reserve’s policies to control inflation.

The Fed’s tightening measures and reduced treasury repurchases balanced out, leading to this decrease. However, expectations for rate cuts later in 2024 suggest an increase in liquidity in the second half of the year.

Consumer Price Index (CPI), Personal Consumption Expenditures (PCE), real estate market trends, and unemployment claims point to easing inflation and a weakening economy, which could lead to more liquidity.

China, on the other hand, faces a tough situation with a collapsing real estate market, high inflation, and a stressed banking sector.

The PBoC added limited liquidity in 2024 after aggressive money printing in 2023. This slow rate of liquidity increase is because of several economic challenges.

Yet, a major credit event could force the PBoC to boost liquidity faster. The timing and likelihood of such an event are hard to predict.

Bond markets

Although expectations for rate cuts have dropped from three to one, bond market volatility remains high. This data doesn’t clearly show rising liquidity conditions but suggests that markets are cautious.

Despite the slight global liquidity increase year to date, Q2 2024 saw a “liquidity air pocket.” Still, with upcoming elections and efforts to maintain financial stability, an overall upward liquidity trend is expected for the second half of the year.

Central bank liquidity is important for Bitcoin investors, as it affects the flow of money into cryptos. Global liquidity first enters traditional financial markets before reaching Bitcoin and the others.

This flow can be tracked through ETFs, public market equities, stablecoins, and corporate treasuries. Bitcoin ETFs, for example, saw net inflows of $15.51 billion since their inception, with rapid inflows in Q1 2024 slowing down in Q2.

Institutional investors often drive these inflows through like basis trades, where they buy the spot asset and sell futures, collecting the premium at expiration. This doesn’t add new demand for Bitcoin, so it affects the net impact of ETF inflows.

Corporate treasuries

Public companies like Microstrategy and Coinbase also serve as indicators of Bitcoin’s market sentiment. Microstrategy, which holds Bitcoin as a treasury reserve, offers leveraged exposure to Bitcoin by issuing convertible debt instruments.

This has boosted its market cap and could inspire other companies to adopt similar practices in the near future. Coinbase, the leading American crypto exchange, provides indirect exposure to Bitcoin.

Its trading volumes and stock price can reflect the overall interest in crypto. The price of Coinbase stock can thus serve as a proxy for Bitcoin liquidity.

Bitcoin miners like Marathon and Riot also affect the market. These companies hold significant Bitcoin reserves, and their market cap is closely tied to Bitcoin’s price.

Miners’ decisions, like selling or holding their Bitcoin production, affect the market’s supply and demand dynamics. Stablecoins are another way for global liquidity to enter crypto markets.

The market cap of stablecoins, currently at $162.52 billion, correlates with M2 liquidity. Both USDT and USDC show how new liquidity flows into the market.

The rise of non-USD-backed stablecoins and potential bad actors in the space can disrupt this correlation, leading to market instability.