In a resounding testament to its formidable standing in the tech domain, Super Micro Computer, the renowned seller of AI-optimized servers, is poised to ascend to new heights as it prepares to join the illustrious ranks of the S&P 500. News of Super Micro’s impending inclusion in this esteemed index ignited a fervent surge in its stock value, propelling it skyward by an impressive 13.5% in extended trade on Friday, March 1.

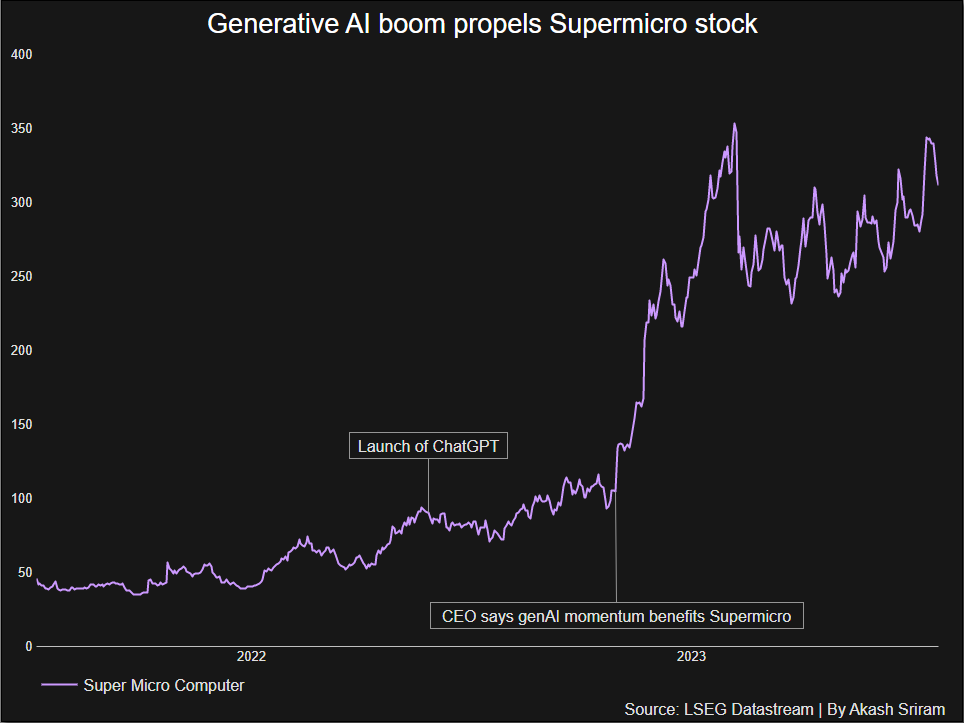

Super Micro’s meteoric rise

In a significant development for the tech industry, Super Micro Computer experienced a meteoric surge in its share value, soaring by an astounding 13.5% in extended trade following the announcement of its imminent inclusion in the S&P 500. The S&P Dow Jones Indices, in a news release, disclosed that both Super Micro and Deckers Outdoor Corp are slated to join the esteemed index, marking a monumental milestone for the companies.

This move, scheduled to take effect prior to the commencement of trading on Monday, March 18, aligns with the quarterly rebalance of the S&P 500, ushering in a new era for Wall Street’s most closely monitored stock benchmark.

The inclusion of Super Micro and Deckers Outdoor Corp in the S&P 500 heralds a paradigm shift in the realm of technology investments, underscoring the burgeoning significance of AI-optimized servers in the contemporary tech landscape. With Super Micro’s unparalleled expertise in crafting high-end servers integrated with Nvidia’s cutting-edge AI processors, the company’s ascension to the S&P 500 not only validates its market dominance but also underscores the pivotal role of AI technology in driving innovation across industries.

Index funds tracking the S&P 500, managing assets totaling approximately $7.8 trillion, are now compelled to integrate shares of Super Micro and Deckers into their portfolios to maintain alignment with the index’s revised composition, signifying a substantial influx of investment into these companies.

Market response and speculation around Super Micro shares

The anticipation of Super Micro’s inclusion in the S&P 500 has been palpable, fueled by the company’s staggering growth trajectory and burgeoning market value, which has exceeded $50 billion. Investors, recognizing the seismic implications of this development, engaged in frenzied trading activities, exchanging nearly $10 billion worth of Super Micro’s shares on Friday alone, eclipsing trading volumes of industry giants such as Microsoft and Amazon.

The surge in after-hours trading further bolstered Super Micro’s remarkable performance, augmenting its gains by an additional 4.5% during Friday’s trading session. Meanwhile, Deckers Outdoor Corp, the other entity slated for inclusion, witnessed a notable uptick of 2.7% in extended trade, contrasting with declines observed in outgoing components Whirlpool Corp and Zion Bancorporation, which dipped by 1.7% and 2% respectively.

As Super Micro Computer prepares to assume its rightful place among the elite constituents of the S&P 500, one cannot help but ponder the implications of this transformative milestone. With its stock surging to unprecedented heights and the tech industry brimming with anticipation, the question lingers: Will Super Micro’s inclusion in the S&P 500 pave the way for a new era of innovation and market dominance in the realm of AI-optimized servers?

As Super Micro Computer ascends to the echelons of the S&P 500, investors eagerly await the unfolding of its next chapter, poised on the precipice of potential breakthroughs and market triumphs. Amidst the fervent speculation and heightened anticipation, the stage is set for Super Micro to redefine the contours of technological advancement and corporate success.