Bitcoin is a digital currency that has been growing in popularity and usage since its launch in

1. As more people invest in Bitcoin, the question of who owns the most Bitcoin has become increasingly important. Onchain data can provide some insight into this question, as it shows who holds the highest percentage of Bitcoin. This article will look at who owns the most Bitcoin according to Onchain data, as well as how much they own. Additionally, we’ll examine how these holdings have changed over time, and what this means for the future of Bitcoin.

An Overview of Who Owns the Most Bitcoin According to Onchain Data

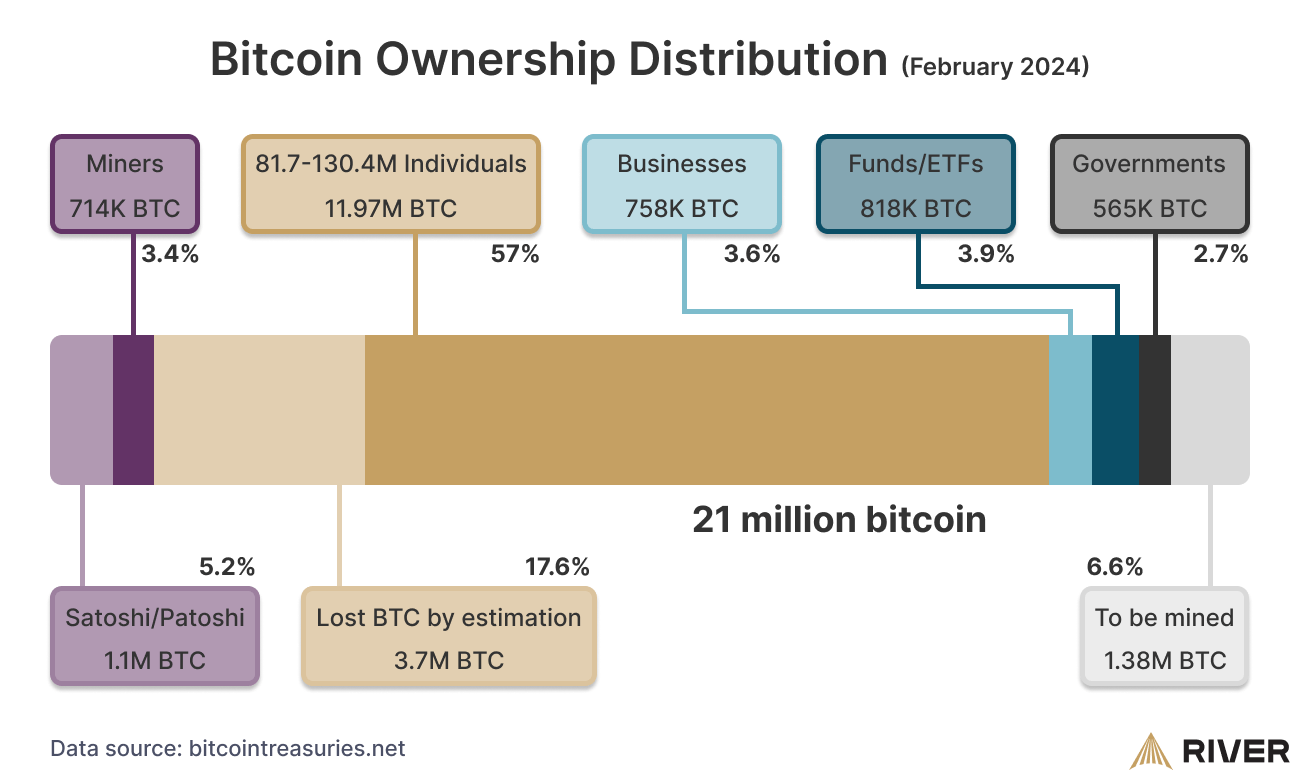

According to onchain data, the top 10 Bitcoin owners, collectively referred to as “whales”, are estimated to own between 1.3 million and 1.7 million Bitcoin. These whales, comprised of individuals and entities, represent a fraction of the total number of Bitcoin holders, yet they control a majority of the total Bitcoin circulating supply. The largest known individual Bitcoin owner is believed to be Satoshi Nakamoto, the anonymous creator of Bitcoin, who is estimated to own 980,000 Bitcoin. This is followed by the Winklevoss twins, who own an estimated 1% of all Bitcoin in circulation. Other major whales include cryptocurrency exchanges, venture capitalists, and private investors. The concentration of Bitcoin ownership among a few whales is a point of concern for many in the cryptocurrency space. These whales can manipulate the Bitcoin market by buying and selling large amounts at any given time, potentially impacting prices. This is why it is important for Bitcoin to become more decentralized, allowing for more people to own and use the digital currency. Ultimately, it is difficult to accurately determine who owns the most Bitcoin due to the anonymous nature of the cryptocurrency. However, onchain data provides insight into the top Bitcoin owners, suggesting that the majority of Bitcoin is held by a small number of individuals and entities.

Exploring the Wealthiest Bitcoin Owners According to Onchain Data

Cryptocurrency is becoming an increasingly popular investment option for many individuals, and the leading digital asset, Bitcoin, has seen its value skyrocket in recent years. With this growing popularity, it’s no surprise that an increasing number of people have become some of the wealthiest Bitcoin owners. Onchain data offers unique insight into the wealthiest Bitcoin owners. By analyzing the blockchain’s public data, researchers are able to identify which addresses contain the most Bitcoin. Using this data, researchers have identified the top five wealthiest Bitcoin owners, based on the amount of Bitcoin held in their wallets. The first place on the list belongs to an unknown entity or group, which holds over one million Bitcoin. This mysterious address has never been used to make a transaction, and its owner is unknown. Second place belongs to cryptocurrency exchange, Binance, which holds around 740,000 Bitcoin. Binance has rapidly become one of the largest and most popular cryptocurrency exchanges, so it’s not surprising that they would have such a large amount of Bitcoin in their wallets. Third place is occupied by another unknown address, which holds around 600,000 Bitcoin. This address has seen more activity than the first address, but the identity of its owner is still unknown. The fourth place belongs to cryptocurrency exchange, Huobi, which holds around 500,000 Bitcoin. Huobi is another popular exchange, and it has seen a lot of growth over the past few years. Finally, the fifth place is occupied by another unknown address, which holds around 440,000 Bitcoin. The identity of this address’s owner is also unknown. These five addresses contain the majority of Bitcoin, and their owners are some of the richest people in the world. Although the identities of these individuals remain a mystery, they are undoubtedly some of the wealthiest Bitcoin owners.

Examining the Distribution of Bitcoin Wealth According to Onchain Data

Onchain data provides a unique insight into the distribution of Bitcoin wealth. This data can be used to measure the inequality of Bitcoin wealth among users, as well as the overall distribution of wealth among the Bitcoin network.

The Gini coefficient is a measure of inequality that is commonly used to assess the distribution of wealth. The Gini coefficient ranges from 0 to 1, with 0 representing perfect equality and 1 representing perfect inequality. The higher the Gini coefficient, the more unequal the distribution of wealth.

Analysis of the Bitcoin network reveals a Gini coefficient of 0.

1. This indicates a highly unequal distribution of wealth among Bitcoin users. The top 1% of Bitcoin holders control nearly 50% of the total Bitcoin wealth, while the bottom 50% of users control just 2% of the total Bitcoin wealth. This demonstrates that a relatively small number of people control the majority of Bitcoin wealth.

The wealthiest Bitcoin holders are commonly referred to as “whales”. These whales control large amounts of Bitcoin and their trades can have a significant impact on the Bitcoin markets. The influence of whales has been widely debated, as some argue that large traders have an unfair advantage in the markets.

Overall, onchain data reveals a highly unequal distribution of Bitcoin wealth. The top 1% of Bitcoin holders control nearly 50% of the total Bitcoin wealth, while the bottom 50% of users control just 2%. The influence of whales on the Bitcoin markets has been widely debated, as some argue that large traders have an unfair advantage.

Analyzing the Impact of Onchain Data on Bitcoin Ownership

Cryptocurrency ownership is an area of increasing interest for investors, entrepreneurs, and researchers alike. With the rise of blockchain technology and cryptocurrency, the ability to securely track, store, and transfer digital assets has become easier than ever before. As a result, onchain data has become a valuable resource for understanding digital asset ownership. By studying onchain data, it is possible to gain insight into the ownership of Bitcoin, the most popular and widely adopted cryptocurrency. Onchain data can be used to analyze the various types of Bitcoin ownership, including private and institutional investors, traders, miners, and exchanges. By examining the types of Bitcoin transfers and the wallets involved, it is possible to gain insight into the distribution of Bitcoin ownership. This data can provide insight into the demographics of Bitcoin owners, their economic motivations, and how their ownership patterns may change over time. It is also possible to use onchain data to examine how Bitcoin ownership is impacted by various external factors. For example, the aggregated data can be used to analyze how the price of Bitcoin is impacted by news, events, and social media activity. By looking at the aggregate data, it is possible to gain insight into the overall Bitcoin ownership and identify trends in the market. In conclusion, onchain data can provide valuable insight into the ownership of Bitcoin and its impact on the cryptocurrency market. By studying the types of Bitcoin transfers and the wallets involved, it is possible to gain insight into the demographics of Bitcoin owners, their economic motivations, and how their ownership patterns may change over time. Additionally, onchain data can be used to analyze how Bitcoin ownership is impacted by external factors such as news, events, and social media activity. By utilizing this data, researchers and investors alike can gain valuable insight into the ownership of Bitcoin and how it affects the overall cryptocurrency market.

Understanding the Significance of Onchain Data for Bitcoin Ownership Statistics

Onchain data provides valuable insights into the ownership of Bitcoin. By understanding the significance of this data, Bitcoin owners can gain a better understanding of the network’s activity and the ownership dynamics of the cryptocurrency. Onchain data is generated from the Bitcoin blockchain. This data is used to track the activity of the network, including the number of transactions, the amount of Bitcoin sent and received, the number of addresses on the network and the number of unspent outputs. By analyzing the onchain data, it is possible to infer the ownership dynamics of Bitcoin. One of the key insights that onchain data reveals is the distribution of Bitcoin ownership. By looking at the number of Bitcoin addresses on the network and the total amount of Bitcoin held in each address, it is possible to get an idea of how much of the cryptocurrency is held by each type of user. This information is important for understanding how the Bitcoin network is distributed and how it might evolve in the future. Another insight that can be gleaned from onchain data is the usage of Bitcoin. By looking at the number of transactions that take place on the network and the amount of Bitcoin sent and received, it is possible to get an idea of how people are using the cryptocurrency. This information can be used to inform decisions about the development of the Bitcoin network and its infrastructure. Finally, onchain data can be used to track the movement of Bitcoin between wallets. By looking at the movement of funds between addresses, it is possible to track the flow of Bitcoin within the network and identify clusters of users that are actively trading. This information can be used to better understand the dynamics of the market and the impact of certain events on the price of Bitcoin. In conclusion, onchain data is an invaluable tool for understanding the ownership dynamics of Bitcoin and its usage. By looking at the data, it is possible to get a better understanding of the distribution of ownership and the flow of funds within the Bitcoin network. This information can be used to inform decisions about the development and infrastructure of the network.

Who owns the most Bitcoin according to Onchain Data is an interesting question to ask. While some research has been done to try and answer this question, the truth is that it is impossible to know exactly who owns the most Bitcoin. This is because Bitcoin is a decentralized asset and transactions are anonymous. As more research is done, the answer to this question may become more clear, but for now, we can only speculate.