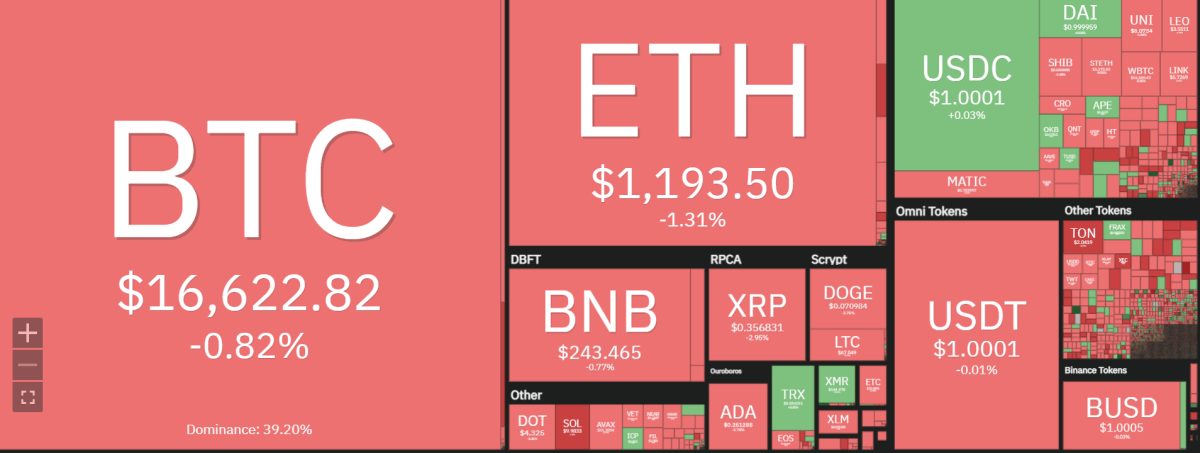

Bitcoin price analysis shows Bitcoin is trading in a low volatile channel as the price gets dragged below the surface as equities tank again on Tuesday. Bitcoin is trading at $16,627.02 after a period of trading in a tight range. Bitcoin might see a dip toward $16,020 by the new year.

Bitcoin succumbs to further losses as global economic uncertainty continues

According to Bitcoin price analysis, as traders seek protection against the tumultuous global markets, Bitcoin’s (BTC) price is unable to compete. This comes in response to US Housing Price Index figures showing diminishing real estate prices nationwide and a 2-year bond auction by the US Treasury that has yielded an unusually high amount of bids – higher than what was registered back in 2017. Investors are now turning towards bonds for safety as we near the end of this year. The bond market’s activity caused the CME Fed Fund Futures’ expected rate cut for 2023 to vanish, resulting in hikes projected throughout that year.

On Tuesday, Bitcoin’s price declined once more as the US equity market plummeted. What is noteworthy here is that every time BTC has decreased in value, Nasdaq was at the forefront of this fall followed by the S&P 500 and subsequently Dow Jones index which all points to a switch between sectors due to traders leaving tech for other markets. As the returns of US Treasury bonds become increasingly attractive, many investors are choosing to invest their funds in either cash or these bonds. After all, it’s almost guaranteed that the U.S. government will never default on its debts and so there is a measure of security when investing this way.

BTC presents an opportunity for traders to capitalize on the reliability of the US Treasury, with investors attaining annual returns between 1.5-4% or 5%, all without being exposed to the erratic swings of equity markets. In the weeks ahead, more capital is expected to be diverted from Bitcoin’s price performance into bonds due to the US Federal Reserve’s scheduled rate hikes in 2023. This could potentially drive BTC up to $16,020 and cause it to experience further drops in subsequent days and weeks.

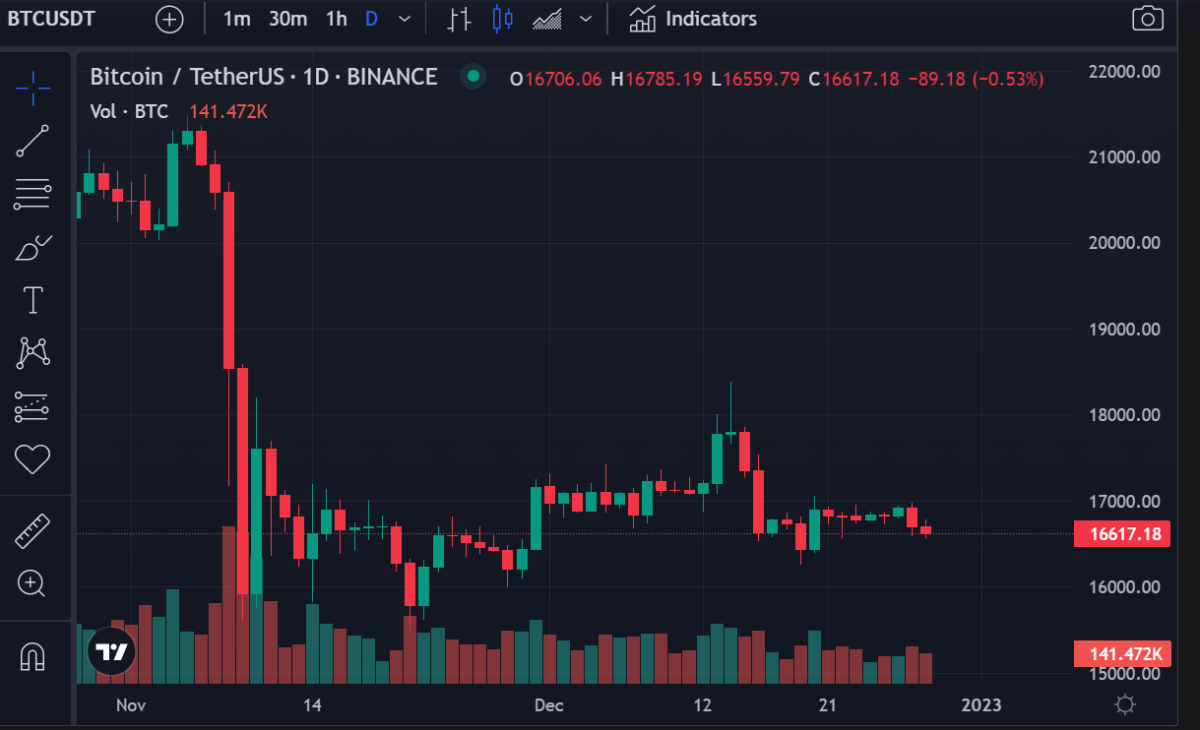

Bitcoin’s technical picture remains bearish on all timeframes

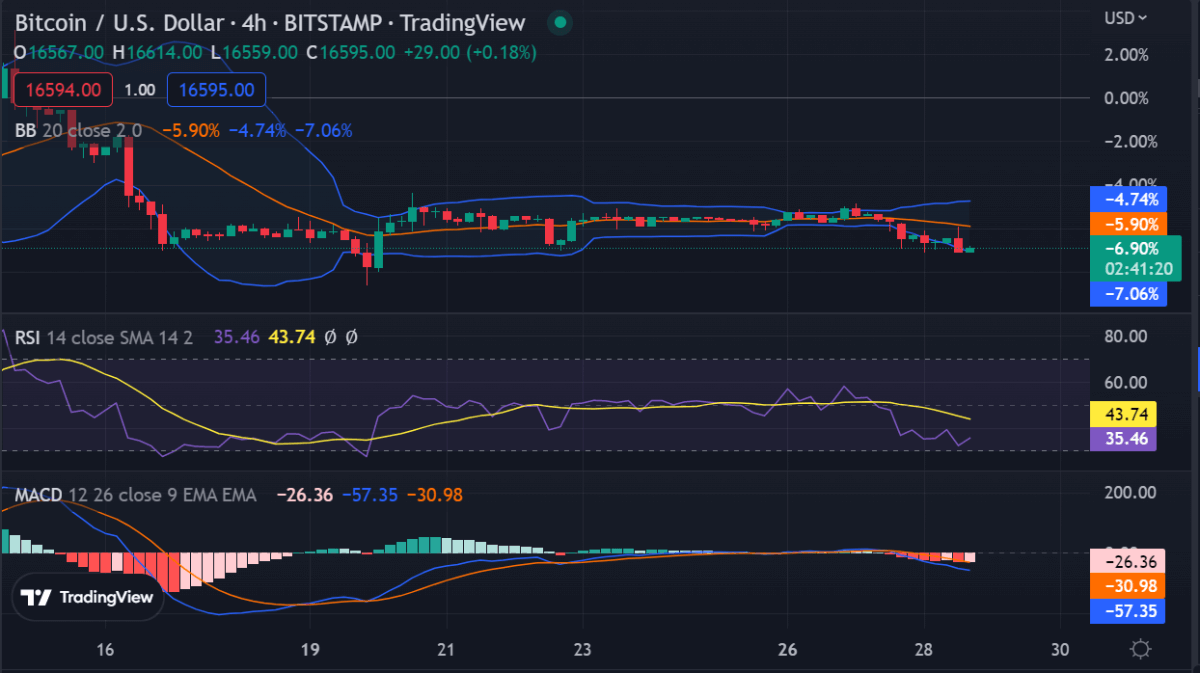

Bitcoin price analysis shows short-term selling pressure is likely to continue until BTC consolidates around $16,500.The relative strength index (RSI) for Bitcoin is also in a bearish zone, suggesting that bearish momentum could increase if the price drops below $16,000.

Looking at the moving averages to measure the momentum of the price, Bitcoin is expected to face strong resistance at the 100-day simple moving average (SMA) line.

As for medium-term prospects, Bitcoin needs to break above $17.000 in order to turn the tide and start a new uptrend. The $17,000 has been a key resistance for Bitcoin to break in the last few days. Bitcoin price analysis on the daily chart shows continued sideways trading, with bears looking to push the price below $16,000 and bulls looking to break out of the ascending triangle.

Bitcoin price analysis on 4-hour and hourly timeframes indicate Bitcoin is still stuck in a bearish flag pattern. If Bitcoin drops below the support of $16,300 it is likely to continue to drop toward $15,900. On the other hand, if bulls manage to break above $17,000 a rally could start in the short term.

The technical indicators are signaling that Bitcoin is currently in a bearish zone, and it’s likely to continue downwards until the price consolidates around $16,500. For instance, The Relative Strength Index (RSI) is below 40 and the MACD is showing a bearish divergence.

The Fibonacci retracement level shows that key support lies at $16,000. If the bulls manage to hold above this level then a short-term rally could be expected. A rebound scenario could occur if the bulls establish support above $16,000 and push BTC to break above the 50-day SMA line.

Bitcoin price analysis conclusion

Bitcoin price analysis sums that the cryptocurrency is still stumbling to break above the $17,000 resistance. If Bitcoin drops below $16,000 then it is likely to continue downwards toward $15,900. However, if the bulls can establish support above that level then a short-term rally could start.

Apart from technical analysis, fundamental factors such as the US Federal Reserve’s scheduled rate hikes in 2023 could also affect BTC’s price performance. It is important to note that Bitcoin price could continue to move in a range until further clarity emerges from the bond markets or if traders switch back from bonds to equities.

At this point, it appears that Bitcoin’s market trends will remain closely linked to the bond market in the weeks ahead. Until there is clarity on whether investors are truly committed to bonds or decide to switch back to equities, volatility should be expected in the crypto markets.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Cardano, and Curve