Today’s surge in the Cardano price can be attributed to a combination of fundamental factors, market sentiment, and broader industry trends. Crypto markets are known for their volatility, and Cardano, with its unique features and active development, is no exception.

Cardano’s price skyrockets

As of this writing, Cardano (ADA) is trading at a price of $0.584578, with a 24-hour volume of $2,284,805,117.55. This corresponds to a price increase of 50.95% over the past week and 8.93% over the last twenty-four hours.

The current valuation of cryptocurrencies on a global scale is $1.72 trillion, representing a change of 0.68% over the past twenty-four hours and 92.94% to date. Bitcoin (BTC) currently holds a market capitalization of $860 billion, signifying a dominance of 50.13%. Stablecoins, meanwhile, have a market capitalization of $131 billion, or 7.61% of the total crypto market capitalization.

Recent gains in Cardano were not accompanied by any revolutionary fundamentals. Conversely, they emerged on the cryptocurrency market this month, closing the gap with Bitcoin.

Significantly, since its local peak on December 6, Bitcoin’s dominance in the crypto market has decreased by 3.5%, suggesting that numerous traders have redirected capital away from Bitcoin in pursuit of profitable prospects in alternative cryptocurrencies.

Since December 6, this has benefited Cardano, whose market share has increased by more than 46%. Such capital movements are typical in the crypto market.

After a substantial price increase, Bitcoin is commonly sold by traders who opt to reallocate their gains to more modest yet precarious cryptocurrency assets. Similar to the performance of altcoins in early November, when Bitcoin’s market share also declined, this is the case.

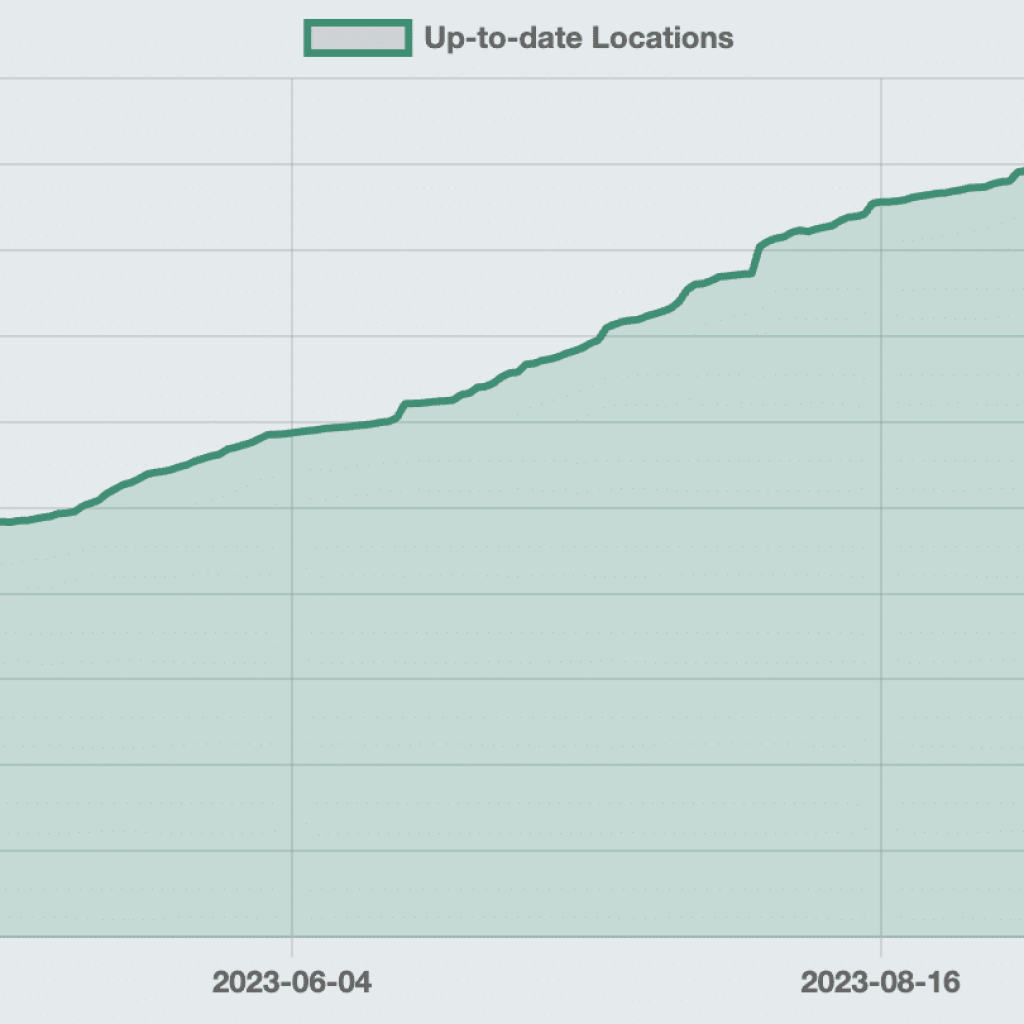

The price hike of Cardano corresponds to a significant upsurge in the aggregate quantity of ADA deposited throughout its blockchain ecosystem.

The total value locked (TVL) in decentralized applications (dApps) on Cardano surpassed 765.22 million ADA on December 9. This increase was led by Lenfi, a lending and borrowing protocol on the Cardano blockchain, whose ADA reserves increased by 90%.

The price increases of Cardano on December 9 correspond with the liquidation of short positions valued at approximately $5 million, in contrast to long liquidations worth $2.30 million. The ADA market liquidated short positions worth $6.91 million the day prior, compared to long positions worth $1.27 million.

Overall crypto market performance

The value of Bitcoin (BTC) currently stands at $43,930.03, accompanied by a 24-hour trading volume of $18,414,025,353.36. This corresponds to a price increase of 0.44% over the last twenty-four hours and 13.39% over the last seven days.

The value of Ethereum (ETH) currently stands at $2,350.44, accompanied by a 24-hour trading volume of $14,865,618,028.27. This signifies a price decrease of -0.03% over the last twenty-four hours and a surge of 12.00% over the last seven days.

As of today, Solana (SOL) is trading at $73.61, representing a 24-hour trading volume of $3,190,450,064.50. This reflects a price increase of 0.01% over the last twenty-four hours and 19.33% over the last seven days.

At present, Shiba Inu (SHIB) is trading at a price of $0.00001017, with a 24-hour volume of $346,991,585.56. This reflects a price increase of 21.06% over the last week and 0.63% over the last twenty-four hours.

Dogecoin (DOGE) is currently trading at $0.099514, with a 24-hour volume of $1,775,281,790.50 in volume. This corresponds to a price increase of 1.31% over the last twenty-four hours and 18.77% over the last seven days.