Binance Coin price analysis has been quite bullish today, as the price went all the way up to $1439 before rapidly falling back again. However, despite the bubble’s burst, Binance Coin is still hovering around the $828 mark, which means that most people who bought in a day or two ago are still in great profits. But are the bulls exhausted already?

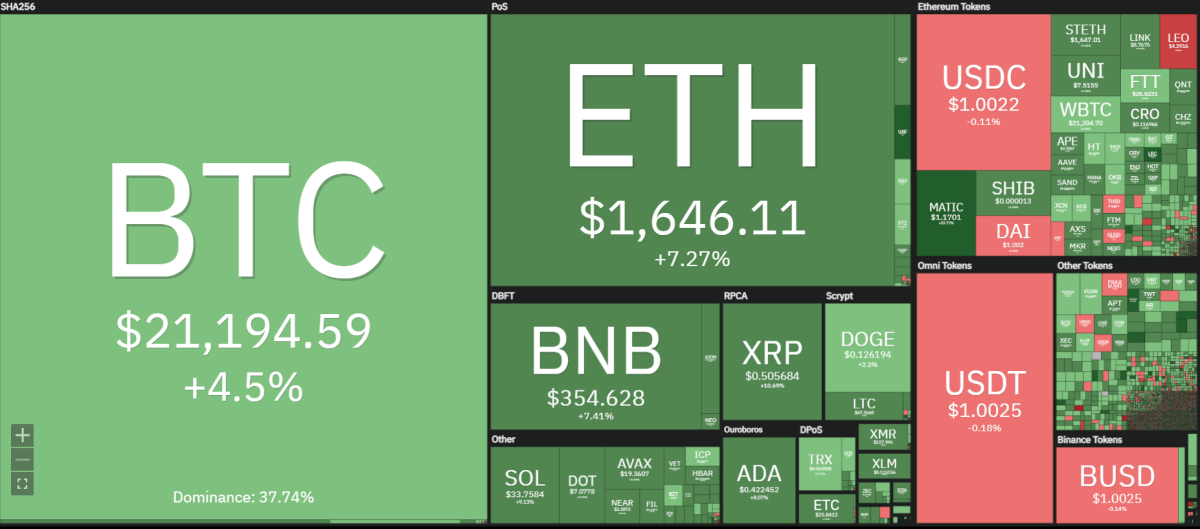

The overall cryptocurrency market has now taken a rather bearish turn gain. The price of Ethereum went down by 2.54 percent. At the same time, Bitcoin has reduced by 0.93 percent. Other altcoins such as Ripple and Cardano are also marking a decrease, as they are trading in the red too.

Nevertheless, Binance Coin has certainly had quite an interesting day today. The price suddenly increased and pumped up. However, its recent high was rather short-lived. For now, it has found some stability around $828 but it is not expected to last longer.

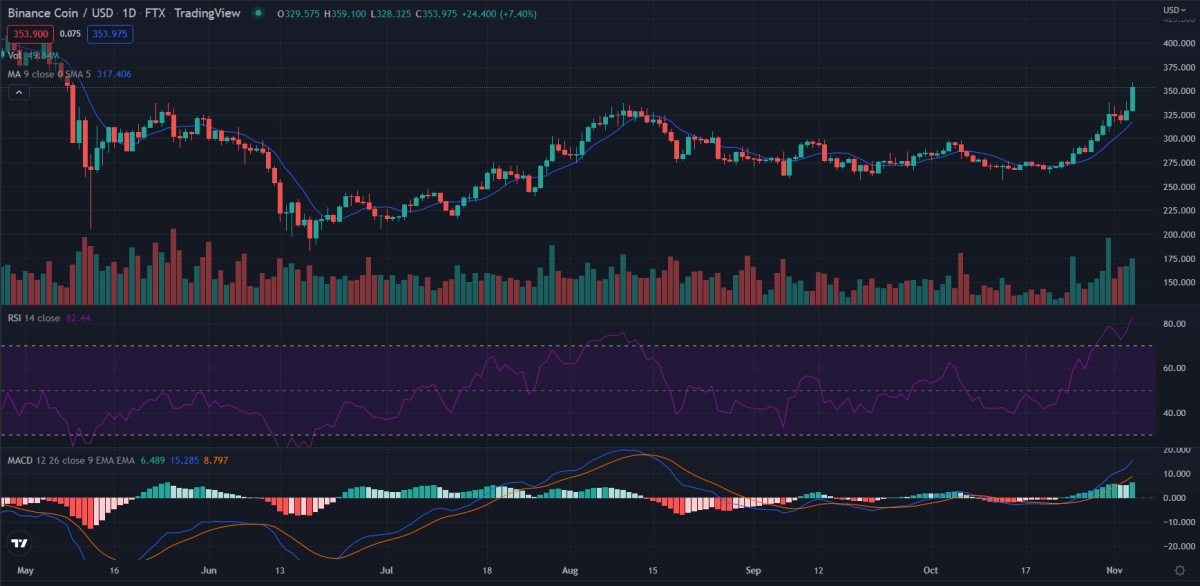

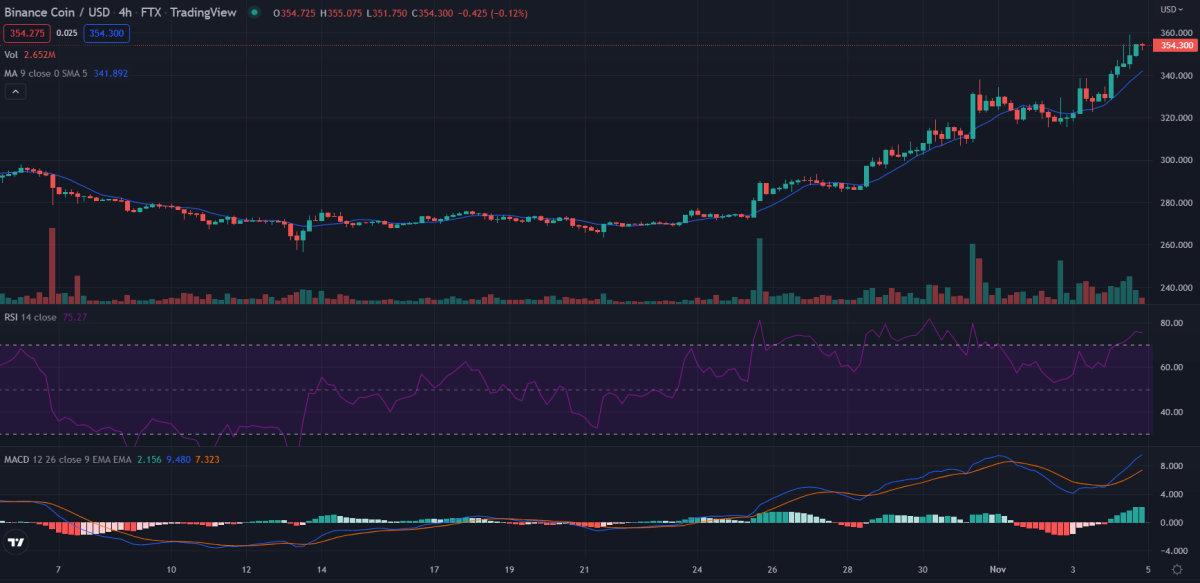

Looking at the RSI, it is obvious that the market is extremely overbought right now. The RSI is at almost 84, with a very steep curve. The MACD is also showing a similar pattern. So, this bubble can definitely burst at any moment. If that happens, Binance Coin may find stability around the $600 mark.

Binance Coin 24-hour price movement

The 24-hour price movement of Binance coin has been very interesting. It was trading in a range for a good part of the day and the pump only occurred much later in the day. After pumping to $1439, Binance Coin ended up facing significant resistance from the bears and fell, creating a reversed candle wick.

This could have been taken as a sign of an impending downtrend, which triggered selloffs. However, it again retraced above slightly before setting new resistance at around $1109, only to fall lower again and stabilize around $828.

However, the little moment that Binance Coin price analysis had is already over. Those who are still thinking about investing for a short-term gain must remain cautious, as both the RSI and MACD suggest against it. So, it may not be wise enough to invest for the shorter term at this point.

4-hour Binance Coin price analysis: Can Binance Coin retrace again?

The biggest question that investors have in mind right now is whether Binance Coin price analysis can retrace all the way to $1439 again in the short-term. Well, it is unlikely, considering the fact that the bulls are already exhausted. It is now time for the bears to take over and pull the price down again for correction.

The RSI on the 4-hour chart is also at 73, which shows that the market is still quite overbought. So, it has not stabilized yet. At the same time, the MACD on the 4-hour chart is yet to catch up. Nevertheless, we already have a reversed candle-wick pattern being created in the reds. This is a tell-tale sign that Binance Coin price analysis is going to fall in price over the next few hours.

Binance Coin price analysis: Conclusion

Overall, Binance Coin has already had its run-up and is now set to go lower again for correction. Its run-up was short-lived and resistance was set at $1439 after the bubble burst. At this point, investors should not take a new position for short-term returns. In the meant time, you may want to learn more about cryptocurrency investment.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.