Bitcoin price is barely above $20,000 per coin – a shock to most new and long-time holders of the cryptocurrency alike. The selloff took the cryptocurrency back down to its production cost, which has acted as a bottom in the past.

In this article we’ll take a closer look at the cost to produce each BTC and its relationship with price action. We’ll also examine why the scarce digital asset could very likely find a bottom at such levels.

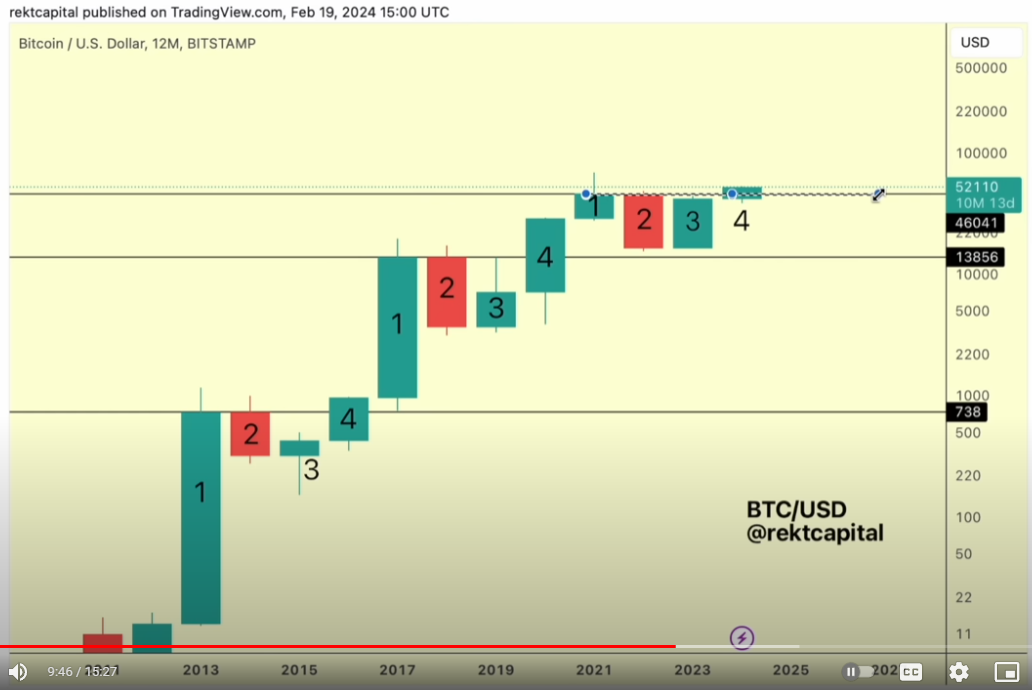

Bitcoin Falls To Production Cost, Aligns With Former ATH Retest

Bitcoin is unlike any other asset before it, and since its inception and entire industry has been created hoping to mimic the success of its network. Investors pile into altcoins hoping to find the next Bitcoin and profit.

The cryptocurrency relies on an energy-intensive proof-of-work process to generate new coins. Mining isn’t cheap, or else everyone would do it. In fact, according to the Production Cost Indicator designed by Bitcoin expert Charles Edwards, it costs roughly $20,260 per BTC at the low end.

Related Reading | Coinbase Considers Bitcoin Creator A Risk To Business, Here’s Why

It doesn’t take a mathematician with the skills of Satoshi to know that’s barely a few hundred dollars away from current prices. Interestingly, the selloff fell straight to the cost of production. Looking back, significant bottoms such as December 2018 and March 2020 both touched the lower boundary.

The high end of the metric is around $33,766, which once breached could be a sign that the downside is finished. Similar to Black Thursday, retesting it is even more bullish.

BTC Production Cost Indicator could call the bottom | Source: BTCUSD on TradingView.com

How Satoshi Called The Bottom 12 Years Ago

Considering a bottom after such a brutal selloff and amidst the backdrop of the most bearish macro environment Bitcoin has ever faced, could seem hard to believe or even too good to be true. But there is a reason for this sort of base-building behavior in scarce assets.

Scarce assets like commodities tend to build a base and bottom out around the cost of production. Even Satoshi discussed this in the past, dating as far back as 2010. The mysterious founder is quoted as saying that the “price of any commodity tends to gravitate toward the production cost. If the price is below cost, then production slows down. If the price is above cost, profit can be made by generating and selling more.”

Related Reading | Why Bitcoin Doesn’t Need Musk, Saylor, Or Anyone Else

What Satoshi describes is the revenue model which BTC miners follow. They produce new coins at as profitable of a rate as they can, and sell them as price deviates higher than the cost of production. Returning to such levels, often cleanses the market of less efficient operations, leaving only the fittest behind.

BTC miners are capitulating | Source: BTCUSD on TradingView.com

Is this what is happening now with Bitcoin? And what happens when only the strongest have survived? Could Satoshi have really predicted the bottom this far in advance?

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com