A top crypto analytics firm has spotted an often overlooked metric hinting that big buyers are accumulating Bitcoin (BTC).

In a thread on the social media platform X, on-chain data analytics provider CryptoQuant explores the question of what has changed with BTC over the last year.

“What has changed to Bitcoin in the past 1 year?

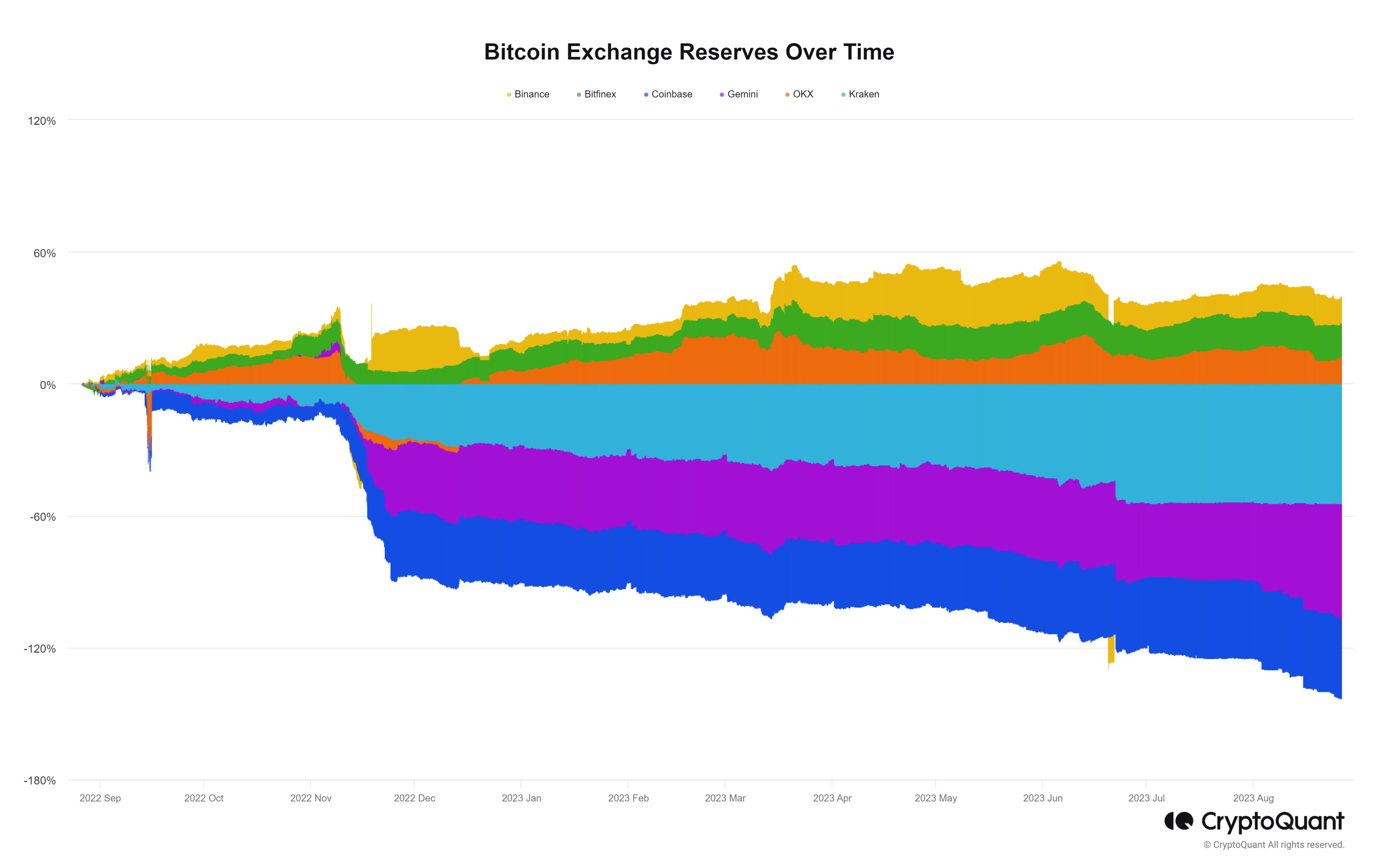

- US-based Centralized Exchanges’ reserves continue to decrease.

- The outflow amount hints at the possibility of institutions’ accumulation.

- The recent price action has been driven by the futures market.”

According to CryptoQuant, the BTC reserves on non-US-based exchanges have increased over the last year while the same number has declined in US-based exchanges.

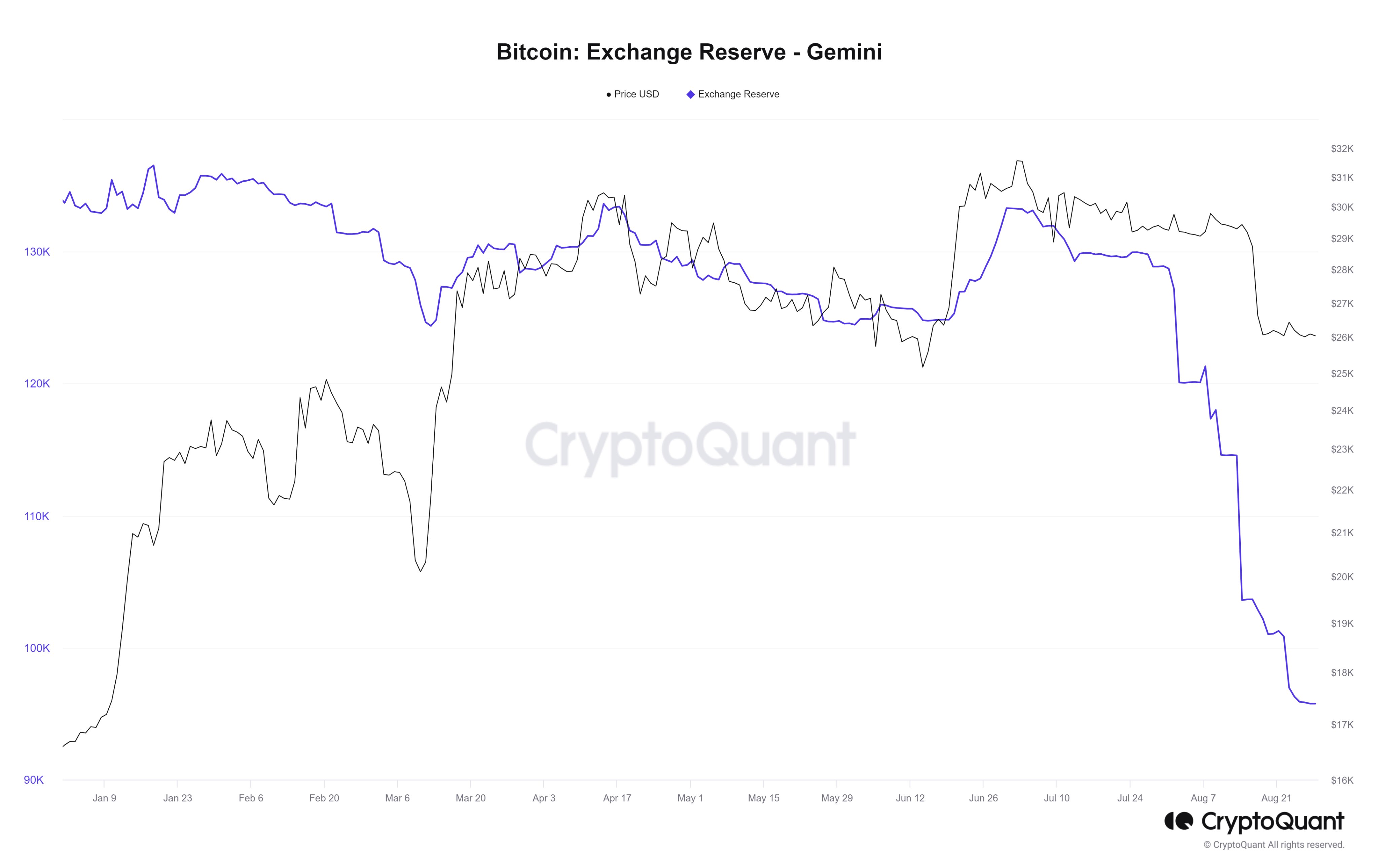

CryptoQuant also says that institutional buyers are likely consistently collecting the leading crypto asset by market cap.

“Institutions’ accumulation

Considering the amount withdrawn and the deposit and withdrawal records of the wallets, institutions are continuously buying Bitcoin.

For example, In August alone, more than 20K BTC, accounting for roughly 25%, were withdrawn from Gemini.”

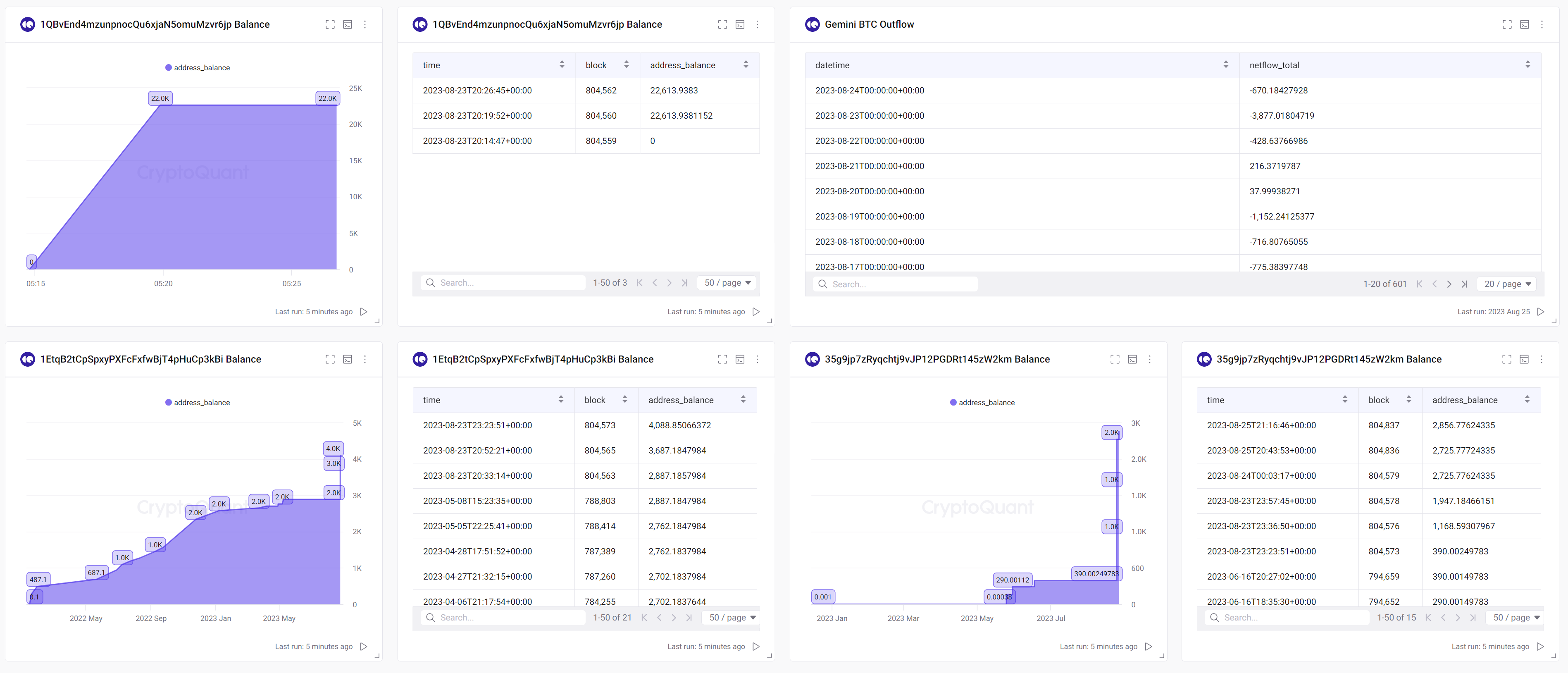

Continuing the thread, the analytics firm provides more evidence to support its institutional conclusions.

“Institutions’ accumulation

– 27.7K BTC were withdrawn from Gemini’s wallet address: 3Fup

– These Bitcoin were transferred to wallets like 1QB, 1Et, and 35g.”

The firm also finds that investors are becoming increasingly exposed to BTC derivative products and futures markets.

BTC is worth $27,470 at time of writing, up 5.4% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/RealmDrifter/Konstantin Faraktinov

The post Analytics Firm Identifies Under-the-Radar Metric Hinting of Institutional Accumulation of Bitcoin (BTC) appeared first on The Daily Hodl.