A widely followed crypto analyst is breaking down Ethereum (ETH) and Bitcoin (BTC) while naming altcoins he thinks could outperform the slumping markets.

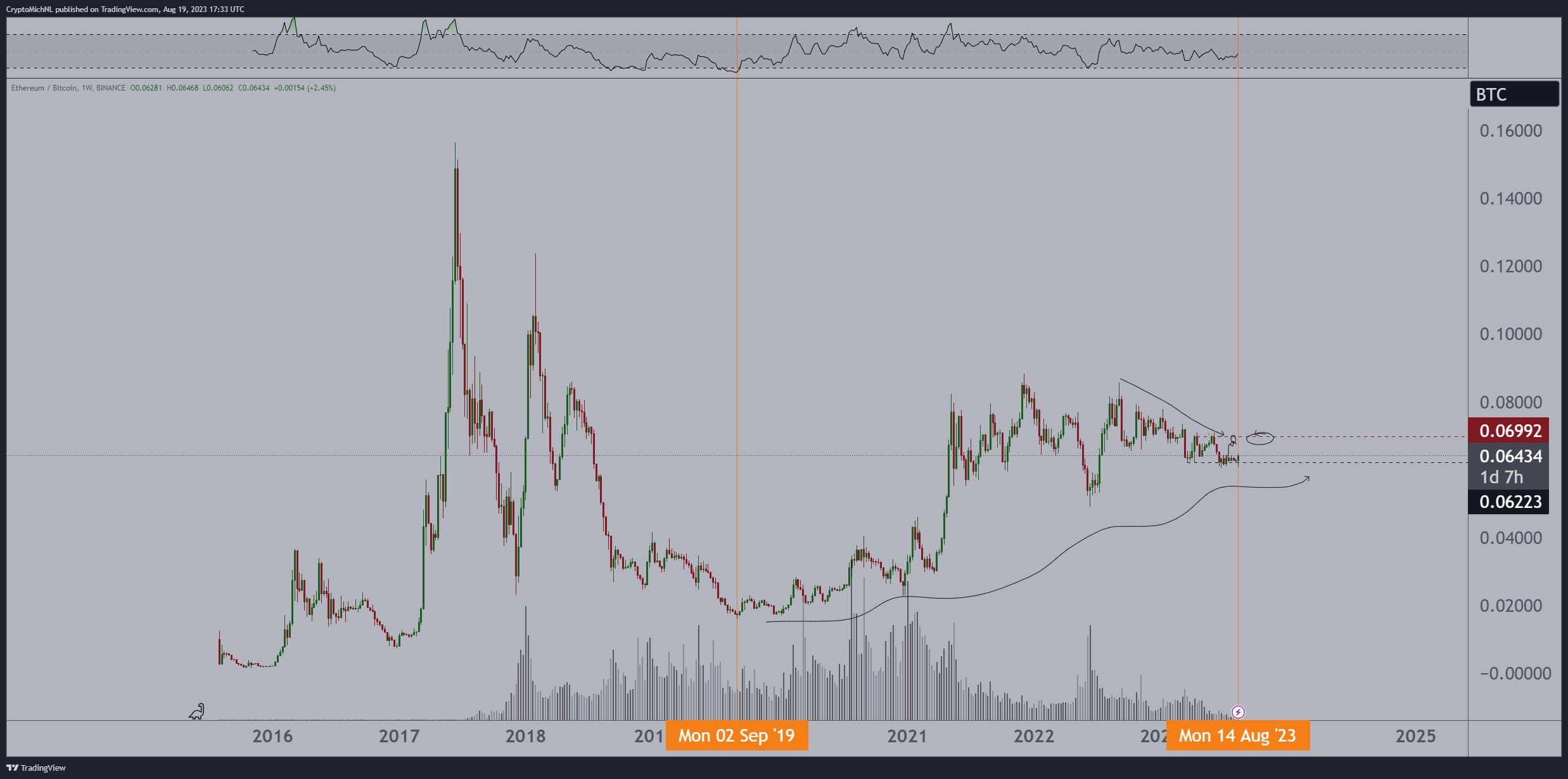

Crypto trader Michaël van de Poppe suggests to his 663,900 followers on the social media platform X that, historically speaking, ETH’s current price dip might have something to do with BTC’s upcoming halving.

“In 2019, Ethereum dipped towards the cycle low in September ’19. Eight months prior to the Bitcoin halving.

In 2023, Ethereum seems to be making the low again eight months prior to the halving.”

ETH is worth $1,644 at time of writing, down 7.6% in the last week.

Looking at the top crypto by market cap, the analyst says BTC could be following in the footsteps of commodities.

“Silver & Gold showing massive strength after terrible PMI (Purchasing Managers’ Index) rates.

Yields seem to top out, through which Bitcoin is likely to follow the commodities.”

The trader also provides a chart to help solidify his point.

“Bitcoin moves alongside commodities.

Silver reclaimed all the losses and is back to the levels of July.

Matter of time whether Bitcoin runs back to $30,000.

If we have another sweep of the lows at $24,000-25,000 -> I’m a final buyer before the bull.”

BTC is trading for $26,042 at time of writing, down 8% over the last seven days.

Finally, Van de Poppe names his top “newer coins” and “memecoins” that he’s keeping an eye on.

“During the coming period, comparable to 2020, I think certain categories could outperform.

Newer coins: ARB / OP / INJ / SUI

Memecoins: PEPE / DOGE

Definitely in the books to monitor.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/tomertu/Andy Chipus

The post Analyst Opens the History Books on Ethereum, Compares Bitcoin to Commodities and Names Top Rising Altcoins appeared first on The Daily Hodl.