AMP Price Prediction 2023-2032

- AMP Price Prediction 2023 – up to $0.0037

- AMP Price Prediction 2026 – up to $0.0122

- AMP Price Prediction 2029 – up to $0.0389

- AMP Price Prediction 2032 – up to $0.1175

Amp seeks to enable users to stake tokens without having to transfer them to a smart contract physically. This function seeks to make Amp suitable for any form of value exchange, including digital payments, traditional currency exchange, loan distributions, real estate transactions, and more. Staking Amp seeks to improve overall utility by increasing in proportion to the number of users and transactions (e.g., customers, wallets, merchants) that join the network. As a result of technological innovations, Amp seeks to drive network economic growth through adoption and payment volume (i.e., productivity output).

How much is AMP worth?

Today’s live AMP price is $0.003883, with a 24-hour trading volume of $8,901,874. Amp is up 0.47% in the last 24 hours. The current CoinMarketCap ranking is #262, with a live market cap of $161,740,197. It has a circulating supply of 42,227,702,186 AMP coins and a max. supply of 99,444,125,026 AMP coins.

AMP price analysis: AMP elevates up to $0.00382 following upturn

TL; DR Breakdown

- AMP price analysis confirms a bullish trend.

- Coin value has improved up to $0.00382.

- Strong support is available on $0.00232.

The latest one-day and four-hour AMP price analysis for 20 December 2023 confirms signs of an upward trend for the day. The price has been following an ascending movement since the past 24-hours, as the buying pressure remained on the higher end. As the bulls are currently occupying the winning end, the coin value has improved up to $0.00382.

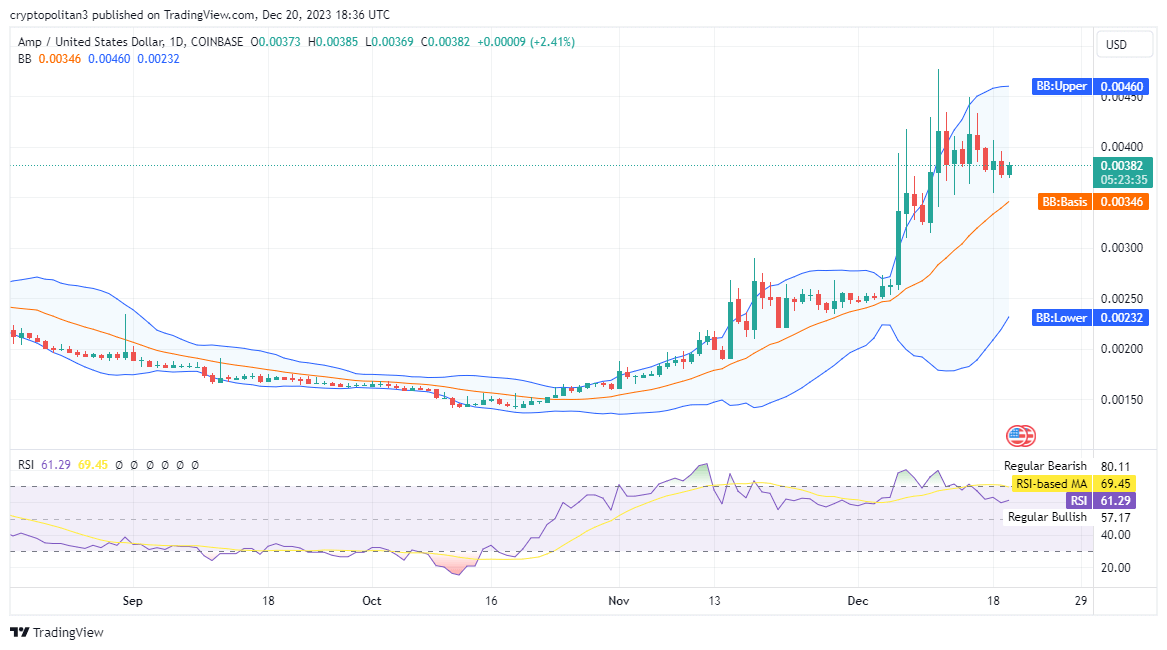

AMP price analysis 1-day chart: Cryptocurrency seeks bullish recovery above $0.00382 high

The recent one-day AMP price analysis confirms signs of an increasing trend for the day. A commendable rise in cryptocurrency value was observed since the past 24-hours, as the buying activity has been aggravating. Today, a further rise in bullish strength was observed as the coin value stepped up to $0.00382 high. Moreover, the Moving Average (MA) has decreased to $0.00389 as well.

Moreover, the volatility is decreasing as well which is a bullish hint regarding the coming market trends. As the volatility is changing the upper and lower values of the Bollinger bands indicator have shifted as well. Currently, the upper end of the Bollinger bands indicator is present at $0.00460 high whereby its lower end is situated at $0.00232. The Relative Strength Index (RSI) indicator confirms the ongoing uptrend as its overall value has spiked up to an index 61.29.

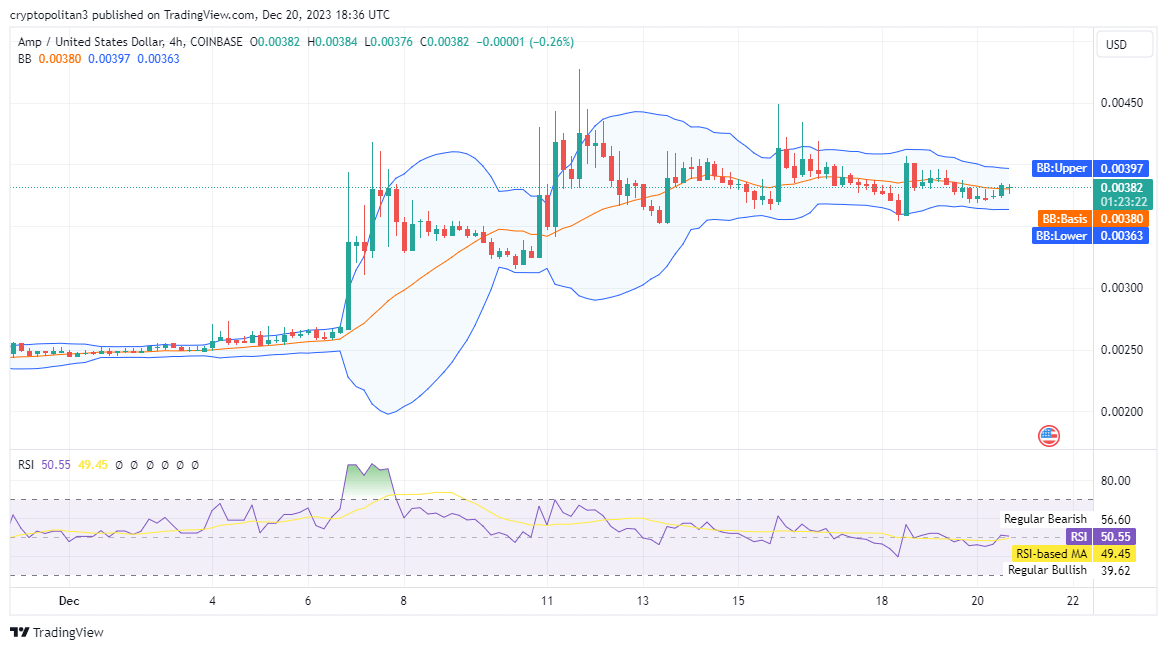

AMP/USD 4-hour price chart: AMP value hikes past $0.00382 amidst bullish rally

The four-hour AMP price analysis presents a highly bullish scenario regarding the current market situation. The bulls have been ruling the market since the earlier hours of the day, and a considerable rise in coin value has been recorded. As the buying activity is intensifying since the past four hours, AMP/USD value has increased up to $0.00382. On the opposite side the Moving Average value has descended to $0.00378 as a result of the previous slump.

The volatility is decreasing which means that the coming market trends can remain bullish. As the volatility is declining, the upper end of the Bollinger bands indicator have repositioned itself on $0.00397 high. Whereby, the lower end of the Bollinger bands indicator now occupies $0.00363 extreme. The RSI graph confirms the ongoing upward trend as its overall value has moved up to index 50.55.

What to expect from AMP price analysis next?

The latest one-day and four-hour AMP price analysis presents a bullish scenario regarding the ongoing market trends. Although a bearish dive was recorded yesterday, today the coin value has found recovery up to $0.00382 hill. Moreover, the four-hour price analysis is confirming a rise in cryptocurrency value as well.

Also Read:

- How to Stake AMP Tokens

- Galxe & Forbes join forces in Web3 revolution

- Unveiling the Future: Google Drive’s Revamped Homepage

- Ubisoft’s Classic Game “Beyond Good & Evil” Gets Enhanced Edition

AMP Recent News and Events

“Good technology turns complex mechanics into simple UX” – Tyler Spalding, CEO of Ampera.

This concept is pivotal in understanding how technological advancements are not just about the sophistication of their underlying mechanics but also about how these advancements are presented and interacted with by the end-users. Further buttressing Tyler’s statement about stablecoins being a more efficient form of value transfer.

AMP Shares Decline in November Due to NIM Pressure. In November, AMP Ltd (ASX: AMP) experienced an almost 11% drop in its shares, attributed to a disappointing investor update. The company’s announcement of plans to launch a digital bank for small businesses was overshadowed by concerns about continued net interest margin (NIM) pressure into FY 2024.

UBS responded with a sell rating and an 18% price target cut, citing expectations of softening bank volumes and margins. However, Ord Minnett sees potential upside, retaining an accumulate rating with a trimmed price target of $1.30.

Citi, remaining neutral, noted the positive step of settling the Buyer of Last Resort class action and anticipates another capital return soon. Investors face conflicting views amid uncertainties about AMP’s future performance.

The Amp community has introduced a bot for Tracking on-chain staking for $AMP. The Amp community unveils a bot for tracking on-chain $AMP staking, simplifying the process. Effortless monitoring of on-chain $AMP staking is now possible with the new bot.

A moratorium is the best accommodation IMHO. This would stop any new or ongoing legal actions against the companies in question. This would give the company the breathing room it needs to make the proposed reorganization. Know more about staking before you cash in your AMP.

As a turbulent year for investment markets draws to a close, AMP’s Chief Economist, Dr. Shane Oliver looks ahead to 2023, and why there’s room for optimism. Soundcloud, Spotify, Google, and Apple podcasts.

AMP Price Predictions 2023-2032

Price Predictions By Cryptopolitan

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2023 | 0.0033 | 0.0036 | 0.0037 |

| 2024 | 0.0053 | 0.0054 | 0.0060 |

| 2025 | 0.0072 | 0.0074 | 0.0090 |

| 2026 | 0.0102 | 0.0105 | 0.0122 |

| 2027 | 0.0145 | 0.0150 | 0.0179 |

| 2028 | 0.0222 | 0.0228 | 0.0254 |

| 2029 | 0.0333 | 0.0345 | 0.0389 |

| 2030 | 0.0478 | 0.0491 | 0.0581 |

| 2031 | 0.0676 | 0.0700 | 0.0820 |

| 2032 | 0.0992 | 0.1027 | 0.1175 |

Amp Price Prediction 2023

In 2023, the Amp market is expected to see its maximum price reach $0.0037. The minimum price is projected to hover around $0.0033, with the average trading price anticipated to be approximately $0.0036.

Amp Price Prediction 2024

For 2024, Amp’s price trajectory suggests a maximum price of $0.0060. The minimum price is expected to align at $0.0053, with the year’s average trading price estimated to be around $0.0054.

AMP Price Forecast for 2025

Our AMP price prediction for 2025 indicates a bullish trend for Amp, with the maximum price potentially reaching $0.0090. Conversely, the minimum price of the coin might stabilize at $0.0072, with an average trading price of $0.0074.

Amp (AMP) Price Prediction 2026

In 2026, based on current projections and technical analysis, Amp’s maximum price is anticipated to reach $0.0122. The minimum price could be around $0.0102, with an average trading price of $0.0105.

Amp Price Prediction 2027

According to our Amp price prediction for 2027, the maximum price is expected to surge to $0.0179. The minimum price could be around $0.0145, with an average trading price of $0.0150.

Amp Price Prediction 2028

Our Amp price prediction for 2028 suggests a maximum price of $0.0254. The minimum price is projected to be $0.0222, with an average trading price of $0.0228.

Amp (AMP) Price Prediction 2029

For the year 2029, the maximum price of Amp is predicted to reach approximately $0.0389. The minimum price is expected to be $0.0333, with an average trading price of $0.0345.

Amp Price Forecast 2030

The AMP price forecast for 2030 suggests a maximum token price of $0.0581. The minimum price is projected at $0.0478, with an average trading price of $0.0491.

Amp (AMP) Price Prediction 2031

For 2031, the Amp price forecast suggests a maximum price of $0.0820. The minimum price for the year could be around $0.0676, with an average price of $0.0700.

Amp Price Prediction 2032

Our AMP price prediction for 2032 shows a potential maximum price of $0.1175. Conversely, it could trade at a minimum of $0.0992, and an average trading price of $0.1027.

AMP Crypto Price Prediction By Technewsleader

Technewsleader’s analysis forecasts a promising future for AMP, predicting a steady rise in its value over the next decade. In 2023, AMP is expected to grow by approximately 33.3%, reaching around $0.004. The momentum continues in 2024, with a projected 133.33% increase, pushing the price to $0.007. Looking ahead to 2028, the five-year outlook suggests a potential rise to $0.031. The predictions become even more bullish for 2030, with AMP potentially climbing to $0.067. By 2032, the forecast indicates a significant surge, with AMP’s price expected to range between $0.13 and $0.15, highlighting its potential for substantial long-term growth.

AMP Price Prediction By DigitalCoinPrice

Digitalcoinprice forecasts a steady ascent in the value of Amp (AMP) over the coming years. Their analysis suggests that by the end of 2023, Amp could attain a value of $0.00756. This upward trend is expected to continue, with the price projected to increase to $0.0125 by 2025, and further escalate to $0.0157 by 2026. In 2028, Amp’s average price is anticipated to be around $0.0179. The forecast for 2029 indicates a potential price range for AMP between $0.0232 and $0.0256, implying some variability. Looking further ahead to 2032, Digitalcoinprice predicts that Amp’s price could reach as high as $0.0669, reflecting a significant growth trajectory over the decade.

AMP Price Prediction By Wallet Investor

Wallet Investor’s projection for Amp (AMP) indicates a downward trend, suggesting that the cryptocurrency might decrease to $0.000316. This forecast presents a rather pessimistic view of its investment potential in the upcoming year.

AMP Coin Price Prediction by Market Experts

AJ Five suggests a potential spike in AMP’s value to approximately $0.004 to $0.0045, followed by a gradual decrease. This kind of rapid fluctuation is characteristic of the crypto market and highlights the need for timely decision-making in cryptocurrency investments. The analysts forecast a more sustained increase in AMP’s value over the next 6 to 8 weeks. Over a much longer period, AJ Five anticipates a rally to the $0.01 mark in the second half of 2024.

According to Moon333’s analysis AMP has experienced a breakout from a falling wedge pattern, indicating a potential bullish reversal after a downward trend. The analyst highlights significant resistance levels at $0.045 and $0.079. These levels previously acted as support and are now key points for potential price breakouts. Moon333 suggests a target price between $0.08 and $0.10.

AMP Overview

In traditional payment systems, transactions often suffer from slow speeds and security vulnerabilities, largely because they rely on intermediaries. While blockchain technology promised to address these issues, it has struggled to provide both speed and security at the same time. Usually, one has to be compromised to achieve the other. Amp cryptocurrency aims to resolve this dilemma entirely by offering a unique decentralized solution that delivers both speed and security.

The core goal Amp remains consistent: to secure transactions and associated data, making them both faster and more secure. Developed on the Ethereum blockchain and compliant with the ERC20 token standard, Amp offers users the flexibility to trade in either fiat currency or other digital assets.

Understanding Amp is closely tied to understanding its parent company, Flexa Network, which was co-founded in 2018 by Daniel C. McCabe, Machary Kilgore, Trevor Filter, and Tyler Spalding. Flexa serves as an open network that enables real-time cryptocurrency payments at both online and brick-and-mortar retailers.

Flexa introduced an app called SPEDN, which allows users to make payments using various cryptocurrencies like Bitcoin (BTC), Litecoin (LTC), and Ether (ETH). The app is accepted by over 40,000 merchants in the United States and Canada. Originally, the network used FlexaCoin (FXC) as its native token. However, to enhance security for merchants, Flexa transitioned from FXC to the newer Amp token.

AMP Price History

The concept for the AMP ecosystem was conceived in the first quarter of 2019, and the token was officially launched on September 11, 2020, with an initial price of $0.009. In its early months, AMP experienced a downward trend, hitting an all-time low of roughly $0.0007 on November 17 of the same year.

However, the token reversed its fortunes entering 2021. It surpassed its launch price, reaching a notable high of about $0.046 on February 14, 2021. The momentum continued, and by April 18, AMP’s price peaked at $0.064. It set new records, reaching a high of $0.077 on May 7 and then $0.12 on June 16, following its listing on the prominent cryptocurrency exchange, Coinbase.

Despite these spikes, the overall trend for the rest of the year was bearish. By September 2021, AMP had fallen below the $0.05 mark, and by January 2022, it had declined further to $0.02. The bear market proved challenging, and by June of that year, AMP’s price had fallen below its initial launch price. On September 7, it hit a 52-week low of $0.0054.

As of 2023, there are signs of a potential downturn. The token started the year at $0.003052, trading at just about 38.85% below that level.

More About AMP

What is AMP?

AMP can be described as a form of transaction insurance because if a transaction on the Flexa network fails due to lengthy transaction times, the AMP cryptocurrency steps in to offset those losses. The Flexa network includes various exchanges and financial institutions to provide complaint settlements across multiple jurisdictions. Flexa integrates natively with existing point of sale (POS) systems and online platforms to enable payment in a typical checkout experience.

In other AMP crypto news, users worldwide have staked $710m in AMP to back Flexa payments as of 10 March. It was $1.3bn on 6 January. AMP received a 40% boost to its price on 23 November when leading exchange Binance announced it was making AMP available to its users.

AMP Crypto

AMP cryptocurrency is an Ethereum-based digital coin used as collateral to secure transactions and decentralize the risk of asset transfer in decentralized finance (DeFi). It is a new digital currency in the crypto market that provides an instant and versatile interface for verifiable collateralization via a system of collateral partitions and collateral managers. Third-party networks can instantly secure transactions for various assets using AMP crypto.

AMP collateral partitions are designed to collateralize accounts, transactions, applications, and carry balances that are directly verifiable on the blockchain of Ethereum. AMP collateral managers are smart contracts that could be locked, released, and redirected to support value transfer activities.

This new ability to use any asset immediately upon transfer is a feature any asset can benefit from, whether digital or physical, cryptocurrency or Central Bank Digital Currency (CBDC)

AMPToken.org

The creators of AMP coin aim to remove the likelihood of fraud and reduce the cost of counterparties transactions. AMP users can stake AMP tokens to guarantee financial exchange such as digital payments, currency exchange, loan payments, and property sales regardless of the consensus mechanism.

Co-founder Tyler Spalding said that the startup gradually leverages its wallet service while providing more centralized software solutions for merchant partners. Amp already works with companies that use its services, including Flexa, CoinGekco, Gemini, Sushi, Uniswap, and many others.

Furthermore, AMP token supports a vast range of use cases for collateral. Also, it introduces the concept of predefined partition strategies, which could enable unique capabilities like collateral models for staking without ever leaving their original address.

AMP Crypto real-world use cases

Collateral for payment networks

Flexa enables instant, fraud-free payments to merchants across its digital payment network. Apps that integrate Flexa stake Amp ensure all payments can be settled in real-time regardless of the asset or protocol used. Visit the Staking Guide for details on using AMP for global power payments.

Collateral for individuals

Users can assign AMP to a collateral manager and transfer another asset without requiring excessive transaction fees. The exchange counterparty can allow the underlying asset to be used immediately as AMP is sufficiently escrowed against the value of the transaction.

Collateral for DeFi platforms

Amp Price HistoryDeFi platforms are adding Amp to their products. This has further diversified AMP’s current and future uses and effectively increased its collateral quality. Explore the multitude of DeFi platforms already using Amp.

What to do with AMP

Staking AMP

- Stake AMP and earn more AMP (No lock on tokens or staking rewards):

- Flexa Capacity

Yield Farming AMP

- FlashStake

- Sushi Onsen

- Moonswap

Borrow AMP and Lend AMP

- Gemini Earn

- Sushi Kashi

- Yield Credit

- Cream

Become an AMP Liquidity Provider (LP) and earn trading fee rewards

AMP DeFi Integrations

Flexa Integrations

- Wallet Integrations (https://flexa.network/apps)

- Payment Provider Integrations (https://flexa.network/integrations)

- Currencies Supported (https://flexa.network/currencies)

Price Markets

- Chainlink (https://data.chain.link/amp-usd)

- DeFiPulse (https://defipulse.com/flexa)

- DeFiLama (https://defillama.com/protocol/flexa)

- CoinGecko (https://www.coingecko.com/en/coins/amp)

- CoinMarketCap (https://coinmarketcap.com/currencies/amp/)

- LiveCoinWatch (https://www.livecoinwatch.com/price/Amp-AMP)

Trading

- Trading View AMP/USD (https://www.tradingview.com/chart/a9md1XXE/)

- Stocktwits AMP.X (https://stocktwits.com/symbol/AMP.X)

Custody

- Coinbase Custody (https://custody.coinbase.com/assets)

- Gemini Custody (https://www.gemini.com/custody)

- Fireblocks (https://www.fireblocks.com/platforms/all-features-and-integrations/)

Conclusion

The AMP ecosystem has continued to draw investors who use the platform to explore opportunities its ecosystem presents, including Defi, the crypto market, and NFTs.

The network’s smart contracts offer a variety of built-in incentive models, including continuous compounding and micro-distributions. Amp could develop into a preferred network for transactions because of its distinctive offerings. The platform also boasts multiple partners that increase its ecosystem’s value; some include Poliniex, Bittrex, Crypto.com, and Yield. With AMP, users can provide collateral for both digital and physical assets.

Amp network offers value not only in the blockchain space but also for real-world assets. You can buy AMP token on top-tier crypto markets like Binance, Coinbase, and Gemini. The AMP forecast shows that the token will hit higher highs in 2032, meaning it has a bright future and can be a good long-term investment.

However, adverse news and market crashes could derail AMP’s performance in the cryptocurrency market. The analysis is not investment advice; cryptocurrency markets are highly volatile. Therefore, you must do your own research before investing in crypto assets.