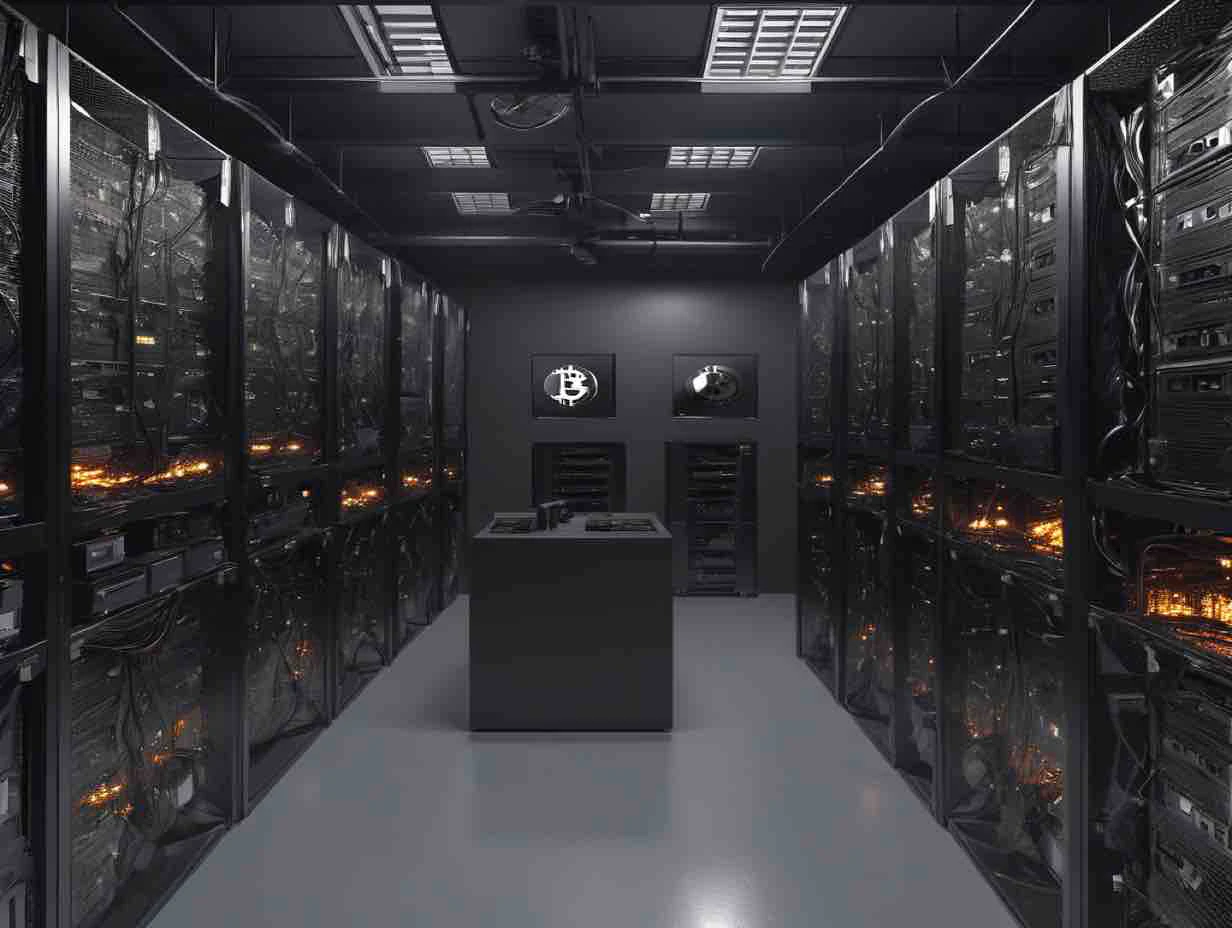

With the Bitcoin halving drawing nearer, Bitcoin mining firms are making preparations for the event. In this regard, Arkon Energy has announced that it has signed a deal to acquire 27,000 Bitcoin mining rigs from Bitcoin mining rig manufacturer Bitmain. The Ohio-based firm revealed via its platform that it purchased application-specific integrated circuit (ASIC) units from the firm.

Arkon Energy secures Antminer and T21 mining rigs

In its announcement, the firm said that it will receive 13,500 Antminer rigs and 14,200 T21 mining machines from the firm. Arkon Energy also mentioned that the delivery of the machines will take place in June, boosting the company’s joules per terahash (J/T) efficiency. With this acquisition, Arkon’s mining equipment is expected to reach an efficiency of 19 J/T. The agreement for the sale of the mining rigs is strategically timed before the upcoming Bitcoin halving event scheduled to occur in the next few days.

Over the last six months, several mining firms have acquired new mining rigs, expanding their operations in time for the halving event. The Bitcoin halving event scheduled to take place will see Bitcoin block rewards cut in half, with analysts predicting a further surge in its price after the event. Presently, miners get 6.25 BTC from mining a block of Bitcoin, and it is expected to reduce by half to 3.125 BTC after the event takes place.

Expansion plans to boost mining capacity

Arkon Energy founder Josh Payne said that the company is delighted to reach the agreement to purchase the miners from Bitmain. Payne mentioned that this new acquisition will enable the company to become an operator of hosting and self-mining infrastructure across their mining centers in Texas and Ohio. Also, the company has revealed that it has plans underway to secure additional mining centers for its operations across the United States.

In its statement, the company noted that the additional sites for its mining operations will boost its capacity to 307 megawatts (MW). However, the statement clarified that the plan is still subject to various factors including funding and development of the sites. Arkon also provided a letter of intent to increase its capacity by adding an extra 100 MW within its existing Hannibal site.

Payne stressed that the company has spent the last two years combing the market for data centers in low-cost power markets in North America. He noted that this new purchase will help them expand, making the company one of the most efficient in the world. This news is coming off the back of Arkon’s announcement to list on Euronext Amsterdam through a combination with BM3EAC Corp.