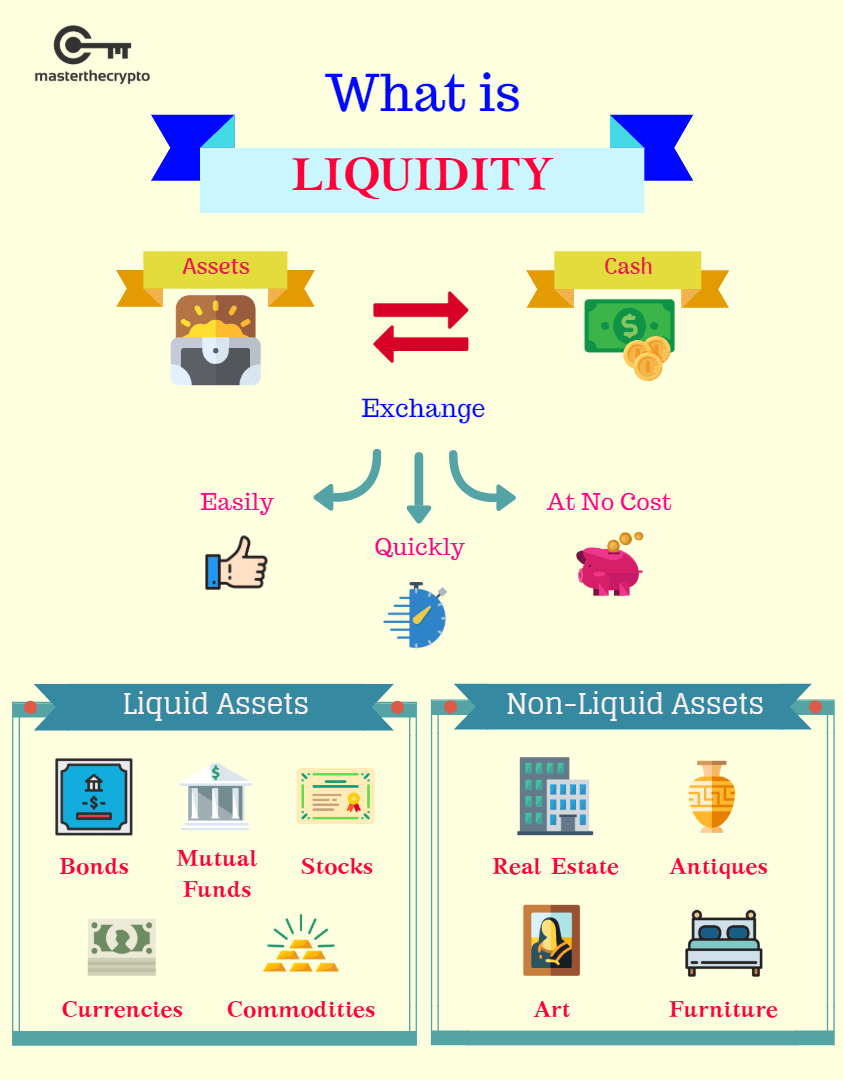

The concept of liquidity takes on unique significance within the dynamic realm of cryptocurrencies. Swift conversion of assets to cash without causing substantial price fluctuations is pivotal for ensuring market stability, health, and investor trust.

Significance of Liquidity in Crypto Exchanges

-

Price Stability

Ensuring stability through high liquidity minimizes the impact of sizable buy or sell orders. This fosters an environment that attracts participants and strengthens investor confidence.

-

Efficient Trading

Increased liquidity facilitates swift trade execution at desired prices, reducing trading costs. It will also enhance overall trading efficiency by enabling rapid position entry or exit.

-

Market Credibility

Exchanges boasting high liquidity levels are perceived as more reliable and trustworthy. This perception aids in expanding the cryptocurrency ecosystem by attracting a diverse user base, including institutional investors.

-

Market Health

Liquidity serves as a barometer for market health; low liquidity can lead to heightened volatility. This may complicate accurate price predictions and trade execution.

-

Token Value

Liquidity is instrumental in establishing and preserving the value of emerging cryptocurrencies. Insufficient liquidity may impede adoption and diminish the market value of a token.

Factors Shaping Liquidity in Crypto Exchanges

-

Trading Volume

Elevated trading volumes signify a consistent flow of assets, contributing to heightened liquidity. Active markets with abundant buy and sell orders facilitate smoother transactions.

-

Market Depth

Deeper markets, characterized by a broad range of prices and transactions, typically exhibit higher liquidity. This allows substantial transactions to push through without significantly impacting asset prices.

-

Trading Pairs

The availability of popular and widely traded pairs contributes to improved liquidity. Compared to less commonly traded pairs, well-known trading pairs influence overall liquidity in an exchange.

-

Market Makers and Providers

Market makers and liquidity providers facilitate trades through constant buy and sell orders. Their presence plays a significant role in determining an exchange’s liquidity.

-

Market Sentiment and Stability

Factors such as market sentiment, regulatory changes, and the overall stability of the cryptocurrency market influence liquidity. Moreover, regulatory uncertainties can impact trading behavior on exchanges.

Types of Liquidity in the Crypto Sphere

-

Exchange Liquidity - Encompasses the availability of buy and sell orders for various trading pairs on a specific cryptocurrency exchange.

-

Asset Liquidity - Reflects the depth and volume of a cryptocurrency's market, indicating the ease of buying or selling a particular coin across multiple exchanges.

-

Network Liquidity - Impacted by transaction fees and congestion, it pertains to a blockchain network's ability to handle transactions swiftly.

-

DeFi Liquidity - Specific to decentralized finance (DeFi) protocols, it involves user-contributed liquidity pools facilitating decentralized trading, borrowing, and lending.

-

Stablecoin Liquidity - Focuses on stablecoins, ensuring they maintain a consistent value and sufficient supply for easy exchange.

Challenges of Liquidity on Crypto Exchanges

Several challenges may arise when the liquidity of a crypto exchange decreases. These include wider bid-ask spreads, increased price volatility, manipulation risks, and the potential for liquidity crises in volatile markets.

High Liquidity Means High Success Rate

A comprehensive understanding of liquidity in the cryptocurrency space is essential for cultivating a stable, efficient, and attractive trading environment. Addressing challenges and implementing strategic initiatives empowers crypto exchanges to elevate liquidity levels, attract diverse participants, and contribute to the sustained growth of the cryptocurrency ecosystem.

About LayerK

LayerK is a tech company that combines state-of-the-art hardware and innovative software to empower individuals and businesses to become participants in tomorrow’s digital economy. Our cutting-edge solutions leverage advanced computing and blockchain technology to pave the way for a future of individual independence.

Learn more about the LayerK ecosystem by visiting our website or following us on our social media accounts.

Website 🔗 https://layerk.com/

Telegram | Facebook | Instagram | Twitter | YouTube

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.