Tokenized real-world assets have surged to a capitalization of $8 billion, outpacing Bitcoin and Ether in both market performance and volatility-adjusted returns.

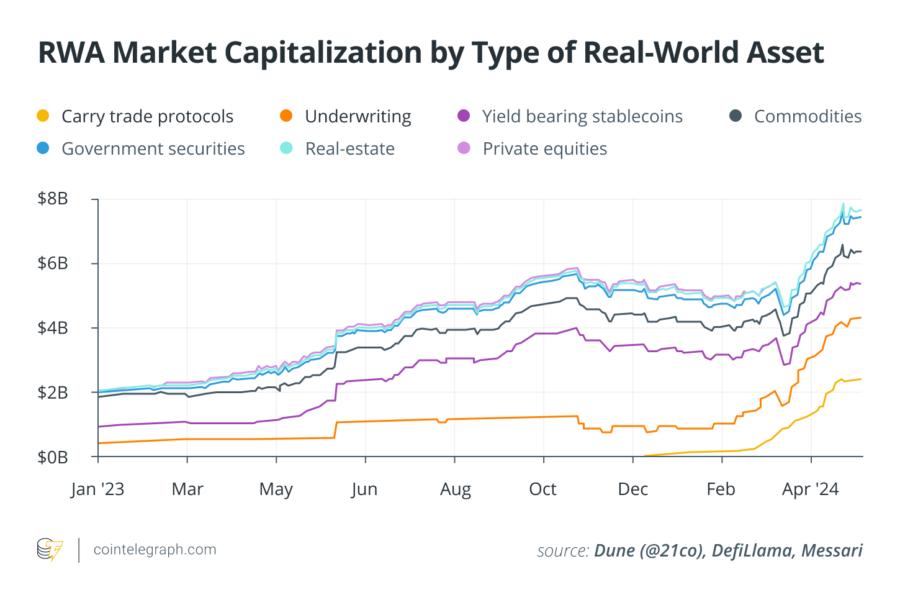

The real-world assets (RWA) market has grown to $8 billion in total value locked (TVL) this year, excluding non-yield-earning stablecoins. Real-world assets currently tokenized on blockchains include private equity, real estate, government securities, commodities and other financial obligations.

The popularity of tokenized RWAs in decentralized finance (DeFi) started to grow as bond yields in traditional finance eclipsed low-risk DeFi yields during the bear market of 2022 to 2023. The United States Federal Reserve’s aggressive interest rate hikes made U.S. Treasury yields competitive with DeFi stablecoin yields despite their much lower risk. As of June 13, the one-year Treasury bill offers a three-month average yield of 5% to 5.24%, while Aave has variable annual percentage returns on stablecoins that range from 3.73% to 7.46%.

Several protocols started to capitalize on higher borrowing costs and subdued DeFi activity by offering tokenized U.S. Treasurys and tokenized private loans in blockchain ecosystems. In early June, the average annual percentage yield for such tokenized private loans was 9.57%. As the crypto market recovered with new institutional activity in 2024, the TVL of RWA projects reached their current $8 billion capitalization.