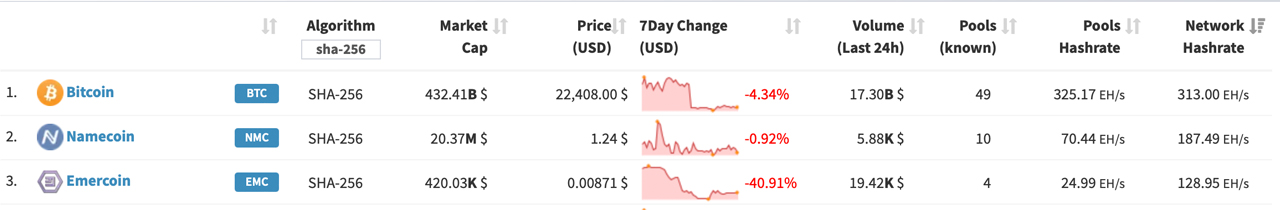

In recent times, Bitcoin’s hashrate has been consistently above 300 exahash per second (EH/s) as multiple mining pools dedicate significant hashpower to the Bitcoin blockchain today. Interestingly, some of the world’s top bitcoin mining pools are also using their hashrate to merge-mine other coins, and these networks have benefited from bitcoin’s increased hashrate.

How Bitcoin’s Hashrate Benefits Other Crypto Networks

Bitcoin’s hashrate secures the network and provides rewards for miners participating in the system, but mining pools also dedicate computational power to networks like Namecoin, Elastos, Emercoin, and Vcash. For example, Namecoin has a hashrate of around 187 EH/s today, and some of the top bitcoin mining pools merge-mine the network to acquire namecoin (NMC) rewards.

Merge mining is a process in which miners can mine various cryptocurrencies at the same time without any additional cost. Merged mining is similar to a person playing Pac-Man and Asteroids at the same time, using the same joystick and earning rewards for both games. Namecoin was the first cryptocurrency project to be merge-mined, as it shares the same SHA256 algorithm as Bitcoin, and the first merge-mined block on the network was mined on Sept. 19, 2011.

Bitcoin pools that dedicate hashrate to the Namecoin chain include F2pool, Viabtc, Poolin, and Mining Dutch. While F2pool is the fourth largest bitcoin mining pool over the last three days, it’s the largest namecoin miner as it dedicates its entire 44 EH/s to the Namecoin network. Viabtc dedicates 26.25 EH/s to the Namecoin chain, and Poolin points 5.10 EH/s toward Namecoin as well. At the time of writing, a single namecoin (NMC) is worth $1.24 per unit and 12.5 NMC plus fees are distributed in each block reward.

Namecoin has the second-largest hashrate among SHA256 blockchains, but the Emercoin (EMC) network is the third-largest under BTC and NMC. EMC has 93.38 EH/s dedicated to the network, and Mining Dutch and Viabtc are the top miners for the coin. Viabtc, which is BTC’s fifth-largest mining pool by hashrate, also dedicates 26.76 EH/s to EMC. The Emercoin network leverages a hybrid proof-of-work (PoW) and proof-of-stake (PoS) consensus mechanism. A single emercoin (EMC) is currently changing hands for $0.0088 per coin.

Meanwhile, Viabtc dedicates the same amount of hashrate to the Syscoin (SYS) network, another hybrid PoW and PoS blockchain. Today, a single SYS trades for $0.167 against the U.S. dollar. In addition to the aforementioned PoW cryptocurrencies that leverage the SHA256 consensus algorithm, miners are also dedicating hashrate to networks such as Xaya, Veil, Hathor, Elastos, and Vcash. Older cryptocurrency networks like Terracoin (TRC) and Unobtanium (UNO) also see a small fraction of SHA256 hashrate.

F2pool dedicates 44.32 EH/s to Vcash, but the coin’s native asset has no listed value on any of the top coin market aggregation sites. Elastos has over 100 exahash dedicated to the chain, and top mining pools like Antpool, F2pool, Viabtc, and Mining Dutch are dedicating hashrate to the Elastos network. Current statistics further show that 100 exahash per second is also dedicated to the RSK smart contract network.

What do you think the future holds for merge mining and the relationships between different blockchain networks? Share your thoughts in the comments section below.