Overview

Zoomex and Binance are two prominent cryptocurrency exchanges, each offering unique features and services that cater to a diverse range of traders. Zoomex, founded in 2021 in Singapore, is known for its focus on futures trading with high leverage and a blend of centralized (CEX) and decentralized (DEX) options. Binance, established in 2017, has grown to become one of the largest and most versatile exchanges globally, offering a vast array of trading pairs, advanced trading tools, and comprehensive services.

This article provides a detailed comparison of Zoomex and Binance, examining their features, fee structures, security measures, customer support, and more.

Key Takeaways

When comparing Zoomex and Binance, several key points emerge that can help traders decide which platform best suits their needs:

- Founding and User Base: Zoomex, established in 2021, has quickly grown to over 2 million users, while Binance, founded in 2017, boasts a massive user base of over 30 million.

- Trading Options and Leverage: Both platforms offer a range of trading options. Zoomex focuses heavily on futures trading with leverage up to 150x, whereas Binance provides a broader spectrum including spot, futures, margin, options, and P2P trading with leverage up to 125x.

- Fee Structures: Zoomex has competitive trading fees with a maker fee of 0.02% and taker fee of 0.06%. Binance offers slightly higher standard trading fees at 0.10% but provides various ways to reduce these fees, such as holding BNB or achieving VIP status.

- Security Measures: Both exchanges prioritize security with advanced measures. Zoomex uses cold/hot wallets, multi-signature wallets, encryption, and mandatory 2FA. Binance also employs cold/hot wallets, the SAFU fund, advanced encryption, 2FA, and anti-phishing codes.

- Customer Support and Resources: Zoomex offers 24/7 support via email, live chat, and a comprehensive Help Center. Binance provides extensive support and educational resources, including Binance Academy, webinars, and detailed guides, making it a robust platform for learning and trading.

Key Features Comparison

| Feature | Zoomex | Binance |

| Founded | 2021 | 2017 |

| Headquarters | Singapore | Malta (formerly China) |

| User Base | 2 million+ | 30 million+ |

| Supported Cryptos | 300+ perpetual contracts | 500+ trading pairs |

| Leverage | Up to 150x | Up to 125x |

| Trading Options | Futures, Spot, DEX | Futures, Spot, Margin, Options, P2P, DEX |

| Fiat Support | Third-party services | Direct and third-party services |

| Security Features | Cold/Hot Wallets, Multi-Sig, 2FA, Encryption | Cold/Hot Wallets, SAFU Fund, 2FA, Advanced Encryption |

What is Zoomex?

Zoomex, established in 2021 in Singapore, is a dynamic cryptocurrency trading platform founded by former executives of Binance and Bybit. This exchange offers a diverse range of trading options, including futures trading with leverage up to 150x, spot trading, and decentralized exchange (DEX) options. It aims to provide a secure, user-friendly environment for both novice and experienced traders.

Zoomex has experienced rapid growth, attracting over 2 million registered users across more than 30 countries. The platform supports over 300 perpetual contracts and features advanced trading tools designed to cater to a wide array of trading strategies.

Key Features of Zoomex

A standout feature of Zoomex is its Copy Trading service, which allows beginners to replicate the trades of successful traders, enhancing their trading outcomes. This feature has been particularly popular, drawing a substantial number of elite traders and followers.

Zoomex also prioritizes security with robust measures, including multi-signature cold wallets, advanced encryption protocols, and mandatory Two-Factor Authentication (2FA). Additionally, the platform provides educational resources such as tutorials, webinars, and articles to help users improve their trading skills.

Pros of Zoomex

No KYC Required

- Ensured Privacy: Zoomex does not require KYC (Know Your Customer) verification, prioritizing user privacy. This commitment to anonymity ensures data remains private and secure, providing peace of mind for all traders.

Solid Liquidity

- Reliable Market Making: The platform is known for its robust and reliable market-making (MM) capabilities. The expertise of the Zoomex team ensures top-tier liquidity, enabling smooth and efficient trading.

Commitment to Security and Compliance

- Secure and Compliant: Zoomex adheres to stringent security measures and regulatory standards. With their DEX, all transactions comply with existing regulations, fostering a secure and legitimate trading environment. The exchange has maintained a flawless security record with no incidents.

Responsive to User Feedback

- Customer-Oriented: At Zoomex, the customer’s voice is essential. The platform is continuously refined based on feedback from surveys and reports, underscoring a commitment to user satisfaction and setting Zoomex apart from competitors.

Diverse Events and Generous Rewards

- Engaging Campaigns: Zoomex hosts a variety of campaigns to attract and retain users, including global trading competitions (ZWTC), welcome campaigns, and special events like World Cup and Euro Cup promotions. Exciting giveaways, such as Tesla distributions, are also featured.

Zoomex Native Token

- Strategic Token Introduction: Zoomex has carefully planned the launch of their native token. In 2024, followers can discover and trade with this new token, contributing to the platform’s growth and innovation.

Cons of Zoomex

- Limited Fiat Options: Fiat-to-crypto purchases are available through third-party services, which may incur additional fees.

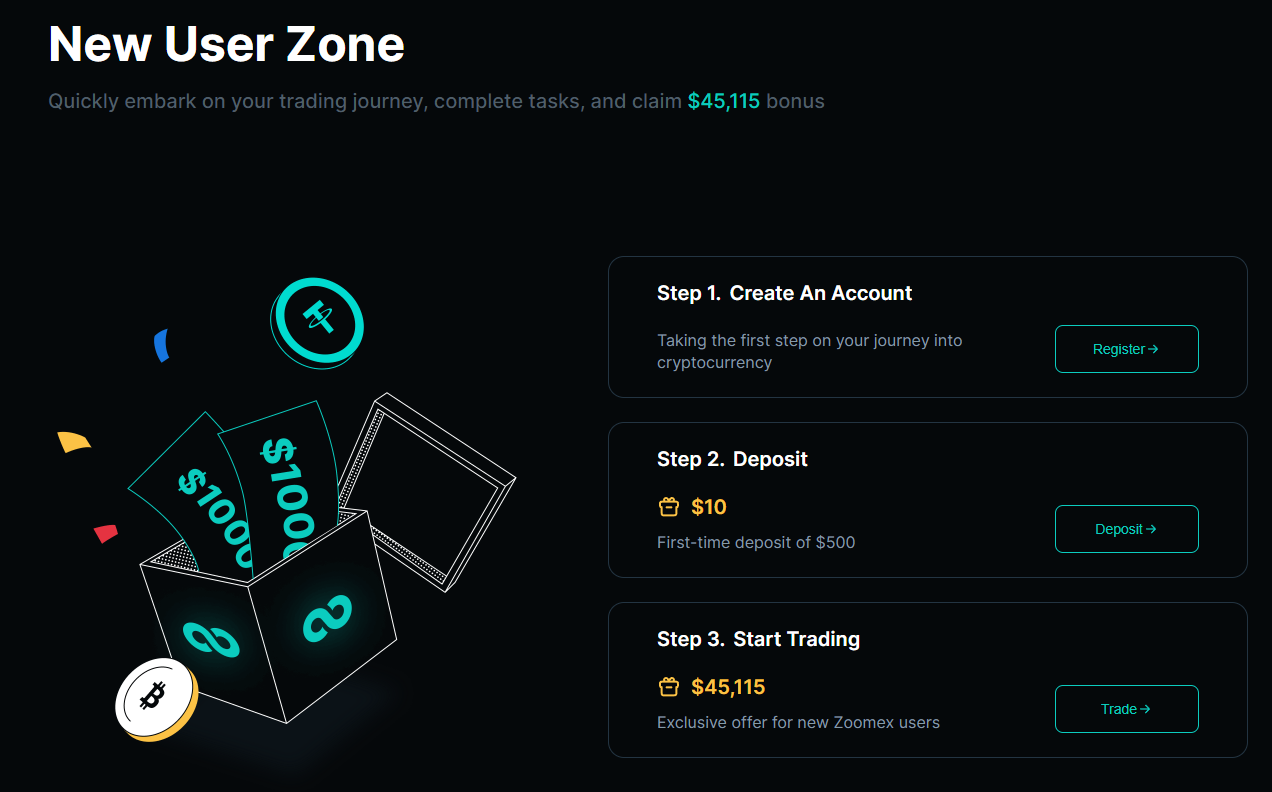

Sign up with Zoomex using referral code ZX30727 to receive exclusive bonuses and discounts on trading fees.

What is Binance?

Binance, established in July 2017 by Changpeng Zhao (CZ), has grown to become the largest cryptocurrency exchange in the world by trading volume, with over 194 million registered users. It offers a comprehensive platform that includes a wide range of trading options, financial products, and services, making it a leading blockchain ecosystem.

Binance supports an extensive selection of cryptocurrencies, providing over 500 trading pairs. Beyond basic trading, Binance offers numerous financial services, including staking, savings, and liquidity farming, allowing users to earn interest or rewards on their crypto holdings. The platform also features an NFT marketplace for creating, buying, and selling non-fungible tokens.

Key Features of Binance

Binance is renowned for its advanced trading options, such as futures, options, margin trading, and P2P trading. The exchange supports its own blockchain, the BNB Chain, which enables cheaper and faster transactions compared to Ethereum. Binance is also dedicated to security, having established the Secure Asset Fund for Users (SAFU) to protect user funds in extreme cases.

Pros of Binance

- Advanced Trading Options: Provides futures, options, and margin trading, appealing to experienced traders.

- Own Blockchain (BNB Chain): Enables cheaper and faster transactions.

- Promotions and Rewards: Frequently runs promotions, airdrops, and offers higher staking rewards for new users.

- Token Sales: Opportunities for users to participate in token sales for promising new projects.

- NFT Marketplace: A platform for creating, buying, and selling digital art and NFTs.

Cons of Binance

- Separate Platform for US Users: Binance US offers lower liquidity compared to the main platform.

- Complex Interface: The advanced trading features can be overwhelming for beginners.

Sign up with Binance using referral code BNC456 to get a 100 USDT trading fee rebate and a 10% discount on trading fees.

Zoomex vs Binance: Liquidity & Volume

Binance is renowned for its enormous trading volume and high liquidity, making it the go-to platform for high-volume traders. According to CoinMarketCap, Binance’s 24-hour spot trading volume frequently exceeds $15 billion, with a significant portion driven by its Bitcoin (BTC) trading pairs.

In comparison, Zoomex, though rapidly growing, has a lower trading volume relative to Binance. Zoomex’s highest trading volumes are seen in its futures market, particularly with pairs like BTC/USDT and ETH/USDT. The exchange has made significant strides in the market, but it still trails behind Binance in overall trading volume.

In the futures market, Binance dominates with over $40 billion in daily volume, while Zoomex handles a considerable but smaller volume, often exceeding $5 billion. This makes Binance a preferred choice for traders looking for high liquidity and large trade execution without significant slippage.

Registration and Verification

Zoomex

Registering on Zoomex is a straightforward process designed to get you trading quickly while ensuring account security. Here’s a detailed guide:

- Sign Up: Visit the Zoomex homepage.

- Provide Information: Enter your email address, create a strong password, and accept the terms and conditions.

- Verify Email: Click the verification link sent to your email.

Binance

Registering on Binance involves a similar process but includes some additional steps for security and compliance:

- Sign Up: Visit the Binance website and click “Register”.

- Provide Information: Enter your email address, create a secure password, and agree to the terms of service.

- Verify Email: Confirm your email by clicking the link sent to your inbox.

- Complete KYC: Submit identification documents (passport, ID card) and proof of address. Binance also requires a selfie or video verification in some cases. Enhanced verification levels unlock higher withdrawal limits and access to more features.

Trading Interface

Zoomex

Zoomex offers a user-friendly trading interface with advanced tools designed to cater to both novice and experienced traders:

- Charting Tools: Comprehensive charting options with various indicators and drawing tools.

- Order Types: Supports market, limit, and stop orders, providing flexibility in trading strategies.

- Market Data: Real-time data on price, volume, and order book depth helps traders make informed decisions.

Binance

Binance’s trading interface is highly regarded for its depth and versatility:

- Charting Tools: Advanced charting provided by TradingView, including numerous technical indicators.

- Order Types: Extensive order types such as market, limit, stop-limit, OCO (One-Cancels-the-Other), and more.

- Market Data: Real-time data with detailed metrics on trading pairs, including depth charts and trade history.

Fees and Costs

Zoomex

Zoomex offers a competitive fee structure that benefits active traders. Below is a detailed breakdown:

| Fee Type | Rate | Description |

| Trading Fees | Maker: 0.02% | Applied to limit orders adding liquidity. |

| Taker: 0.06% | Applied to market orders removing liquidity. | |

| Withdrawal Fees | Varies by cryptocurrency | Fees depend on the specific cryptocurrency being withdrawn. |

| Deposit Fees | Free | No fees for cryptocurrency deposits. |

| Fiat Purchase Fees | Varies by provider | Fees for purchasing cryptocurrencies with fiat depend on third-party service. |

Binance

Binance is known for its low trading fees and multiple options to reduce costs:

| Fee Type | Rate | Description |

| Trading Fees | Maker: 0.10% | Standard fee; reduced with BNB holding or VIP level. |

| Taker: 0.10% | Standard fee; reduced with BNB holding or VIP level. | |

| Withdrawal Fees | Varies by cryptocurrency | Specific fees based on the cryptocurrency being withdrawn. |

| Deposit Fees | Free | No fees for cryptocurrency deposits. |

| Fiat Purchase Fees | 1-3% (varies) | Depends on the payment method and third-party service used. |

Security Measures

Zoomex

Zoomex prioritizes security through multiple layers of protection:

- Cold and Hot Wallets: About 95% of funds are stored in cold wallets, offline and secure from online threats. The remaining 5% are kept in hot wallets for daily transactions, balancing security and liquidity.

- Multi-Signature Wallets: Multiple approvals are required for transactions, significantly reducing unauthorized access risks.

- Encryption: Uses advanced encryption protocols to protect user data and communications, ensuring that all information is secure and private.

- Two-Factor Authentication (2FA): Mandatory 2FA adds an extra layer of security, requiring a second form of verification, typically a code sent to a user’s mobile device.

Binance

Binance employs industry-leading security measures:

- Cold and Hot Wallets: Majority of funds are stored in cold wallets, with a small percentage in hot wallets for operational liquidity.

- SAFU Fund: Binance established the Secure Asset Fund for Users (SAFU) to cover user losses in extreme situations.

- Advanced Encryption: Robust encryption technologies ensure the safety of user data.

- Two-Factor Authentication (2FA): Provides enhanced account security through 2FA, along with biometric verification options.

- Anti-Phishing Code: Users can set an anti-phishing code to identify legitimate Binance communications.

Customer Support

Zoomex

Zoomex offers comprehensive support through multiple channels:

- Email Support: Detailed inquiries can be sent via email for in-depth responses.

- Live Chat: Available 24/7 for immediate assistance, ideal for urgent issues.

- Help Center: A rich resource with FAQs, guides, and troubleshooting tips to help users find quick solutions to common problems.

Binance

Binance provides robust customer support services:

- Email Support: Users can submit support tickets for complex issues.

- Live Chat: 24/7 live chat support for immediate help.

- Help Center: Extensive help center with tutorials, FAQs, and detailed guides. Binance also offers a community forum for peer support.

- Social Media: Active on various social media platforms for additional support and updates.

Educational Resources

Zoomex

Zoomex provides a variety of educational materials aimed at enhancing trading knowledge:

- Tutorials: Step-by-step guides on using the platform and various trading strategies.

- Webinars: Live sessions with industry experts discussing market trends and trading techniques.

- Articles: In-depth articles on cryptocurrency, blockchain technology, and market analysis.

Binance

Binance excels in offering extensive educational resources:

- Binance Academy: A comprehensive platform with courses on blockchain, cryptocurrency, and trading.

- Tutorials: Detailed guides on using Binance’s features and trading tools.

- Webinars and AMA Sessions: Regular webinars and Ask Me Anything sessions with industry experts.

- Research Reports: In-depth market analysis and research reports from Binance Research.

Frequently Asked Questions (FAQ)

Is Zoomex available in the US?

Zoomex is not available for customers in the United States for cryptocurrency trading. Due to regulatory restrictions, U.S. residents cannot use Zoomex’s services. If you’re in the U.S. and looking for a crypto exchange, consider alternatives that comply with local regulations, such as Coinbase or Binance US.

Is Zoomex a good exchange?

Yes, Zoomex is considered a good exchange, particularly for those interested in high-leverage futures trading. It offers a user-friendly interface, advanced trading tools, robust security measures, and competitive fees. Although it has lower liquidity compared to larger exchanges like Binance, its innovative features and focus on security make it a popular choice among traders globally.

What is better than Binance?

While Binance excels in high liquidity, diverse trading options, and an extensive web3 ecosystem, some users might prefer exchanges like Coinbase for its ease of fiat deposits, or Kraken for its strong security measures. Zoomex is notable for its high-leverage futures trading and no KYC requirement, which may appeal to traders seeking these specific features.

Which is better for beginners, Zoomex or Binance?

For beginners, Zoomex offers a simpler and more straightforward interface, which might be easier to navigate. It focuses on high-leverage futures trading and provides comprehensive support. However, Binance offers a wide range of educational resources through Binance Academy and has a more extensive feature set. Beginners might find Binance’s advanced features overwhelming, but its “simple mode” can help ease the learning curve.