Coinspeaker

What’s behind 8% Ethereum Price Rally Ahead of ETH Options Expiry?

Along with Bitcoin, the world’s second-largest cryptocurrency Ethereum (ETH) has registered strong gains surging more than 8% in the last 24 hours and shooting past $2,650 levels. The asset class has already recovered more than 30% from the sub $2,000 levels earlier this week during the Black Monday crash.

Both BTC and ETH share a correlation index of 0.82 over a 90-day period. This suggests that the two asset classes are moving in lockstep with each other. In this broader market recovery, blockchain analytics platform Santiment reported that Bitcoin and Ethereum remain the preferred choice for investors.

🗣️📊 Bitcoin and Ethereum have unsurprisingly been the crowd's primary focus. But as crypto price rebounds have taken place, it's the more speculative assets that are surging while the crowd ignores them.

Trading 101: Buy the dip in times and sectors where the crowd isn't. 👍 pic.twitter.com/CXGTI6GsrJ

— Santiment (@santimentfeed) August 5, 2024

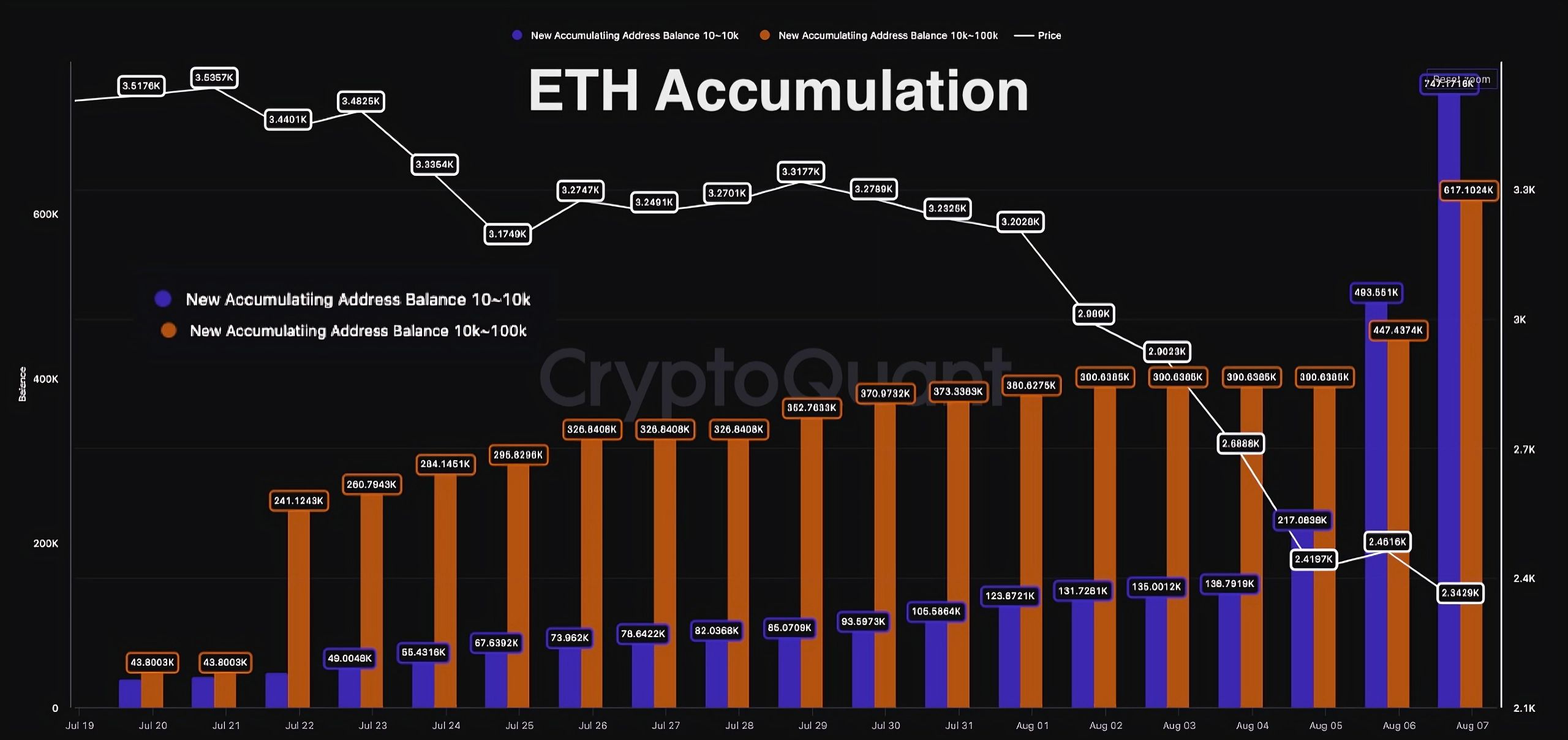

Also, the Ethereum addresses added a massive 757,000 ETH during the recent price dip showing a strong accumulation trend during the correction. According to an on-chain data aggregator, Ethereum accumulation addresses holding between 10-10K ETH and 10K-100K ETH have steadily increased their allocations since July.

As shown in the chart below, big addresses absorbed a large number of Ethereum after Monday’s lows. It shows that addresses with balances of 10 to 10K holdings added a total of 530K ETH. On the other hand, addresses holding 10K and 100K added a total of 227K ETH after the 5th of August.

Photo: CryptoQuant

Ethereum (ETH) Options Expiry and Price Trajectory Ahead

Today, August 9, a total of 206,000 ETH options are set to expire with a put call ratio of 0.96 highlighting a closely contested battle between the bulls and the bears. The options have a max pain point of $2,950 and a notional value of $560 million, reflecting the substantial market interest and potential impact on Ethereum’s price dynamics.

Still believe this to be the case and as previously mentioned I don't think $ETH get's through the red zone on the first go, so thinking we probs see something like this.

Contingent on $BTC rejecting somewhere between here and 69k. https://t.co/kjSg0C6cHi pic.twitter.com/01FDoICRe7

— CrediBULL Crypto (@CredibleCrypto) August 8, 2024

Amid this sharp recovery in the ETH price, analysts are expecting sideways consolidation over the next few weeks. CrediBULL Crypto, a well-known crypto trader, predicts that Ethereum may experience “one more marginal lower low”, potentially retesting support at $2,111. He pointed out Ethereum’s relative weakness compared to Bitcoin as a key factor, suggesting that a minor correction in BTC could lead to a more significant decline for ETH.

What’s behind 8% Ethereum Price Rally Ahead of ETH Options Expiry?