On-chain data shows a massive amount of Bitcoin dormant since between 5 and 7 years ago has observed some movement during the past day.

Bitcoin 5 Years To 7 Years Age Band Has Just Shown A Large Movement

As pointed out by an analyst in a CryptoQuant Quicktake post, a large movement of dormant tokens has occurred on the Bitcoin blockchain during the past day.

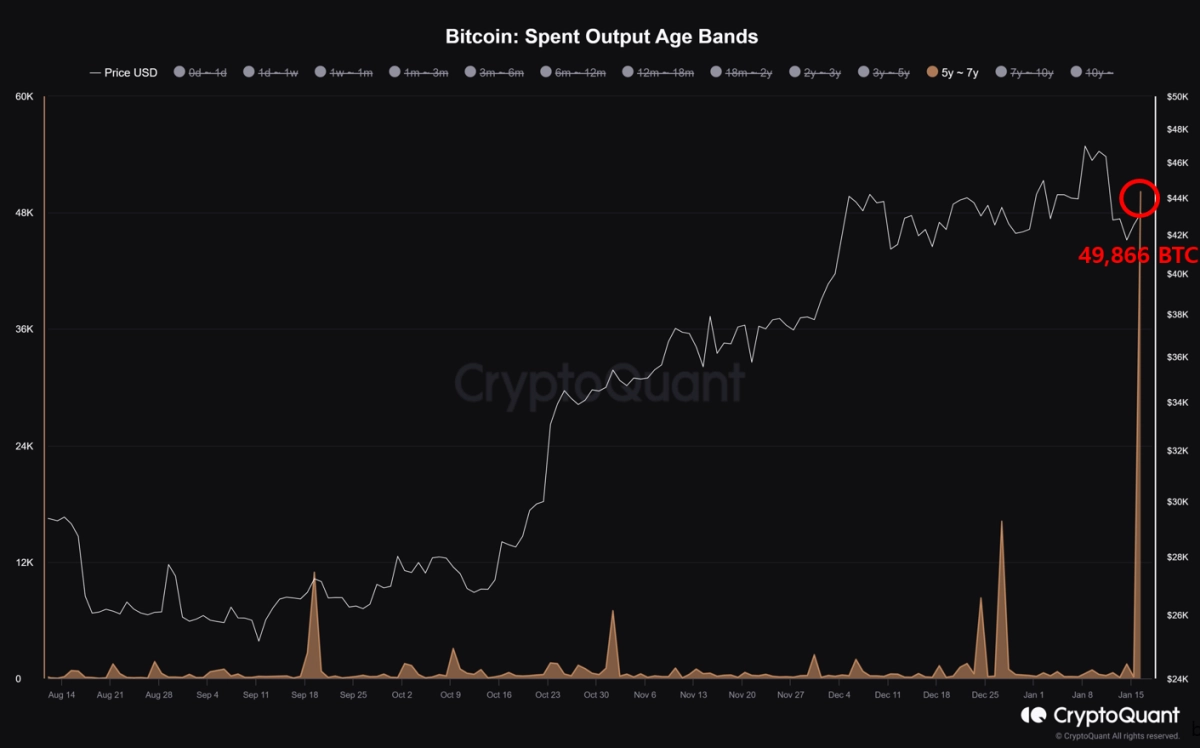

The relevant indicator here is the “Spent Output Age Bands” (SOAB), which basically tells us about the amount of Bitcoin that each age band is transferring on the blockchain right now.

The age bands refer to groups of coins or investors divided based on the total time that they have been dormant. Coins that haven’t moved on the network since between six and 12 months ago, for example, would belong in the 6-month to 12-month age band.

When the SOAB would register a spike for this cohort, it would mean that addresses part of this cohort have decided to finally move their coins. It’s generally hard to say what the intent behind any move like this can be, but the dormancy time can perhaps provide some hints.

A large amount of BTC supply constantly keeps churning around quickly due to short-term traders, so the younger age bands observing a spike is a common occurrence.

Experienced hands usually stay quiet and only make moves at specific times, so SOAB spikes from such age bands can be something worth noting. Often, the purpose behind moves from aged entities is to sell.

In the context of the current topic, one such old group is of interest: the 5-year to 7-year age band. Here is a chart that shows the trend in the SOAB for this particular Bitcoin age band:

As shown in the above graph, the Bitcoin SOAB for the 5-year to 7-year age band has spiked, suggesting that coins that had been dormant for at least five years prior to this have just been moved.

This age band is among the oldest in the sector, and at these old ages, the probability that the coins are, in fact, lost rather than simply being HODL’ed starts becoming significant.

From the chart, it’s visible that a total of 49,866 BTC was moved during the latest spike, which is worth over a whopping $2.1 billion at the current exchange rate of the asset.

The quant has noted in the post that the average buying price of coins aged between 5-7 years would be $6,672, so this stack would have amassed a profit of around 640% by now.

This is clearly a significant gain, so this whale that has awakened after its long slumber may look to realize their profits. These coins, though, weren’t headed towards exchanges, so it’s possible the whale hasn’t pulled the trigger on selling them just yet.

BTC Price

At the time of writing, Bitcoin is trading around the $42,700 mark, down 5% in the past week.