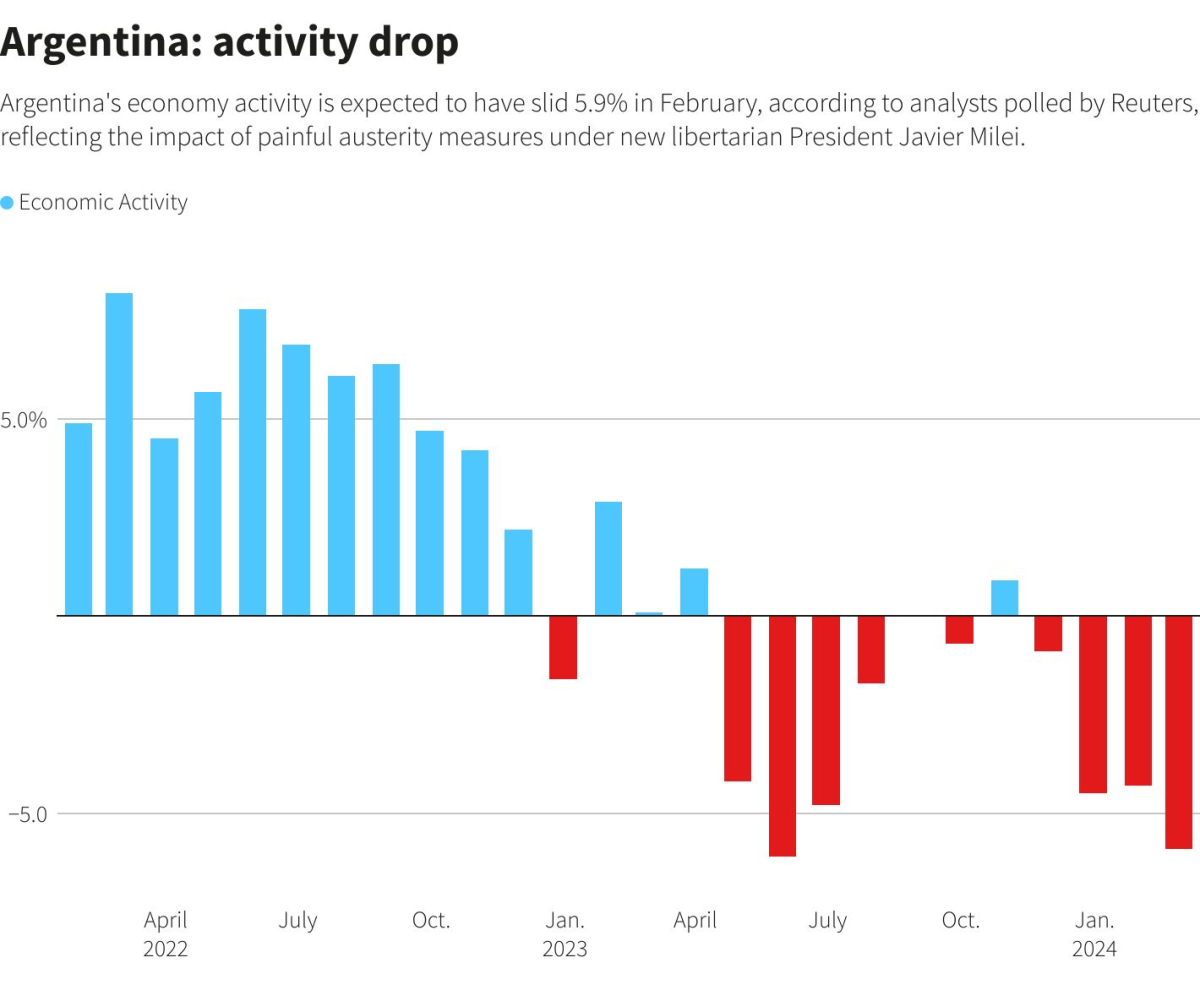

Argentina has faced economic activity decline by 5.9% in February year-on-year, according to a Reuters poll from market analysts. This decrease is part of a continuing trend, marking the fourth straight month of declines under President Javier Milei’s austere economic policies.

Steep Declines Across Key Sectors

The Reuters poll, conducted in mid-April with 11 analysts, showed estimates of economic decline from 4.1% to 7.1% year-on-year for February. Despite some growth in farming and mining, sharp downturns were evident in consumption, manufacturing, and construction sectors.

The consulting firm Orlando Ferreres & Asociados noted that while agriculture and mining saw healthy growth due to low comparison bases from previous years, industries like commerce, manufacturing, and construction experienced strong contractions.

Milei has implemented significant austerity measures, including cutting government size, reducing subsidies for fuel and transport, closing some state institutions, and conducting audits on welfare programs.

These actions are part of his broader strategy to manage one of Argentina’s worst economic crises by stabilizing the government’s finances and avoiding social unrest amid rising poverty and inflation, which threatens spending power.

Economist Pablo Besmedrisnik of Invenómica noted that the weakness in private consumption, coupled with reduced state spending, is expected to continue impacting economic activity negatively. Following the trend from previous months, February’s decline came after a 4.3% drop in January and a 4.5% decline in December.

Signs of Recovery Amid Fiscal Surpluses

Despite the challenges, Eugenio Marí, Chief Economist at the Libertad y Progreso Foundation, mentioned that inflation, which is nearly at 300% annually, shows signs of slowing. He predicted that economic activity would reach its lowest point in March before beginning to recover in April, driven by exporting sectors. This recovery is anticipated to aid in improving the purchasing power of salaries and pensions.

In a significant development, President Milei announced from the presidential palace in Buenos Aires that Argentina achieved its first quarterly fiscal surplus since 2008. This surplus, which amounted to 0.2% of GDP at the beginning of the year and included a third consecutive monthly surplus in March, has been a boost to investor confidence, with Argentine bonds rising in value.

Diego Ferro of M2M Capital in New York described Argentina as an appealing investment following these developments. However, he cautioned that the sustainability of Argentina’s fiscal health depends on continued structural reforms rather than short-term fixes.

President Milei attributed this rare fiscal surplus to stringent cost-cutting measures, including significant reductions in transfers to provincial governments and public works spending. The high inflation rates have indirectly aided in reducing the real public expenditure on wages and pensions. Adriana Dupita of Bloomberg Economics voiced concerns about the long-term viability of this strategy, highlighting the adverse effects of inflation on public sector salaries and pensions.

Milei has embarked on various reforms since taking office, including currency devaluation, restructuring government ministries, deregulating prices, and gradually reducing energy and transport subsidies. These measures have begun to slow the monthly inflation rates, indicating initial steps towards economic stabilization.

In his address, President Milei assured Argentines that their sacrifices would lead to tangible benefits, promising a future with reduced tax burdens and enhanced economic prosperity. As the country celebrates this fiscal milestone, the pressure remains on Milei’s administration to maintain momentum and implement necessary long-term structural reforms to ensure ongoing economic stability.