Crypto markets are notoriously volatile, influenced by a myriad of factors ranging from macroeconomic trends and regulatory developments to technological advancements and market sentiment.

Today, as the crypto market experiences an unexpected surge, enthusiasts and investors alike find themselves on the edge of anticipation, questioning the driving forces behind this sudden upswing. This surge prompts the question: Will Bitcoin (BTC) reach the elusive $40,000 mark by the end of the week?

Crypto shows promising market tides – Why?

The cryptocurrency market has turned green again today (November 29), with most digital assets posting significant gains. According to CoinGecko, Solana (SOL) is one of the best performers, with a 24-hour increase of more than 8%.

One explanation for the asset’s resumed surge could be the prevalent bullish mood surrounding it and its remarkable price performance in recent months. Remember that SOL has increased by 80% in the last month, hitting about $70 at one time.

Another possible factor is the price increase of the Solana-based memecoin Bonk (BONK). The coin gained 12% yesterday (November 28) when crypto exchange KuCoin launched the BONK/USDT trading pair. Memecoin has increased by 17% in the last 24 hours and is up 600% in the last 30 days.

Ethereum has increased by 2.5% and recaptured the $2,000 resistance level. Binance Coin is currently trading at $230, while XRP is above $0.6.

Cardano, Dogecoin, Polygon, and Polkadot have all gained over 4% in the last 24 hours, while LINK, AVAX, NEAR, and MNT have gained 5-7%. The larger-cap alts have benefited Solana and THORChain the most. SOL is up 11% and trading above $60, while RUNE is up 14.5% and trading well above $6.

Overall market performance

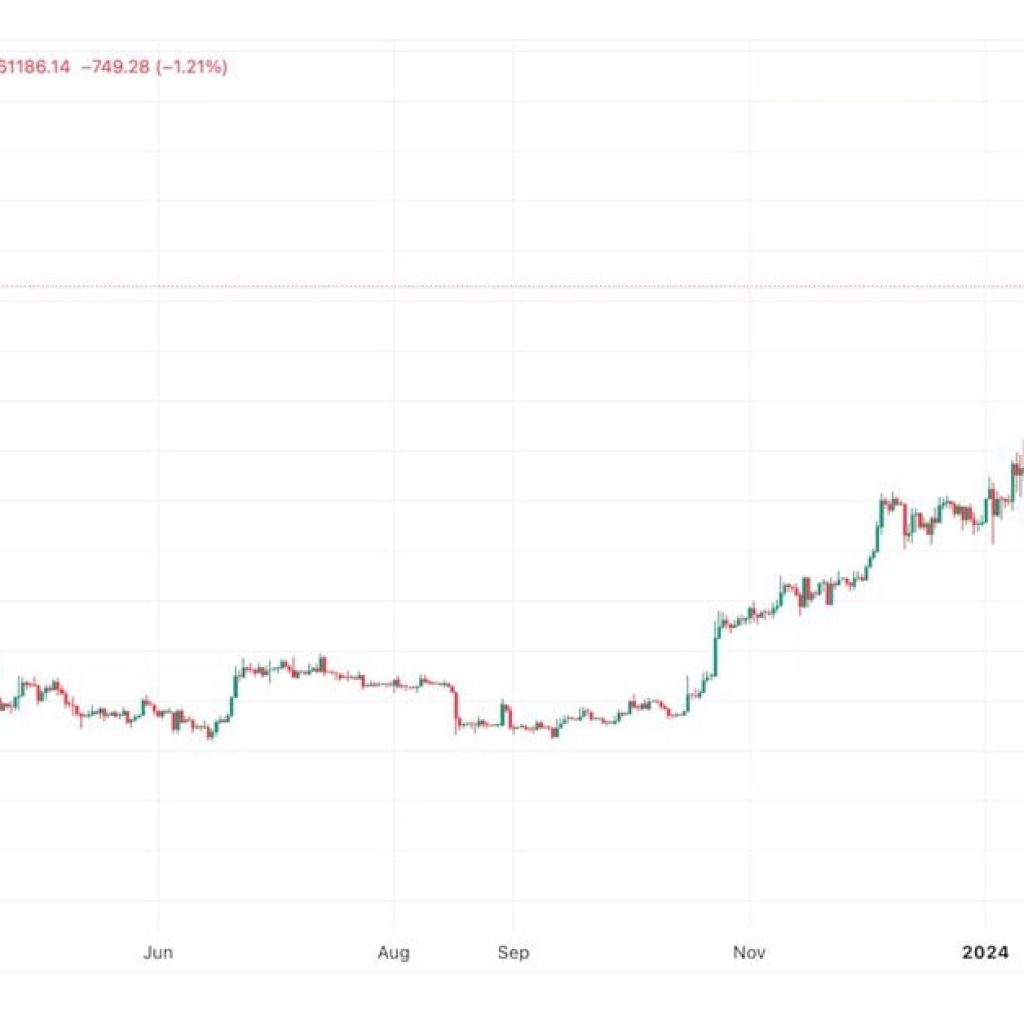

Wednesday morning in Asia, Bitcoin crossed the $38,000 mark, bolstered by renewed optimism regarding the approval of a spot exchange-traded fund (ETF) earlier this week and the anticipation of interest rate reductions by traditional market observers.

In other news, multinational bank Standard Chartered revised its April prediction that bitcoin (BTC) would hit $100,000 by the end of 2024. Analysts believe that the planned approvals for several spot bitcoin ETFs “are likely to come sooner than expected,” acting as drivers for a crypto market bull run.

Late Tuesday, Bitcoin momentum began to increase as Federal Reserve governor Chris Waller stated that recent data indicated an economic decline and that inflation’s continued moderation indicated current policies were “appropriate.”

In the event that inflation continues to decline, Waller added, there is a strong case for interest rate decreases within the next few months.

Generally, interest rate decisions affect market conditions. Generally, risk assets such as equities and cryptocurrencies decline when interest rates increase, as investors may opt to reinvest their profits in bonds.

According to CoinGecko, the global crypto market cap is $1.49 trillion today, a 0.85% increase over the last 24 hours and a 70.85% increase over a year ago. Bitcoin (BTC) has a market cap of $739 billion as of today, signifying a 49.68% market dominance. Meanwhile, the market cap of stablecoins is $130 billion, accounting for 8.72% of the total crypto market cap.

What’s the way forward for XRP investors?

Ripple’s native currency, XRP, is among the digital assets flashing green today, with its price jumping 3% in the last 24 hours and breaking above the $0.60 barrier once more. Several cryptocurrency analysts have predicted in recent months that the coin is primed for another significant climb in the future.

One of them is X (Twitter) user JD, who believes XRP is on the cusp of a “parabolic move” if three critical variables are met. A bullish cross on an SRSI resistance level, both SRSI lines closing above 80, and a breakthrough over an 8-year trendline are among them.

According to the analysts, such factors could cause the price of XRP to skyrocket above $11. That surge is predicted to take place in 2025.