In a deep dive into the Solana blockchain network, Visa elucidated its reasons for selecting Solana as a part of its stablecoin settlement pilot today. As Bitcoinist reported, Visa announced last week that they are expanding their stablecoin pilot to Solana. The global payments behemoth’s decision comes on the heels of its ongoing efforts to modernize cross-border money transfers by harnessing the power of blockchain technology.

Why Visa Chose Solana

Visa’s exploration, penned by Mustafa Bedawala and Arjuna Wijeyekoon, underscores Solana’s impressive transaction throughput. Although the blockchain has not yet matched Visa’s staggering capacity of 65,000 transactions per second, it boasts an average of 400 user-generated transactions per second. This figure can even surge to over 2,000 during periods of heightened demand. For context, Ethereum, one of the leading blockchain networks, manages an average of just 12 transactions per second.

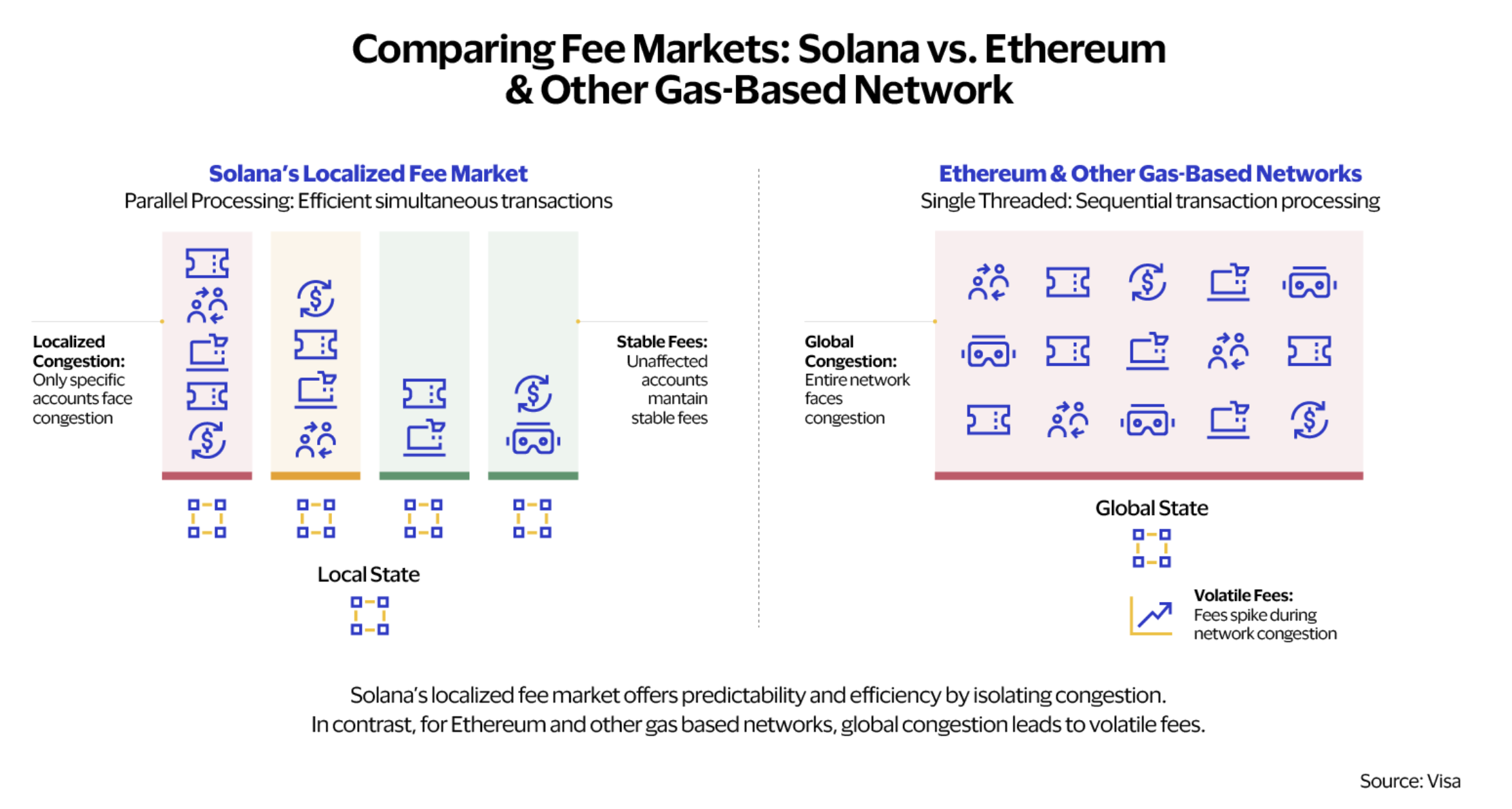

A foundational element of Solana’s high transaction throughput is its ability to process transactions in parallel. This parallel transaction processing ensures that transactions affecting separate accounts can be executed simultaneously. This is in contrast to other blockchains like Ethereum, which process transactions sequentially.

The authors elucidate, “Transactions impacting separate accounts can be executed simultaneously, enabling Solana to efficiently support payment and settlement scenarios.” This multi-threaded approach is instrumental in mitigating network congestion, ensuring that a bottleneck in one segment doesn’t compromise the entire network’s throughput.

Another compelling feature of Solana is its low and predictable transaction costs. Typically, SOL’s transaction fees are less than $0.001, making it an attractive option for payment operations seeking both efficiency and cost savings. This stands in contrast to the fluctuating fees of Bitcoin and Ethereum, which can vary based on network demand.

The blockchain’s unique approach to fees ensures that congestion in one account doesn’t impact others. For instance, if there’s a surge in demand for a specific asset, such as an NFT, only the fees for that particular account will see an increase. This localized fee market is closely tied to the blockchain’s parallel processing capabilities.

Visa also highlighted the importance of transaction finality, which measures the speed at which actions are confirmed on a blockchain network. SOL targets a slot time of 400 milliseconds, making it significantly faster than many of its competitors. Most applications on Solana use “optimistic confirmation” for their finality, a mechanism that allows for quicker transaction confirmations.

In terms of network availability, as of July 2023, Solana has an impressive 1,893 active validators and an additional 925 RPC nodes. This vast number of nodes, spread across over 40 countries, ensures the network’s resilience and reliability. The authors highlight the significance of this diversity, stating it makes the network “more robust against events such as natural disasters or change in access policy by the provider.”

Additionally, the diversity of validator clients on Solana enhances its resilience. While vulnerabilities might plague one client, others remain unaffected, reducing the risk of a singular software flaw destabilizing the network. The introduction of multiple validator clients, such as Jito-Solana and Firedancer, underscores the project’s commitment to network stability.

Meeting Modern Demands

Thus, Visa’s decision to integrate Solana is rooted in the blockchain’s unique technological advantages, including its high throughput, low costs, and significant node presence. As Visa continues its stablecoin settlement pilot, the company aims to ascertain if SOL can meet the rigorous demands of modern corporate treasury operations.

This move by Visa follows its previous integration of the Ethereum blockchain for USDC transfers in a 2021 pilot project in Australia. With the recent extension of its payment function with the stablecoin USDC to Solana, Visa continues to position itself at the forefront of blockchain-based payment solutions. Cuy Sheffield, Head of Crypto at Visa, remarked on the integration, stating that by leveraging stablecoins like USDC and global blockchain networks, Visa aims to enhance the speed of cross-border settlements.

At press time, SOL traded at $18.06 after bouncing off the 61.8% Fibonacci retracement level.