Coinspeaker

$80 Million Crypto Fund Nickel Tapers Investors’ Expectations after Record Performance

The first quarter of 2024 has turned out to be very eventful for Bitcoin and the broader crypto market, as well as for several crypto funds operating in the market. Nickel Digital Asset Management registered its best-ever quarterly performance for its $80 million Diversified Alpha fund.

This fund from Nickel aims to exploit market pricing inefficiencies. As per Nickel, this fund typically provides returns in the range of 15-20% annually, said Chief Executive Officer Anatoly Crachilov. However, amid strong market undercurrent in the first quarter, the Diversified Alpha fund provided a staggering 11% return.

Amid a strong mix of trading volumes, market volatility, and “high dispersion”, Nickel’s Diversified Alpha fund returned 5% during the month of March, explained the crypto fund in a recent presentation. However, Nickel in its presentation stated that these are one-of-its-kind returns and investors shouldn’t expect these conditions to last forever. It also noted that the high risk in the fund could lead to greater-than-expected drawdowns.

During the presentation, David Fauchier, Diversified Alpha’s manager, said:

“Unfortunately, this is not a new normal, we won’t make 5% every month going forwards. Everything you could want in a quarter pretty much happened at some point during that quarter.”

Crypto Funds Outperformed During Q1

Nickel isn’t the sole crypto manager enjoying a prosperous quarter; funds managed by Brevan Howard and Pantera Capital have also capitalized on the bullish market to achieve substantial gains. During the period, Bitcoin surged by 67%, surpassing the performance of most traditional asset classes, while the broader Bloomberg Galaxy Crypto Index recorded a notable 57% increase.

Despite the widespread success seen across many crypto hedge funds, Diversified Alpha’s exceptional performance has raised some concerns, as noted by Nickel. In an interview, Michael Hall, Nickel Digital’s chief investment officer, said:

“We don’t want to overstep expectations. We want to let them know that they can have negative months as well. That’s just being honest and straightforward.”

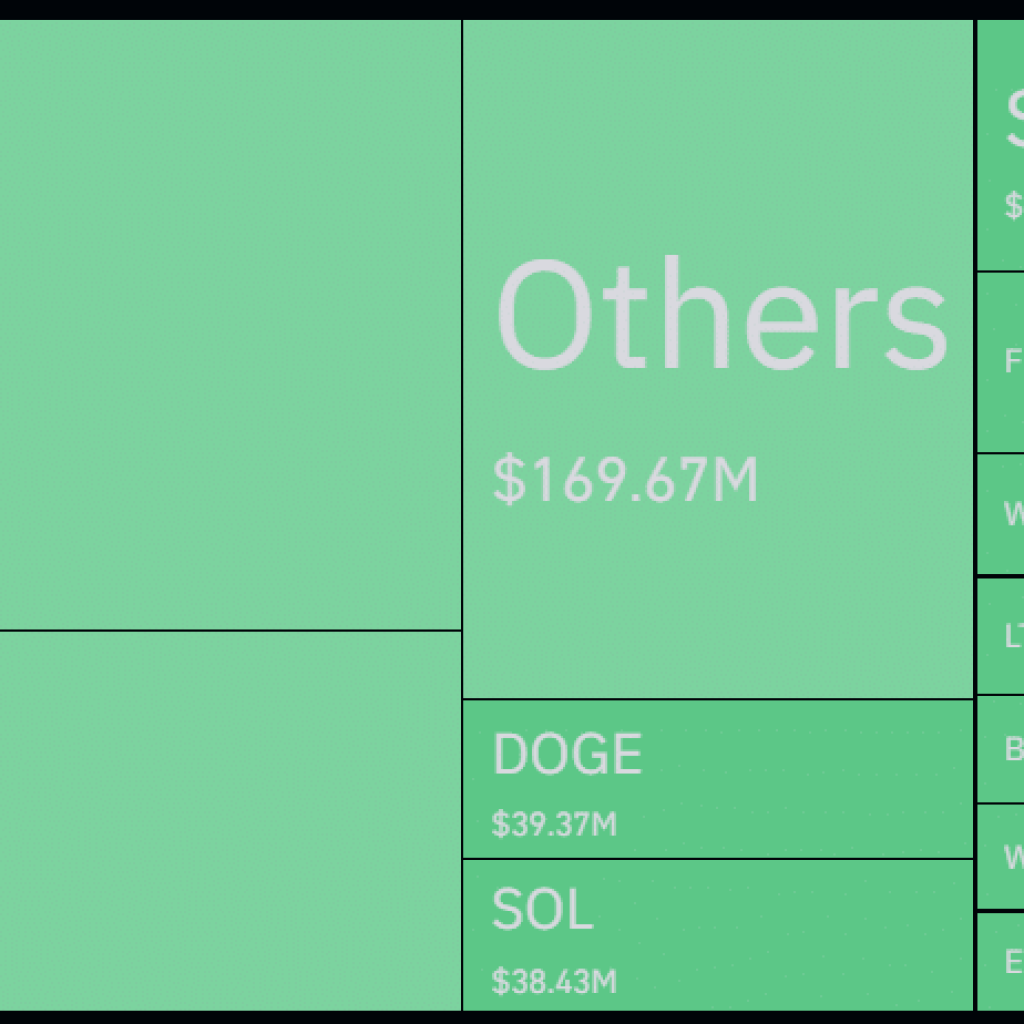

On the other hand, crypto investment products have continued to see strong inflows amid the launch of the spot Bitcoin ETFs earlier this year. This new Bitcoin investment product has registered more than $12.26 billion in net inflows so far.

The upcoming Bitcoin halving event will lead to a major supply squeeze. If the Bitcoin ETF demand continues to remain high, it can push the BTC price even higher.

$80 Million Crypto Fund Nickel Tapers Investors’ Expectations after Record Performance