The digital realm experienced a massive upheaval recently, with Binance, a paramount figure in the cryptocurrency sphere, under acute scrutiny. Their swift maneuverings following the catastrophic collapse of Silvergate have raised eyebrows.

To many, it appears as though Binance offloaded a staggering volume of cryptocurrencies in the midst of the chaos. Let’s delve into this sequence of events that has the entire crypto community buzzing.

Proof-of-Reserves: A revealing picture

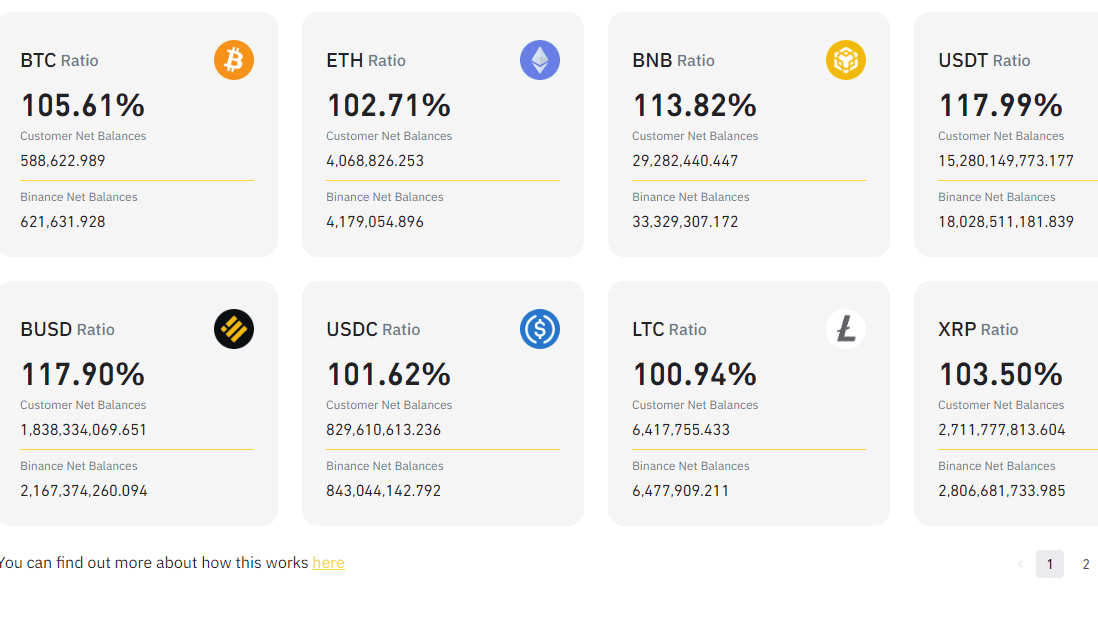

On August 1, Binance, eager to prove its mettle and perhaps regain some trust, made its latest proof-of-reserves (PoRs) public. This tool, designed to showcase the financial health of an entity, indicated that Binance possessed adequate crypto and cash reserves to cover its users’ funds.

So far, so good. With an enviable ratio of over 100%, it ostensibly reflected that the exchange was in a position of strength and could weather financial storms.

However, it’s not the proof but the suspicious movement within it that caught the collective eye of the crypto community. Between March and May, a staggering shift occurred within Binance’s USDC reserves.

From a whopping $3.4 billion at the start of March, the figure plummeted to a mere $23.9 million by May’s end. Such a drop in reserves, especially during a period marked by Silvergate’s dramatic decline, is not just a statistical anomaly; it’s a red flag.

The great crypto shuffle

The crypto chessboard saw Binance making strategic moves immediately after Silvergate’s downfall on March 12. While on the one hand, the company began transitioning its customer’s USDC to its native Binance USD, on-chain data uncovers an even more intriguing tale.

A massive conversion of its USDC reserves into Bitcoin and Ethereum commenced post-haste. Aleksandar Djakovic, a prominent on-chain analyst, brought to light that between the fateful dates of March 12 and May 1, Binance reportedly acquired an estimated 100,000 BTC and 550,000 ETH.

The sum total of this crypto acquisition? A cool $3.5 billion, mirroring the exact surplus of USDC it once had. The exactitude of these figures and their timing is more than a little suspect.

Coinbase’s CEO, Brian Armstrong, never one to mince words, took a veiled jab during a recent earnings call. He insinuated that Binance had swapped out USDC for another stablecoin, further fueling the speculation and skepticism regarding Binance’s true intentions and actions.

In an era where trust in digital assets is paramount, PoRs have risen to prominence. They offer a means for exchanges to display their holdings, assuaging public concerns and reinforcing their trustworthiness.

The collapse of FTX, another significant crypto exchange, last year exemplified the dire need for such transparency.

Despite its founders’ previous assurances regarding FTX’s stable financial situation, its downfall in November 2022 was a stark reminder of the volatility and unpredictability inherent within the crypto ecosystem.

While Binance’s latest PoRs suggest a position of strength, their actions in the wake of Silvergate’s collapse prompt more questions than answers. Was it a tactical move to ensure its survival or a calculated gamble to capitalize on another’s misfortune?