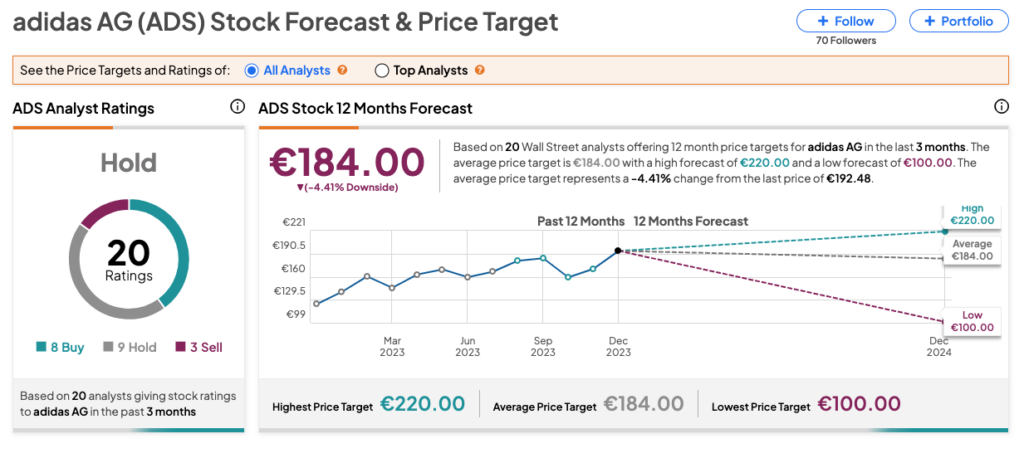

Adidas, a global sportswear giant, has recently faced a significant downturn in its stock value following a cautious outlook for the year 2024. The company’s shares witnessed a sharp decline after the release of its 2024 forecast, which fell well below analyst expectations.

This unexpected development has sparked concerns among investors and the financial community, leading to a flurry of reactions and speculations about the future of Adidas in the market.

Adidas faces market downturns

According to reports from reputable financial sources, Adidas anticipates an operating profit of around 500 million euros for the year 2024. While this figure represents an increase from the previous year, it has not met the optimistic projections set by industry analysts. The disparity between the company’s forecast and market expectations has triggered a selloff, impacting the overall valuation of Adidas shares.

Adidas AG fell after the German sportswear company said negative currency fluctuations would reduce its profit this year to less than half of what experts expected.

Adidas stated late Wednesday that its operating profit in 2024 will be around €500 million ($542 million). That’s less than the average expert expectation of €1.27 billion. The business intends to alleviate some of the harm by continuing to sell the remaining goods from its collapsed Yeezy collaboration with rapper Ye.

Adidas shares tumbled as high as 7.4% on Thursday. The stock has lost half of its value since its peak in 2021. Rivals Nike Inc. and Under Armour Inc. fell in US trading Wednesday.

Instead of wiping off €250 million in remaining Yeezy inventory, the German shoemaker announced that it would sell it at least at cost.

Despite a €1 billion currency impact from factors such as the Argentine peso’s devaluation in 2023, Adidas expects to return to growth this year as it continues its turnaround efforts in the face of rising concerns about global demand for trainers and sports gear.

Adidas also reported a “severe impact” from the Argentine peso’s devaluation at the end of the year. Adidas rival Puma also announced lower earnings after the peso fell by 54% in mid-December. Argentina is a key market for both sportswear brands.

Investors have been looking for signs of weakness in the sector after Nike expressed concerns about consumer demand in China and around the world in December, while Puma warned about the impact of Argentina’s hyperinflation.

The company’s profitability could potentially increase if it could generate more money from its remaining Yeezy inventory rather than simply recoup expenditures, as is currently planned. It has only written down €12 million ($15 Million) of products that were “either damaged or very broken in sizes.”

The effects of the negative market outlook on DeFi ecosystems

Adidas recently announced a cautious outlook for 2024, leading to a significant decline in its shares. While this primarily affects the sportswear giant, the repercussions extend to various sectors, including the realms of cryptocurrency, non-fungible tokens (NFTs), and the metaverse.

The cautious market outlook from Adidas may contribute to increased volatility in the crypto market. Cryptocurrencies are known for their sensitivity to global economic conditions and market sentiments. Negative outlooks from major corporations can lead to a loss of investor confidence, potentially triggering sell-offs in various asset classes, including cryptocurrencies.

This is especially true because the entity is involved in Web3 and NFTs.