Asian investors are charging into 2025 with their eyes glued to three major themes: the relentless power of the U.S. dollar, the unstoppable rise of crypto, and Donald Trump’s chaotic trade policies.

Everyone from Wall Street brokers to regional fund managers is scrambling to reposition portfolios for what’s shaping up to be a rollercoaster year for Asia.

Global funds are playing it smart. They’re blending old-school strategies with the new economy. The goal? To shield Asian assets from the fallout of America’s unpredictable policies.

Dollar-denominated debt has become the darling of the moment, delivering stable returns despite the greenback’s rampage through 2024. Meanwhile, gold refuses to go out of style, holding tight to its reputation as the ultimate safety net for jittery investors.

China: Stimulus-fueled bets and a tariff-shaped battlefield

China is throwing money at its economic problems, and investors are paying attention. Beijing’s top brass pledged to pump even more fiscal stimulus into the system, ramping up government spending to counter the impact of looming U.S. tariffs.

The Central Economic Work Conference set the stage, and the Politburo wasted no time committing to boosting consumption as a defense against export risks.

For investors, the game plan is clear. Fidelity suggests betting on Chinese onshore equities, which are more tied to domestic policy than export risks.

UBS strategists are all about bank shares. Why? They’re dirt cheap and pay solid dividends, making them a rare shelter in a stormy macroeconomic climate.

But it’s not just stocks. Debt is back in the spotlight. Morgan Stanley likes Chinese debt swaps to dodge currency risks, while Goldman Sachs is calling dibs on mid-range sovereign bonds.

These picks reflect expectations that China’s stimulus spree could flood the market with longer-term debt, creating opportunities in the belly of the curve.

India: Manufacturing shift and strong growth vibes

While China fights off slowing growth, India is becoming an alternative manufacturing hub. With its economy largely shielded from global risks, India’s domestic market is looking better than ever.

Analysts at Eastspring Investments are betting big on large-cap stocks, particularly in healthcare, telecom, and financials. But they’re not ignoring the risks. High valuations and a recent earnings slowdown are casting a shadow over the optimism.

Local bonds are the golden child here, thanks to low external debt and India’s inclusion in global bond indices. But the real kicker is the long-term game.

Rising urbanization, ongoing reforms, and supply chain shifts are fueling optimism. India’s demographics and steady growth are doing the heavy lifting, even as short-term challenges linger.

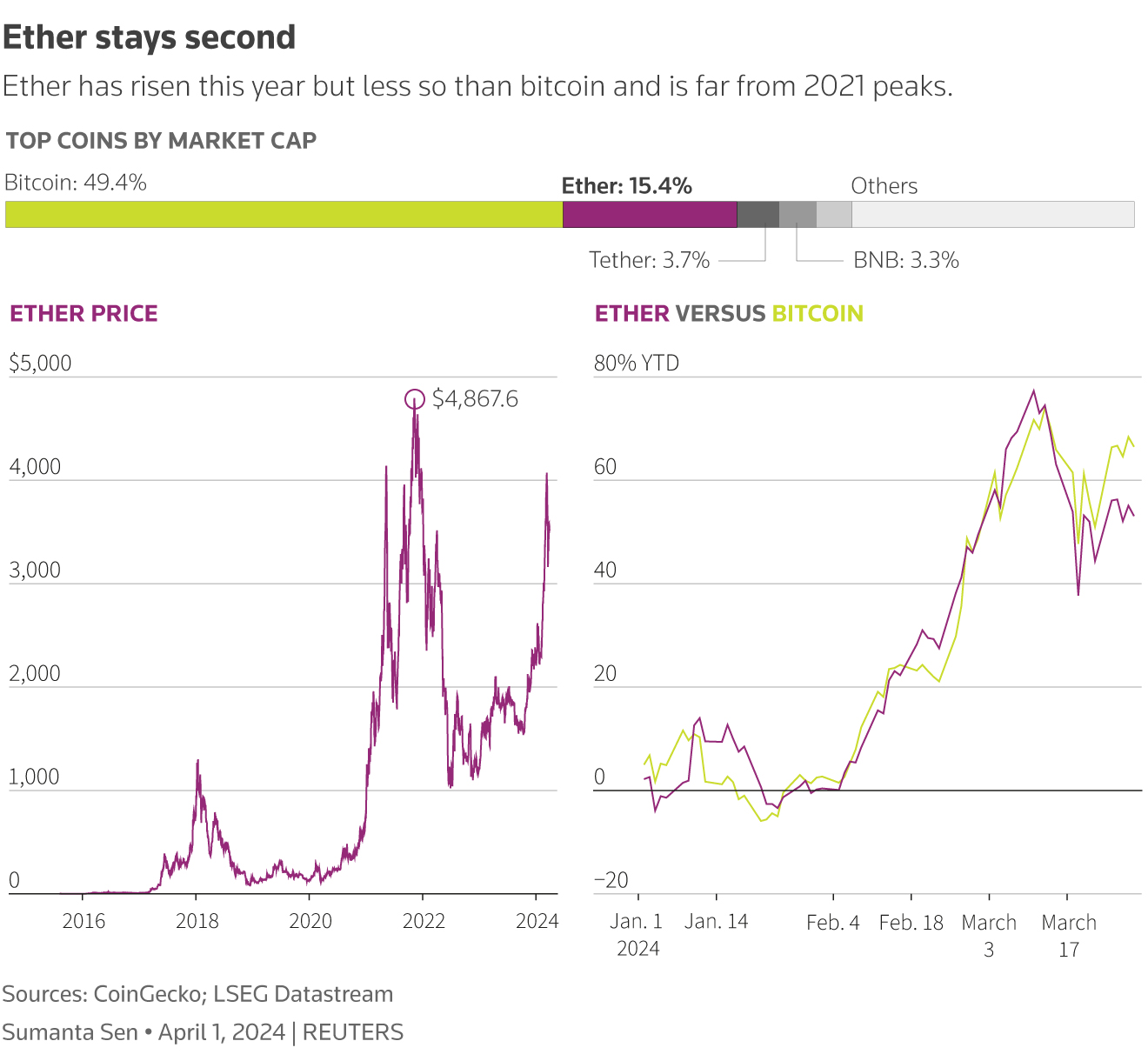

Crypto’s electric rise

Now let’s talk crypto, the true wild card in Asia’s 2025 playbook. Central and Southern Asia, along with Oceania, have taken the global lead in crypto adoption just as king Bitcoin smashed past $100,000 for the first time ever.

Seven of the top 20 nations for centralized and decentralized finance activity hail from this corner of the world. Indonesia is leading the charge. Between January and October this year, it racked up $30 billion in crypto transactions. That’s a jaw-dropping 350% increase over the same period in 2023.

It’s not just about retail traders either. Institutional adoption is gaining traction, with ZA Bank in Hong Kong now offering direct crypto trading to retail clients. Meanwhile, Japan’s AEON is rolling out crypto QR payment systems on Binance’s BNB Chain.

Southeast Asia: The quiet powerhouse

Meanwhile, Southeast Asia is quietly stealing the show, thanks to its manufacturing boom and stable economies. Indonesia is the poster child here, with a strong domestic market, a resilient commodities sector, and a central bank laser-focused on keeping the currency stable.

Sovereign bonds, particularly dollar-denominated ones, are getting love from big players like Amundi and Fidelity.

Vietnam isn’t far behind. It’s carving out its spot as a global export powerhouse, and its potential inclusion in the FTSE Emerging Market Index is making investors sit up and take notice.

This is a region where smart money sees long-term growth, even as global headwinds threaten to disrupt supply chains. High-yield bonds are the name of the game for risk-tolerant investors.

Markets like Sri Lanka and Pakistan are drawing interest for their insulation from trade wars.

UBS Asset Management says it’s all about finding credits that dodge tariff headlines, making frontier markets an unexpected haven.

The dollar and the yen: A battle of currencies

Let’s circle back to the dollar, Asia’s persistent headache. For the fifth year running, the greenback is dominating regional currencies, shaving off three percentage points from local currency bond returns in 2024 alone.

The Bank of Japan’s divergence from G-10 peers has made the yen a standout trade for 2025. Portfolio managers like Carol Lye of Brandywine Global are betting big on this divergence, seeing it as a hedge against Trump-induced volatility.

For other regional currencies, the picture is bleak. With limited room for further monetary easing, central banks in Asia are stuck between a rock and a hard place. It’s a problem with no easy fix, and investors are bracing for more pain as the dollar refuses to back down.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan