In a post on X, Pierre Rochard, Vice President of Research at Riot Platforms (NASDAQ: RIOT), stirred the waters with his interpretation of the US government’s stance on Bitcoin. Citing President Biden’s 2025 budget, Rochard suggested on social media platform X, “BREAKING Biden’s 2025 budget is very bullish on Bitcoin, the White House expects $250k by 2035. They are counting on it for their tax revenues!”

BREAKING

Biden's 2025 budget is very bullish on #Bitcoin , the White House expects $250k by 2035.

They are counting on it for their tax revenues! pic.twitter.com/JOipF3PKpG

— Pierre Rochard (@BitcoinPierre) March 11, 2024

This claim has sparked a wide range of reactions within the crypto community, considering the implications it might have for the future of digital assets. Rochard’s assertion is rooted in his analysis of the US government’s anticipated revenue from digital asset regulation and taxation.

He contends that the projections embedded within the budget documentation implicitly support a bullish outlook for Bitcoin, projecting its value to soar to $250,000 by 2034-2035. However, his interpretation has not gone unchallenged.

Rochard got community noted by X users. “The WH Budget does not contain Bitcoin price projections, only potential revenue from increased regulation and taxation of digital assets in general.”

Zack Guzmán, among others, pointed out potential misinterpretations in Rochard’s analysis, particularly questioning the validity of visual aids used to support his claims. Guzmán remarked, “This is the real page 160 of the White House Budget. (The White House would not put the bitcoin logo over the White House)”.

Does The Biden Administration Really Forecast $250,000 Per Bitcoin?

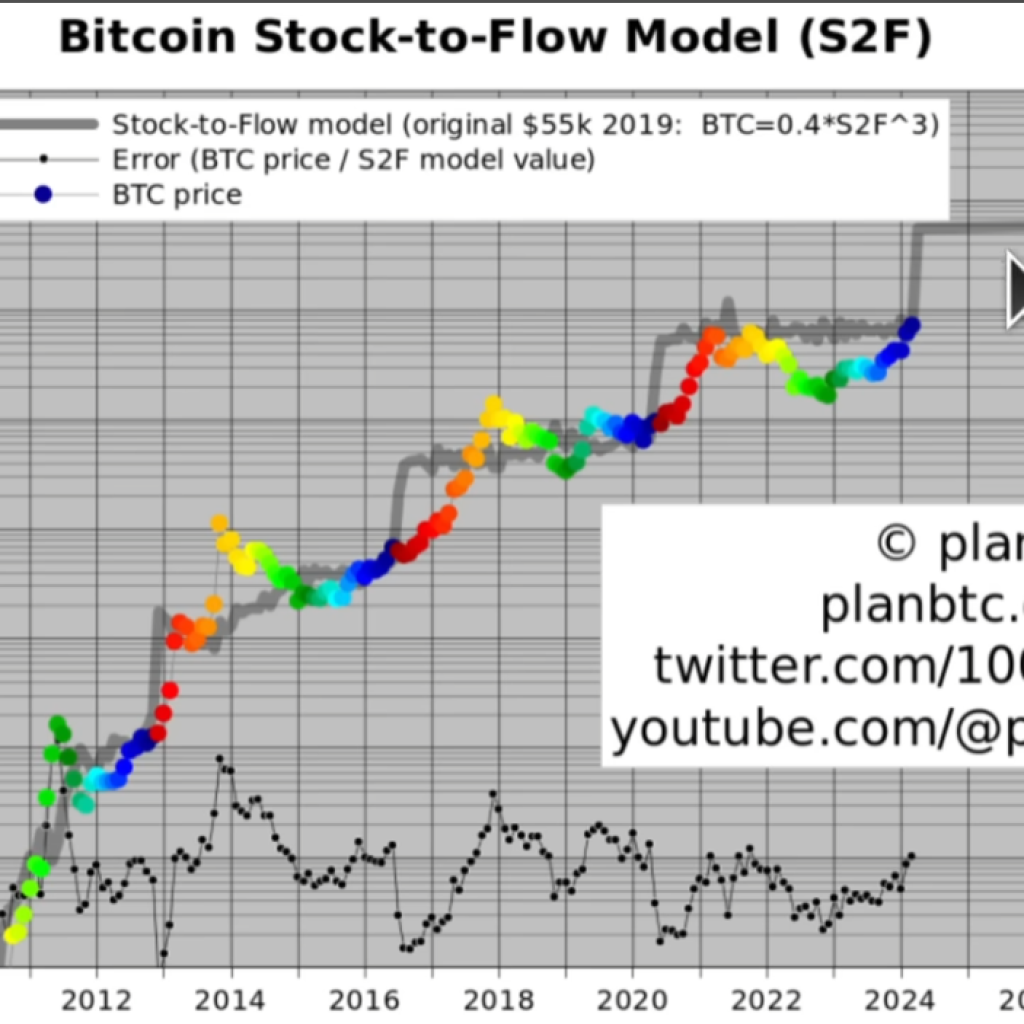

Responding to criticisms and clarifications regarding the nature of his claims, Rochard emphasized the analytical basis of his projections. He stated, “I made the graphs myself to illustrate the bullishness. […] Run the numbers, you think money grows on trees? […] Few understand the relationship between trade volume, taxes, and BTC price.”

Further defending his stance, Rochard argued that his analysis was meant to shed light on the optimistic fiscal assumptions regarding digital assets, rather than misrepresent official government documents.

“The community note is a non-sequitur, I never claimed the image was part of the President’s budget. Obviously it’s a collage to illustrate the assumptions behind the tax revenue. That aside, it’s notable that the White House isn’t just bullish, they are YoY increasingly bullish,” he remarked.

Rochard also accused the White House of painting an overly rosy picture of future tax revenues from digital assets, suggesting a strategic inflation of projections. “I would actually argue that the White House is misleading in this scenario, there’s no way they are actually this bullish. They artificially inflated the fiat tax revenue numbers to make it look better, this is part of their overall attack on Bitcoin.”

In a further bold claim, Rochard extrapolated from the budget’s implications a future where the Bitcoin mining industry in the United States could experience exponential growth. “BREAKING Biden expects the Bitcoin mining industry to 10x in the United States over the next decade, this would imply a $6 million price target for BTC. Even more bullish than the wash trading line item. American dynamism and energy abundance will make this possible!”

Notably, the White House’s proposed budget indeed outlines a series of regulatory and taxation measures targeting the digital asset sector, aiming to harness a projected $10 billion in revenue by 2025 from this burgeoning market. The budget’s focus includes the implementation of wash trading rules, a 30% tax on crypto mining, and other regulations intended to streamline the tax treatment of digital assets and close loopholes that favor specific investor demographics.

At press time, BTC traded at $71,816.