Binance Coin Price Prediction 2023-2032

- BNB Price Prediction 2023 – up to $257.96

- BNB Price Prediction 2026 – up to $934.69

- BNB Price Prediction 2029 – up to $2,892.87

- BNB Price Prediction 2032 – up to $8,624.66

In the wake of the recent resignation of Binance’s CZ Zhao, and the ensuing lawsuit, which has gotten the former CEO to plead guilty to money laundering violations levied by the USDOJ, BNB has since plummeted by 7.91% since touching $253 in November 2023. What next for BNB in 2024? Let’s get into the details.

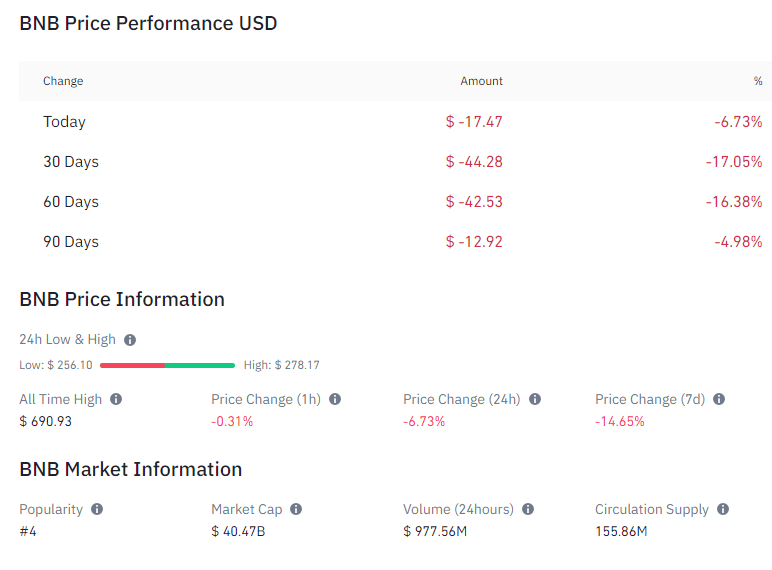

How much is BNB worth?

The current Binance coin price is $266.84 with a 24-hour trading volume of $741,994,702. BNB is down 0.51% in the last 24 hours. The current CoinMarketCap ranking is #4, with a live market cap of $40,498,408,486. It has a circulating supply of 151,693,878 BNB coins and the max. supply is not available.

Binance Coin Price Analysis: BNB declines below $267.3 after abrupt fall

TL;DR Breakdown

- Binance Coin price analysis confirms a downtrend.

- Coin value has dropped down to $267.3.

- Strong support is available on $22.5 end.

The one-day and four-hour Binance Coin price analysis for 24 December 2023 confirms signs of a decreasing trend for the day. The price has been covering a descending path since the past few days, as the bears have secured a swift comeback. Although the past few weeks remained impeccable for bullish growth, today the coin value has descended to $267.5 low.

BNB price analysis on a daily timeframe: Price takes a downturn to $267.3 amidst descent

The latest one-day Binance Coin price analysis indicates a strong bearish comeback for the day. The sellers have been able to successfully dodge past the bullish streak this week, as the coin value has experienced a steady decline. As the past few days remained in favor of the bears, the cryptocurrency value has decreased to $267.3 low. On the other side, the Moving Average (MA) value has spiked up to $257.8 because of the earlier upswing.

The one-day price chart dictates a sharp rise in volatility, which is yet again a bearish hint regarding the approaching market trends. Because of the sharp changes in volatility, the upper and lower bands of the Bollinger bands indicator have shifted their positions as well. Currently, the upper end of the Bollinger bands indicator occupies $275.7 high whereby its lower end is present at $222.5 low. The Relative Strength Index (RSI) indicator confirms the latest bearish turn as its overall value has slumped to an index 65.76.

Binance Coin price analysis on the 4-hour chart: Coin value descends to $267.2 as bears takeover

The recent four-hour Binance Coin price analysis indicates a sharp decline in coin value in the past few hours. The bears have been ruling the market since the early hours of the day, as the selling momentum is intensifying quite continually. As the selling pressure aggravated further in the past four hours, BNB/USD value has depreciated to $267.2 level. Side by side, its Moving Average value has descended to $268.9 as a result of the bearish dive.

The volatility seems to be on the declining end which is a rather encouraging sign regarding the approaching hours of the cryptocurrency. Moving on, the upper and lower values of the Bollinger bands indicator have experienced change as well. Currently, the upper end of the Bollinger bands indicator is present at $275, whereby its lower end occupies $264 extreme. The RSI graph displays a sharp bearish curve and its overall value has sunk to 54.34 bottom.

What to expect from Binance Coin price analysis

The latest one-day and four-hour Binance Coin price analysis confirms a downtrend for the cryptocurrency. A considerable rise in selling activity has been recorded since the past few days, and today the price has moved down to $267.3 end. Whereas, the four-hour price analysis depicts a bearish scenario regarding the current market events as well.

Recent News/Opinion on BNB

Binance and CEO CZ Fined $2.7 Billion in CFTC Verdict for Money Laundering Charges.

The US Commodity Futures Trading Commission (CFTC) has imposed fines of $2.7 billion on Binance, the world’s largest cryptocurrency exchange, and $150 million on its former CEO, Changpeng Zhao (CZ). The penalties stem from allegations of violating US anti-money laundering and sanctions laws, with Binance accused of facilitating over 100,000 suspicious transactions, including those linked to terrorist groups and illegal content. CZ stepped down as CEO in November, pleading guilty to anti-money laundering law violations. The fines highlight regulators’ efforts to enforce anti-money laundering regulations in the cryptocurrency sector, as Binance aims to rebuild trust under new leadership led by CEO Richard Teng.

Judge Rules Binance Founder Must Stay in U.S. for Sentencing.

A federal judge in Seattle has ruled that Changpeng Zhao, founder of Binance, must remain in the U.S. pending sentencing for money laundering charges. The decision overturned a previous ruling allowing Zhao to return to the UAE. The judge expressed concerns about Zhao being a flight risk despite a substantial bond, citing the belief that his vast wealth, mostly held overseas, might incentivize him to forfeit the bond for freedom. The case involves allegations of Binance ignoring criminal transactions, resulting in one of the largest corporate fines in U.S. history. Zhao faces a maximum of 18 months in prison, and both Binance and Zhao have agreed to substantial settlements.

Binance Ends Russian Ruble Support on P2P Platform

Binance P2P is set to discontinue support for Russian Ruble (RUB) trading pairs, including USDT/RUB, BTC/RUB, FDUSD/RUB, BNB/RUB, ETH/RUB, BUSD/RUB, and RUB/RUB, effective from January 31, 2024, at 00:00 (UTC), following its exit from Russia and sale to CommEX. However, users can still engage in P2P trading with RUB on the CommEX platform without any charge. To do this, users need to register or log into their CommEX account and link it to their Binance account. This allows for the transfer of assets from Binance to CommEX for continued RUB P2P trading. As alternatives, users can withdraw RUB through Binance’s fiat partners before the cutoff date, convert RUB to crypto via Binance Convert, or trade RUB for crypto in the Binance Spot market.

DOJ Implements Rigorous Oversight of Binance Following Compliance Agreement

The U.S. Department of Justice (DOJ) has unsealed details of Binance’s compliance commitments, revealing extensive government oversight of the cryptocurrency exchange’s operations. This oversight includes cooperation in providing access to various documents and records upon request and involves several DOJ divisions, including those focused on money laundering, national security, and counterintelligence. Additionally, Binance, having admitted to violating U.S. anti-money laundering and anti-terror financing laws, has agreed to a settlement that includes a $4.3 billion fine and five years of monitoring by the Financial Crimes Enforcement Network (FinCEN). This unprecedented level of scrutiny is expected to significantly impact Binance’s operations and customer privacy.

Crypto Lawyer Seeks Deposition of Ex-Binance CEO Changpeng Zhao in $1 Billion Lawsuit

Adam Moskowitz, a prominent attorney in several high-profile cryptocurrency cases, has filed a motion to depose former Binance CEO Changpeng “CZ” Zhao. This motion is part of a $1 billion lawsuit against Zhao, Binance, and various crypto influencers. Moskowitz emphasized that Zhao’s testimony is critical for all parties involved. The lawsuit, which was temporarily stayed in August, alleges that Binance promoted unregistered securities. This deposition request follows a Washington judge’s order requiring Zhao to remain in the U.S. until his sentencing in February 2024, after he pleaded guilty to a felony charge and agreed to a $4.3 billion settlement with U.S. authorities. The outcome of Moskowitz’s motion to depose Zhao, who has stepped down as Binance’s CEO, is still uncertain.

Binance Coin Price Predictions 2023-2032

Price Predictions by Cryptopolitan

As the crypto landscape continues to evolve, it’s essential to stay informed about potential price trends and developments in one of the industry’s leading assets. Join us as we explore what the years 2023 to 2032 may hold for BNB and gain valuable insights into its potential price movements.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2023 | 229.29 | 250.79 | 257.96 |

| 2024 | 362.65 | 375.19 | 420.31 |

| 2025 | 530.11 | 545.12 | 633.06 |

| 2026 | 788.12 | 815.37 | 934.69 |

| 2027 | 1,143.99 | 1,184.76 | 1,379.84 |

| 2028 | 1,629.16 | 1,688.39 | 2,044.03 |

| 2029 | 2,416.74 | 2,501.16 | 2,892.87 |

| 2030 | 3,404.39 | 3,529.45 | 4,303.39 |

| 2031 | 4,986.75 | 5,127.93 | 6,045.95 |

| 2032 | 7,121.63 | 7,378.02 | 8,624.66 |

Binance Coin Price Prediction 2023

Our Binance Coin (BNB) price prediction for 2023 anticipates that the asset could reach a maximum price of $257.96by the end of December. We expect an average trading price of $250.79 and a floor price of $229.29.

Binance Coin Price Prediction 2024

According to our Binance Coin price projection for 2024, BNB may touch a peak value of $420.31. Our prediction suggests an average trading value of $375.19, with a potential minimum price of $362.65.

Binance Coin Price Prediction 2025

Looking ahead to 2025, our price forecast for Binance Coin suggests that the cryptocurrency could reach a maximum price of $633.06. Our estimations also propose an average value of $545.12 for BNB. In more conservative market conditions, the asset could still maintain a floor price of about $530.11.

Binance Coin Price Prediction 2026

With respect to our Binance Coin price forecast for 2026, we posit that BNB could scale up to a maximum price of $934.69. Our model project’s that the asset could still achieve a base price of $788.12, and a mean price of $815.37.

Binance Coin Price Prediction 2027

For the 2027 financial year, our Binance Coin price evaluation infers that BNB may reach a maximum valuation of $1,379.84. We expect an average trading price of approximately $1,184.76. The minimum price for the digital asset could be close to $1,143.99.

Binance Coin Price Prediction 2028

Our BNB price forecast for 2028, suggests that the ongoing growth of the Binance ecosystem will contribute significantly to BNB’s future price action. Our projections foresee a maximum price of $2,044.03, an average price of $1,688.39, and a minimum trading value of $1,629.16.

Binance Coin Price Prediction 2029

For the year 2029, our Binance Coin price analysis predicts a sustained upward trajectory for the asset, potentially reaching a maximum price of $2,892.87. We also forecast an average trading price of about $2,501.16, and a minimum binance coin’s price of $2,416.74.

Binance Coin Price Prediction 2030

According to our Binance Coin price prediction for 2030, BNB could attain a maximum market valuation of $4,303.39. In addition, our forecasts suggest an average market price of $3,529.45 and a minimum price of $3,404.39.

Binance Coin Price Prediction 2031

Based on the Binance Coin price prediction for 2031, our analysis indicates that BNB could achieve a maximum market value of $6,045.95. The average projected price could be around $5,127.93, while the floor price of binance coin might be approximately $4,986.75.

Binance Coin Price Prediction 2032

Per our Binance Coin price prediction for 2032, we anticipate the possibility of BNB achieving a maximum price of $8,624.66. We predict a minimum price of $7,121.63 and an average price of $7,378.02.

Binance Coin Price Prediction by Wallet Investor

Wallet Investor’s analysis presents a pessimistic outlook for Binance Coin (BNB), predicting a drop to $136.617 by 2024. Their five-year forecast anticipates a significant 93.9% reduction in BNB’s value.

Coincodex Binance Coin (BNB) Price Prediction

Coincodex’s 5-day forecast shows a slight rise to $271.34, while a month later, it’s expected to level at $528.82. In 3 and 6 months, projections are for BNB to hit $971.42 and $744.82, respectively. Their 1-year outlook suggests a high of $943.39 for the coin.

Binance Coin Price Prediction by Technewsleader

Technewleader’s analysis projects significant growth for Binance Coin (BNB) in the coming years. They predict BNB’s price will reach up to $259.14 by late 2023, and in 2024, it’s expected to trade between $345.48 and $432.49. The forecast for 2025 shows a minimum price of $492.43 and a potential high of $605.59. For 2029, they suggest a dramatic increase, with BNB possibly hitting $2,489.39. By 2032, the price is anticipated to oscillate between $6,554.95 and $8,061.80.

Binance Coin Price Predictions by Industry Influencers

CHICHI CHARTING anticipates a possible upward movement for BNB, citing a possible breakout above the $237.9 critical resistance level. The analyst adds that if BNB breaks above resistance, the next target price is identified at $274.50. Beyond that, a higher resistance level is noted at $293.50. In case BNB continues to consolidate below $237.9, there’s a possibility it might retest a previous resistance-turned-support level at $219.7. According to CHICHI CHARTING, if BNB falls below the $219.7 level, it might retrace back to support levels observed during its consolidation phase between August and October ($208.6).

Binance Coin Overview

A year ago, the observation was that BNB and LINK were the only two coins that really steadily went up during the bear market. It is quite likely that as BNB continues to grow in popularity, we will see wider use of BNB. With the introduction of the Binance Card, BNB could almost be used anywhere, though technically speaking, with every transaction, it will be converted into fiat. A good indicator would be market performance. Let’s take a look at how BNB compares with other altcoins.

BUSD and Binance-Peg BUSD is available on multiple blockchains, including Ethereum, BNB Smart Chain, and BNB Beacon Chain. Now Binance-Peg is also available on Avalanche and Polygon. Binance-Peg BUSD support on Avalanche and Polygon provides traders with a fast and safe way to transfer the USD-backed stablecoin across different platforms. All users are now able to explore the Avalanche and Polygon ecosystem with Binance-Peg BUSD more safely and efficiently. In the future, the Binance BUSD team is committed to bringing more use cases into its ecosystem. Follow BUSD updates on CoinMarketCap.

Binance Price History

The varying price differences of Binance Coin (BNB) can be studied better using Crypto Volatility Index (CVIX). CVIX helps analyze the price dynamics and helps to ponder on essential elements that affect the current and future Binance coin prices. CVIX also carefully visualizes the algorithmic methods that demonstrate the market sentiment of BNB, either in a positive or negative light.

Binance Coin had a remarkable 2019. It was positive in many aspects, and although the currency slowed a little in the second half of the year, it had a significant push by the end of 2019, primarily because of the IEO that was launched later that year. Binance coin price closed in 2019 with a gain of over 150%. However, in the following year (2020), a noticeable downward pattern was noticed. It was ongoing for more than six months, mainly due to the pandemic at the beginning of the year. The downward trend was seemingly more extended than usual.

A significant characteristic of many cryptocurrencies is volatility, and the Binance coin suffers from the same. Binance coin has shown a lot of potential over the short-term price analysis. Let’s see what experts have to say about the BNB.

Coinfan’s Binance coin prediction is that BNB holds an optimistic future as the current price rally might continue till the end of the year. Take a look at this progression in BNB prices.

More on the BNB Network

What is Binance Coin?

The Binance coin is listed on the Binance trading platform as an individual coin, a digital asset, trading with the BNB symbol. Binance coin started in 2017 and is backed by blockchain. BNB coin runs on ERC20 Ethereum. the Binance ecosystem is designed to support a range of utilities, such as trading fees, listing fees, exchange fees, etc.

Furthermore, the main reason why Changpeng Zhao (founder of Binance Exchange) initiated the BNB coin was to remove many trading problems hindering the crypto market. The vision he had made solved those problems and, at the same time, made Binance coin a top competitor with other crypto exchanges.

Who are the founders of the Binance exchange?

Changpeng Zhao and He Yi started the Binance coin in July 2017. They first began Binance as an Initial Coin Offering (ICO), but today, Binance has become one of the most significant crypto coins globally.

The crypto token has garnered support from other partnerships, which has helped its usage spread. It includes a partnership with Asia’s premier high-end live video streaming platform, Uplive, which sells virtual gifts for BNB tokens to Uplive’s 20 million-strong user base.

Binance coin is also supported by the platform, the mobile app, and the VISA debit card of Monaco, the pioneering payments and cryptocurrency platform.

Fortunately, price predictions are meant to cover price forecasts for Binance coins for a prolonged period. Therefore, short-term trends are not primarily instrumental in determining the future price of a coin. As a result, the Binance coin price prediction for 2022 onwards will focus on historical price actions and price predictions from market experts.

Binance ’s CEO, Changpeng Zhao, visited El Salvador 4 months ago. His company, being the biggest cryptocurrency exchange in the world, and El Salvador, being the first country to adopt bitcoin as legal tender, something big is brewing. According to the Secretariat of Communications of the Presidency of the Republic of El Salvador, Binance’s CEO is visiting the country “along with other entrepreneurs, who are interested in knowing the investment possibilities.”

Is there a maximum supply of BNB coins?

Yes, a maximum supply of 170,532,785 BNB coins is available, and a total supply 153,432,897 have been distributed as of April 2021. Binance whitepaper says that half of the top supply was used for the ICO and public sale of the token.

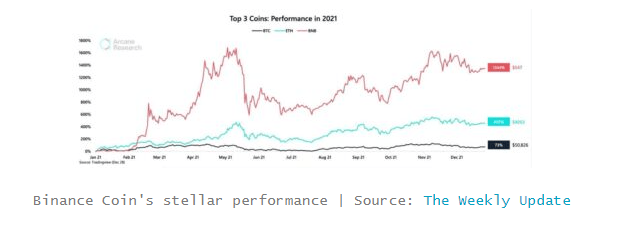

BNB crushed it throughout 2021 as the Crypto Coin of 2021 and cemented itself as the third more popular coin in the world by market capitalization. Not a small feat, considering the phenomenal year that altcoins had. Several projects had their moment in the sun, capturing capital, headlines, and attention. No one got near Binance Coin, though. The award was given by Arcane Research.

Binance Coin adoption and technology

Binance coin is famous for many reasons, but a significant reason is that it holds about 1 billion in trading volume every day. Binance seems to have a very bright future, but it needs stability. To do that (bring stability) and avoid sudden market fluctuations, BNB will have to be burnt using a systematic approach.

BNB had the potential to have an initial coin offering (ICO) of 100 million, and upon its launch, it hit the potential in July 2017, and $15 million was successfully raised. The generated funds were used to make the ecosystem larger by using a large sum of the money for marketing purposes, an exciting business opportunity that provided crypto startups a chance to be listed on the Binance cryptocurrency exchange platform.

Another essential characteristic that makes BNB unique and a center of attraction for adoption is that other digital assets can be traded for BNB. It can pay the Binance 0.1% trading fee when users move their crypto coins from the exchange to a private wallet. The price is typically charged in addition to the withdrawal fee.

However, Binance does not support smart contracts and uses the Tendermint Byzantine-Fault-Tolerance (BFT) consensus protocol which allows multiple nodes (Validator nodes, accelerator nodes, etc.) to be used in transactions, validation, and authentication processes at different stages.

Another vital advantage of the Binance coin is that it can be used in particular ICO investments using the Binance launchpad program; this creates a flawless framework where other virtual tokens can be traded. This creates an excellent opportunity and allows for extra credit and debit cards to be supported on the Binance cryptocurrency exchange platform, the digital currency, and the mobile app.

Learn More About Binance NFT Marketplace

- How to Find Your NFT Contract Address

- How to Get Started with the Binance NFT Marketplace

- How to Buy an NFT on Binance NFT Marketplace

- How to Sell an NFT on Binance NFT Marketplace

- How to Deposit NFT on Binance

- Find Out More About NFT Mystery Box Collection

Conclusion

The Binance Coin ecosystem has continued to draw investors who use the platform to explore opportunities its ecosystem presents, including Defi, the crypto market, and NFTs. The token has risen to glory within a short time as more applications are built on the smart chain. It has several use cases, making it engraved in the trading experience of several traders using the Binance crypto exchange platform.

With Binance Chain expertise, users can deploy smart contracts that fit their application needs or virtual machines that dictate exactly how the blockchain should operate. Binance has built one of the most secure trading platforms in the world where users can enjoy different security features, such as KYC, 2FA, and Anti-Phishing Code, to protect themselves against nefarious actors. Users can also rest assured that their funds are SAFU in Binance.

Currently, BNB is among the top five largest cryptocurrencies by market cap. Despite the current market downturn, the price predictions of BNB are relatively optimistic since the token demonstrates healthy growth behavior, and the trading platform continues to grow and amass new users. The overall development of the Binance exchange could directly translate to the positive growth of the BNB coin.

If the market stabilizes and further developments and collaborations continue in the Binance ecosystem, as we have had with the Binance chain, massive adoptions are imminent in the forthcoming years, which could result in BNB breaking through the $1000 mark. For instance, Paysenger, Mean Finance, Buff Network, Weave6, MIM, and Hinkal, among others, are some of the latest projects coming to the BNB chain. While the prospects of BNB look good, the crypto market still remains volatile, and investors are reminded to do their due diligence and approach the Binance coin market with the utmost caution.