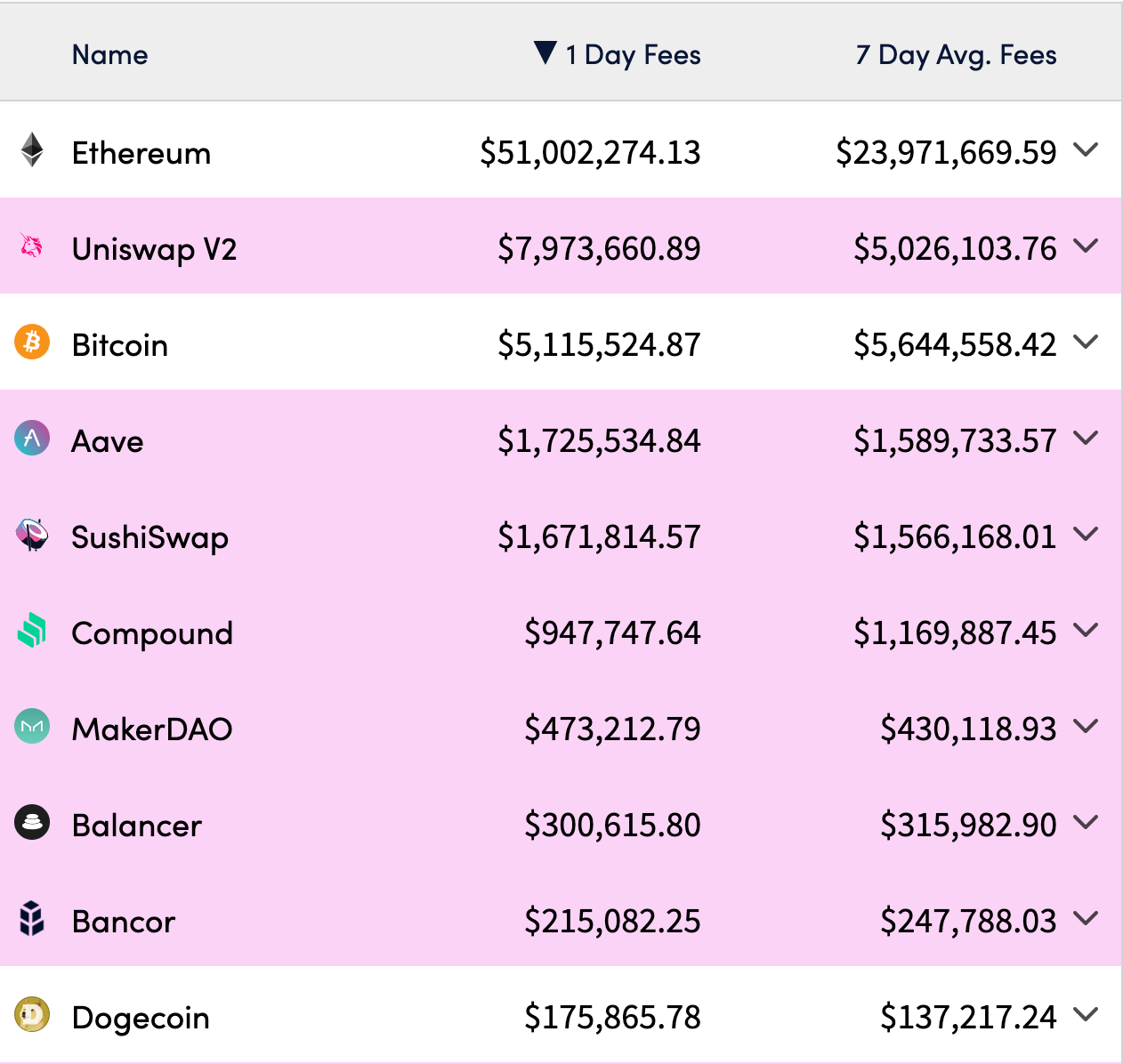

Fees on crypto protocols serve as a proxy to determine a protocol’s activity and gauge the effects of the bull market. DeFi protocols and platforms measure user counts and extraordinary activity days through fees.

There is no doubt that Bitcoin and Ethereum make the most fees each day based on the size of their network. Based on mining or rewarding block producers, those chains also have expenses built into them. Ethereum is the leader with more than $5.6M in average daily fees, while Bitcoin produces more value through block rewards.

Read: Three Ways to Avoid Fees Eating into Your Crypto Trading Profits

For smaller projects, fees reflect a more complex picture, mapping behaviors like trading, staking, mints, identity features, and other Web3 use cases. Fees in this context reflect a project’s applications beyond simple payments and transactions.

High fees single out the most used blockchains during the 2024 market. Those include Binance Smart Chain, Arbitrum One, Optimism, and Polygon.

The most active DEX and liquidity staking protocols have the highest fees. These include Uniswap, Sushi Swap, Aave, Maker, Kyberswap, Curve, and Trader Joe.

Dogecoin is an honorable mention. It is still active on its main net and used for transfers between wallets, exchanges, or other protocols. The low fees make Dogecoin still attractive to use as a main net asset despite the lack of scaling. Dogecoin also rises without a boost from native DeFi or DEX apps.

Which protocols are the most expensive for users?

Most protocols aim to offer negligible fees and earn from volumes, but some incur higher costs for each user.

Cross-matching daily active users with daily fees gives a diverse picture of fees per user. Ethereum clocks in at above $14 in fees per average user among commonly used networks. On-chain derivative trading is also expensive, with the average user paying fees above $300.

There is also a significant divide between active networks with multiple small users and others in which a handful of whales pay much larger fees.

Base, Telegram, and Solana are the cheapest protocols per user, which fulfill their promise of scaling and mass adoption.

Fees also reflect the leader status of a trend. Lido Finance takes in around 50% of all fees in liquid staking, reaching $3.6M daily. For some projects, like Maker DAO and Ethena, fees are unpredictable, and some trading days have outsized gains during mints or special events.

Also read: Best crypto exchanges for US residents: How to choose the best

Aave is the biggest fee producer among lending protocols, with $1.36M in fees. Uniswap brings $2.75M in daily fees, a leader among DEX protocols. Convex Finance takes up most of the fees in asset management, making up to $177K per day.

Bridges and NFT markets are relatively cheap, as DeBridge takes about $45K daily fees. OpenSea, the leading NFT market, generates $54.7K in daily fees, even during the slow phase of NFT trading.

Which services grow or fail based on fees?

Fees may also signal which crypto narratives are on the way out. Friend.tech, once a booming social media with Web3 elements, went past its prime performance, sinking to $4.6K in total daily fees.

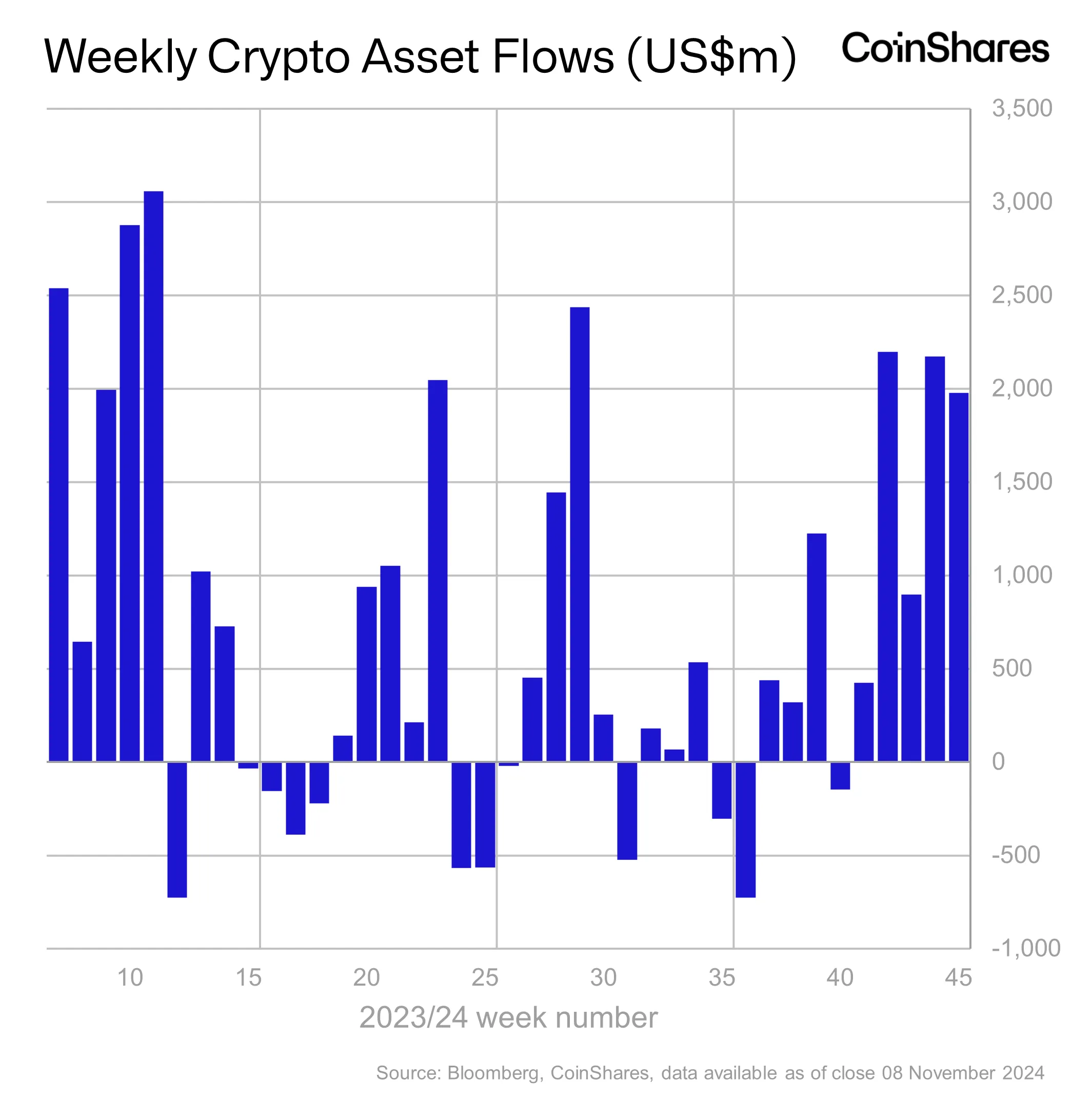

Ethereum, with its rather unpredictable fees, is leading the growth of L1 income for miners. L1 chains accelerated their fees since the end of May. Briefly, the TRON network surpassed Ethereum’s total fees while remaining cheap for individual users.

Ethereum fees also exceeded the average in June, reaching more than $9.4M in 24 hours. Despite its activity and popularity, the Telegram network draws in much lower fees, totaling $156K in the past 24 hours.

Source: Token Terminal

The on-chain derivatives market is one of the most active regarding fees. Led by GMX, the market runs at a robust baseline with $500K to $1M in average daily fees. On outlier days, total fees for on-chain derivatives reach closer to $5M.

Crypto and blockchain protocols vary in structure, and some fees may significantly cut into earnings. To compare, the average Visa card fee is up to $3.96 per purchase, usually taken from merchants. Crypto fees are low, but they may make it difficult for small-scale users to participate in DeFi services, favoring larger investors.

Cryptopolitan reporting by Hristina Vasileva