The U.S Securities and Exchange Commission (SEC) has finally surrendered the long-sought email messages and documents by its former executive William Hinman to Ripple. The documents contain a significant insight central to the Ripple founders’ defense theory in the ongoing lawsuit with the Commission.

Ripple’s finally in possession of the Hinman’s document

On Thursday, Ripple’s general counsel Stuart Alderoty shared the update on Twitter, confirming they are finally in possession of the Hinman documents after several court injunctions resisted by SEC. Due to the Commission’s insistence, however, the documents shall remain confidential at the moment, according to Alderoty.

“Over 18 months and 6 court orders later, we finally have the Hinman docs (internal SEC emails and drafts of his infamous 2018 speech). […] I can say that it was well worth the fight to get them,” Alderoty tweeted.

Stuart Alderoty

The documents in question contain internal SEC emails and drafts of the infamous speech by the former director, William Hinman. During Yahoo Finance All Markets Summit in 2018, Hinman stated that Ether doesn’t classify as a security. Ripple believes the discussion is pivotal in defining XRP, which the SEC claimed falls under the security class.

Despite SEC’s attempts to withhold the documents, Ripple’s team remained persistent, and in September, a federal district judge had to force the Commission by overruling their attempts to prevent the blockchain company from accessing the documents.

Will the Ripple vs SEC case be rekindled?

“I’ve always felt good about our legal arguments, and I feel even better now. I always felt bad about the SEC’s tactics, and I feel even worse about them now,” said Ripple’s general counsel, Alderoty.

A few weeks ago, both Ripple and the SEC already filed for summary judgment to dismiss the lawsuit. However, with the current update, the lawsuit may likely be revived as Ripple has obtained another leverage to prove XRP doesn’t qualify as a security.

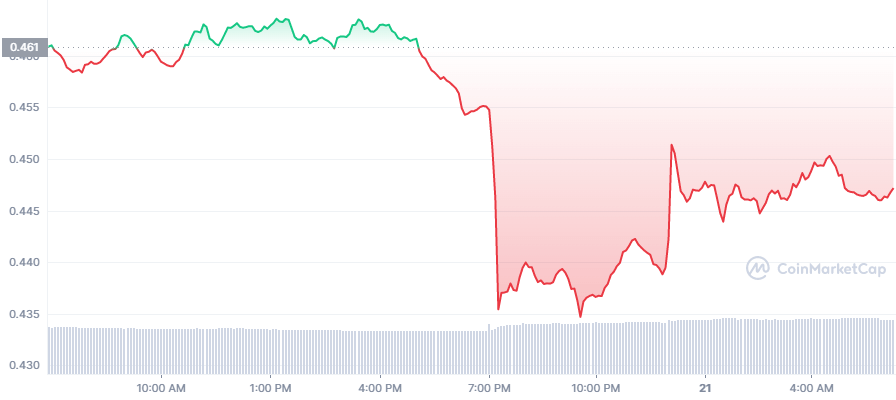

At press time, XRP was trading at $0.4472, over a 2% decrease on the 24-hours chart.