China’s economy is trying to find its footing, but the numbers tell a story of progress mixed with setbacks. October’s industrial production rose 5.3% compared to the same month last year.

While it’s a slight dip from September’s 5.4%, it missed the 5.6% growth experts had forecast, according to the National Bureau of Statistics. Fixed-asset investment also came in flat, growing by 3.4% for the year through October, the same pace as January through September, and shy of the expected 3.5%.

One bright spot, though, came from retail sales. These surged by 4.8% in October, a big jump from September’s 3.2%. Economists had predicted 3.7%, so this was better than expected.

Retail sales are a key measure of domestic consumption, and this improvement is a sliver of good news in a sea of uncertainty. Yet, even with this uptick, the overall economic picture remains wobbly.

Stimulus measures: Big numbers, small impact

Beijing isn’t sitting on its hands. In the last few months, it has slashed policy rates, eased property-buying restrictions, and thrown cash at financial markets. The moves sent China’s stock market on a roller-coaster ride, but they haven’t solved the bigger problem: weak domestic demand.

The government recently approved a $1.4 trillion debt-swap program to help local governments manage their crushing debt. Property taxes have been cut to lower costs for homebuyers. But while these policies look good on paper, they haven’t translated into widespread economic growth. Why? Because Beijing has avoided launching any large-scale fiscal stimulus package that directly boosts household consumption or stabilizes the crumbling property market.

Economists think the Chinese government is playing a waiting game. They’re holding back on big moves until they know what U.S. President-elect Donald Trump will do. Trump’s trade policies, known for their hostility toward China, could force Beijing’s hand. For now, the strategy seems to be wait-and-see.

“While the Trump presidency clearly increases downward pressure on [China’s] growth, how and when the U.S. enacts its trade/tariff policies toward China remains uncertain,” Barclays economists wrote. Analysts are looking ahead to December, when Beijing will hold a major economic policy meeting, hoping for some clarity. Another key moment will come in March when the annual budget is approved.

The property sector, once a powerhouse driving up to 25% of China’s annual growth, is now a shadow of its former self. Real estate isn’t going to pull the economy out of this slump anytime soon. Manufacturing, however, is trying to pick up the slack. Factories are cranking out goods for foreign markets to keep things moving. But this creates its own set of problems.

Trade wars and tariffs

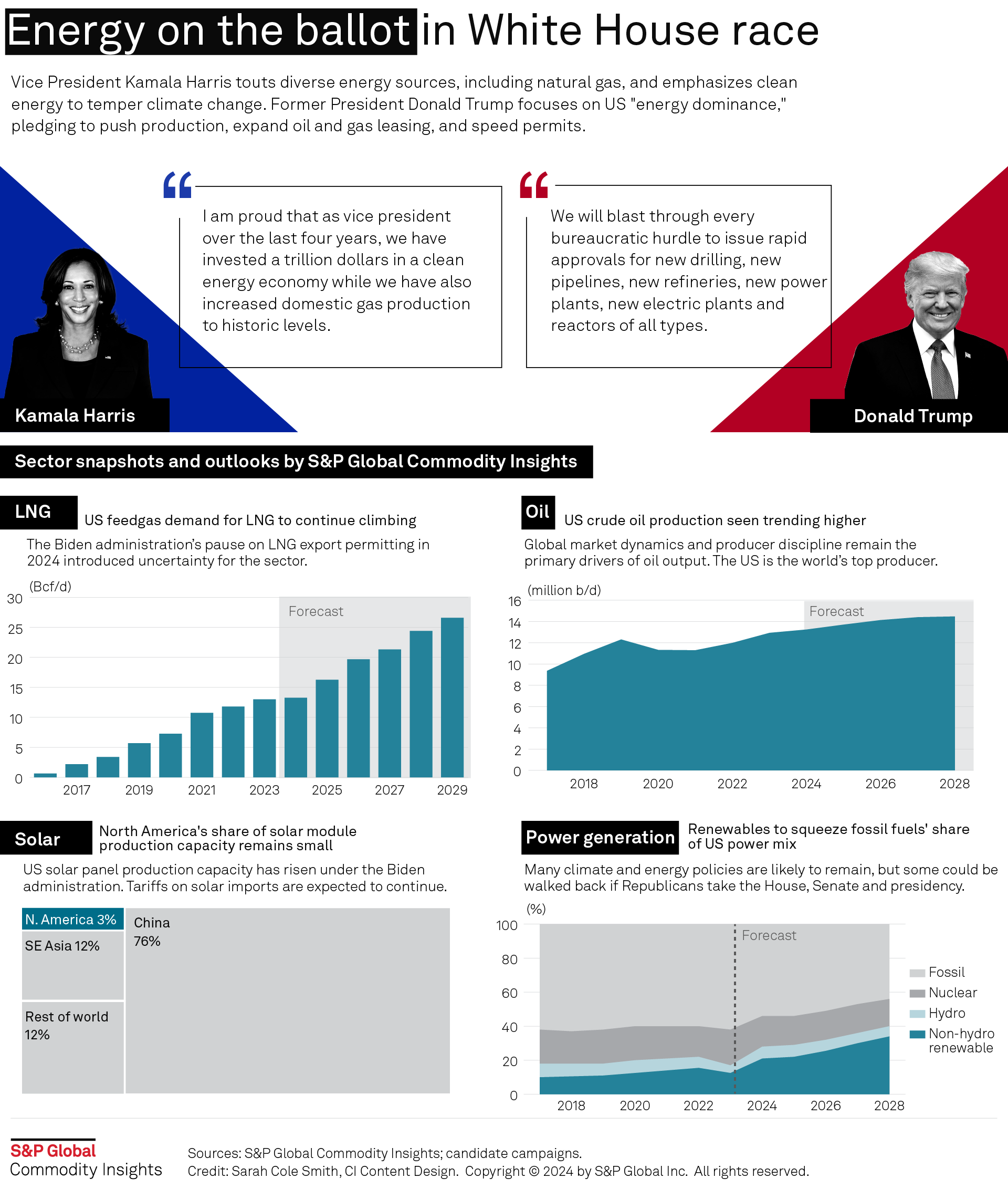

Trump isn’t making things easier for China. He’s threatening to impose a 60% tariff on all Chinese imports, a dramatic escalation of the trade war. If he follows through, U.S.-China trade could shrink by 70%, cutting China’s share of U.S. imports from 14% in 2023 to as low as 4%. That’s according to Oxford Economics, and it paints a grim picture.

This isn’t Trump’s first tariff rodeo. Back in 2018, he slapped hefty duties on Chinese-made washing machines, solar panels, steel, and aluminum. China hit back with its own tariffs on American goods. The Biden administration added more tariffs, targeting Chinese electric vehicles, clean-energy equipment, and semiconductors.

China managed to weather the first round of the trade war. It found new buyers for its goods in Russia and Southeast Asia. It even boosted its global market share in key industries like electric vehicles (EVs). But if Trump ramps up the fight, the next phase will hurt more. UBS estimates that a 60% tariff could slice 1.5 percentage points off China’s GDP growth in the first year alone.

“Trade War 2.0 would likely have a much larger impact than the first phase,” said Duke University economics professor Daniel Yi Xu. Even if Trump doesn’t go all the way with a 60% tariff, economists think some increase is inevitable. Tough-on-China policies have bipartisan support in Washington, which means Trump has plenty of political cover to act.

If the U.S. slams the door, China could try shipping its goods to other countries. But this isn’t 2018. Trade barriers against Chinese imports are rising everywhere, from India to Brazil. Cheap Chinese exports are flooding global markets, and local industries are fighting back. “If other countries respond by also putting up trade barriers, that’s when it starts to become a lot more challenging for China,” said Julian Evans-Pritchard of Capital Economics.

Consumption: China’s last hope?

With real estate in decline and infrastructure spending no longer packing the same punch, Beijing’s options are shrinking. The government can’t build its way out of trouble anymore; it has already covered the country in high-speed railways, highways, and airports. That leaves one big lever: household consumption.

Right now, consumption makes up just 40% of China’s GDP. In the U.S., that figure is closer to 70%. If Beijing wants to keep the economy afloat, it needs to get people spending. This could mean investing more in healthcare and education, reducing household savings rates, and encouraging consumers to open their wallets. A more consumption-driven economy would also help balance China’s trade surplus with the U.S.

Finance Minister Lan Fo’an hinted at “more forceful” fiscal policies for next year. He suggested expanding the budget deficit, increasing local bond issuance, and using the funds more freely.

The government has already accelerated bond sales, raising over 1 trillion yuan ($138 billion) every month from August through October. Cash-for-clunkers programs are also on the table to boost vehicle sales.

Whatever happens next will depend on how Beijing gets through this economic minefield. The stakes couldn’t be higher.