Today’s Aave price analysis reveals that prices are on a prevailing downtrend that has been seen since yesterday’s market rally. The 5.50 percent drop in prices has decreased AAVE to $54.94 from the intraday high of $58.15. The downtrend will likely continue in the near term as AAVE prices are trading close to the lower boundary of the descending channel.

The support for AAVE prices is present at $53.34, and a breakdown below this level could see AAVE enter into a freefall towards the $53.20 region, while a move above $58.15 is required for bulls to take control of the market. The Market cap for AAVE stands at $774 million, and the 24-hour trading volume is recorded at $55 million.

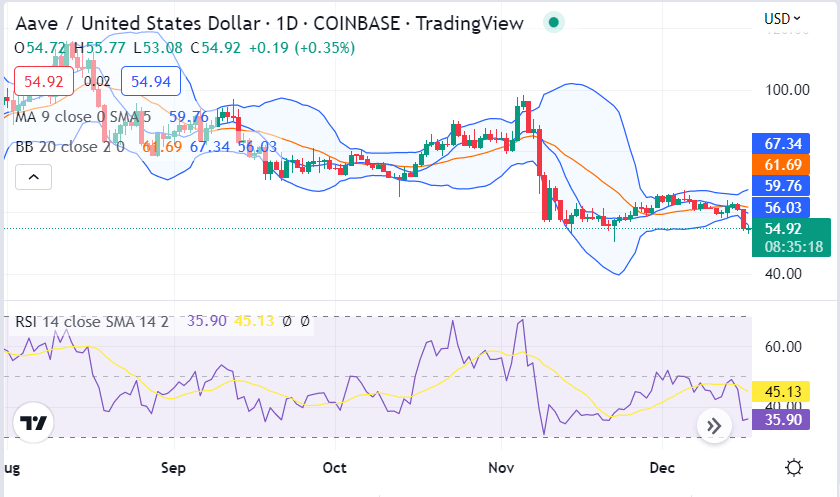

AAVE/USD 1-day price chart: Price goes down to $54.94

The 24-hour Aave price analysis predicts a downward trend for the market as the selling momentum remained high during the day. The bears have successfully tackled the unfavorable circumstances as no considerable bullish efforts have been seen. The price is now at $54.94, and further devaluation will follow if the selling activity experiences a further rise.

The technical indicators signal a continuation of the bearish trend as the RSI indicator is under the 45.13 level and heading towards oversold conditions. The sell-off from the highs has taken AAVE prices below the key support level at $53.34 and also below the 20-day moving average (MA) at $59.76. The 20-day moving average (MA) and the 50-day MA are trending southward, which is a sign that the bears are in control of the market. The Bollinger bands have also widened, which is an indication of high volatility in the market.

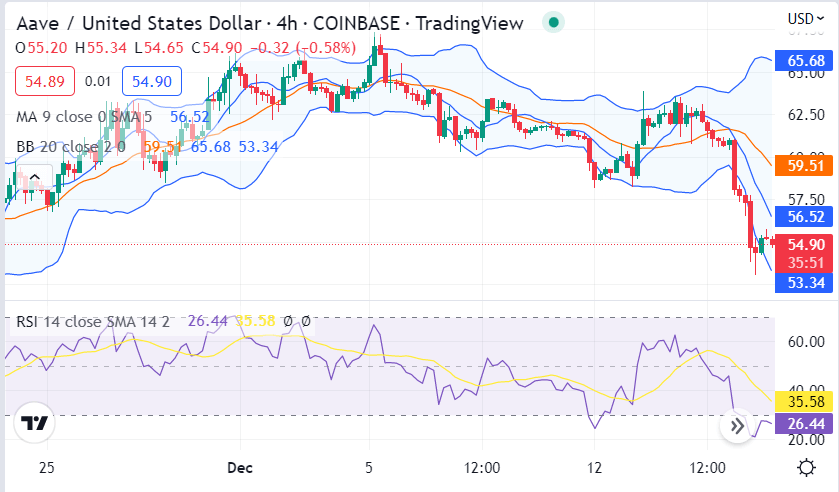

Aave price action on a 4-hour price chart: Bearish trend line intact

The 4-hour Aave price analysis shows a descending channel as the price is trading inside the descending channel. The downtrend will continue if the price breaks below $54.94, and this can result in a decline of the current price toward the $53.34 region. The descending channel is a bearish pattern and has been formed as the price action has made lower highs and lower lows over the last few hours.

Aave price analysis indicates that market volatility increases rapidly, making AAVE prices more prone to wild swings. The Bollinger band’s upper limit is set at $58.15, a resistance barrier. The lower boundary of the Bollinger band is set at $53.34, which rather than providing support, serves as another barrier against downward movement. A bearish trend is indicated by the AAVE/USD exchange rate passing beneath the curve of the Moving Average. Bears control the market now, but uncertainty has grown considerably, suggesting that the trend could change at any time.

The Aave price study reveals that the Relative Strength Index (RSI) is 35.58, indicating AAVE/USD is neither overvalued nor undervalued. The RSI may be used to indicate an improving market trend and a chance of recovery after a rise in which the market trend is rising.

Aave price analysis conclusion

We can deduce that the bears have reclaimed market control from Aave’s price analysis. If this persists, Aave may experience a significant fall more remarkable than it already has. Aave has seen a rocky bearish movement with huge swings in recent days, suggesting that the bulls must up their game if they want to regain momentum and raise the price of AAVE. The bears still have the upper hand, but a trend change is likely based on all market data.