Coinspeaker

Bitcoin (BTC) Volatility Drops to ATL, to Around 15%, amid Short-Term Crypto Market Uncertainty

After enjoying a bullish first half of the year, Bitcoin (BTC) and the altcoins prices have struggled to maintain momentum in the second half. According to the latest crypto market data, Bitcoin price traded around $29.3k on Tuesday, a crucial support level for the bullish uptrend to continue in the coming weeks. However, the possibility of a double top on the weekly time frame and the falling divergence on the RSI has most analysts and investors convinced of an incoming Bitcoin correction towards $25k.

In this regard, experts have argued if the altcoin market will take over the bullish trend as funds flow from top digital assets to mid and low-cap cryptos. On the other hand, sudden weaknesses in the Bitcoin market have historically pulled the altcoin industry with it amid fear of uncertainty.

Bitcoin (BTC) Volatility Drops amid Increased Cash Inflows

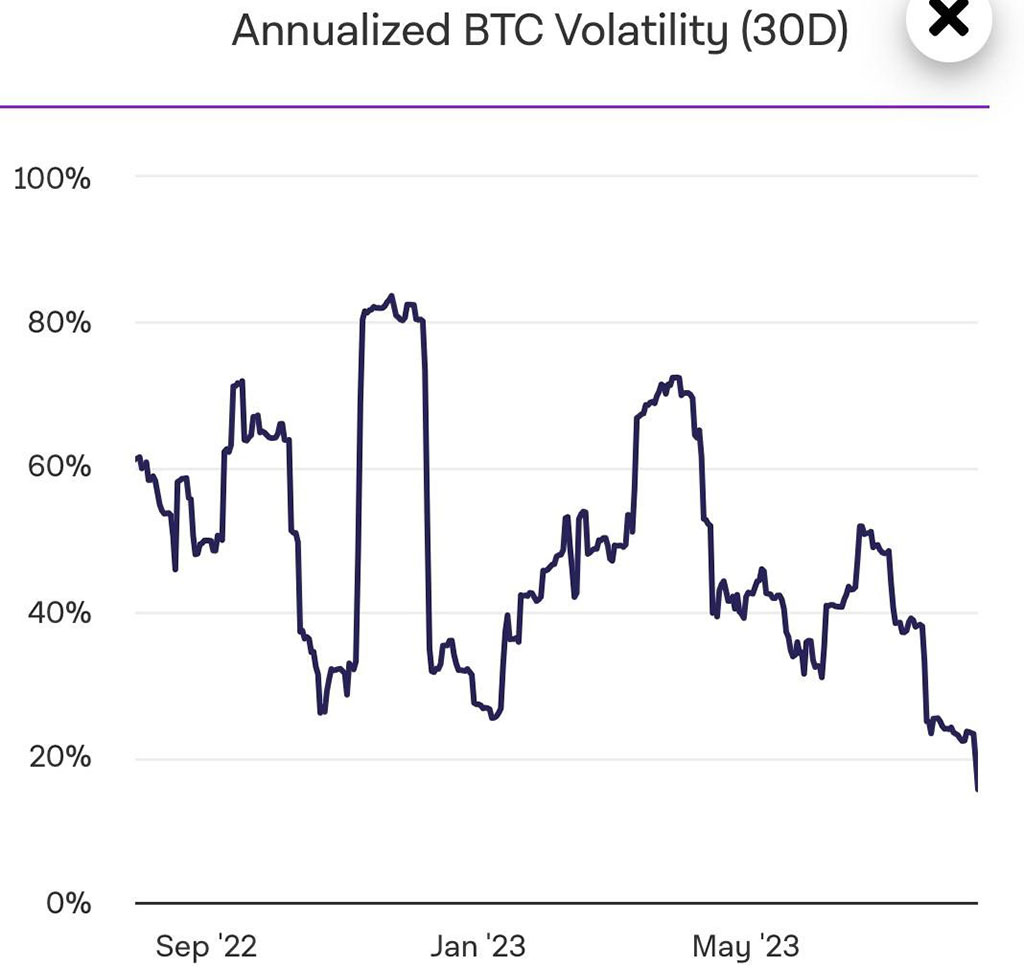

According to market data provided by The Block, Bitcoin (BTC) volatility has dropped to an all-time low of around 15 percent as the bulls and bears contend with the price action. For comparison purposes, the average annualized 30-day volatility for Bitcoin in 2022 was about 61.4 percent, whereas the figures averaged about 43.8 percent in 2023. Nevertheless, there were several high-impact news – including the collapse of TerraLunaUST, FTX, and Alameda Research, among others – that saw over $100 billion wiped out of the crypto market.

The notable decline in Bitcoin (BTC) volatility comes amid mixed cash flow returns as observed by CoinShares. Reportedly, Bitcoin managed to get the attention of investors in the past week with a total inflow of about $27 million. However, the top coin had recorded a total outflow of about $144 million during the prior three weeks.

“Digital asset investment products saw inflows this week totaling US$29m, likely due to the recent US inflation data, which was slightly below expectations, signifying that a September rate hike is less likely,” the report noted.

Bigger Picture

Bitcoin price is expected to continue consolidating horizontally with a range of (+/-) $10k from current levels until after next year’s halving. Although most crypto analysts do not seem to agree on the next course of action for Bitcoin, one thing that remains unanimous is the macro bullish outlook triggered by the halving event. Meanwhile, the debate on the regulatory framework in the United States remains a huge impediment to the institutional and mainstream adoption of Bitcoin and other digital assets products.

Moreover, the US SEC has continued to delay the approval of a Bitcoin ETF, whereas other markets like Canada have a running similar product. As a result, the CoinShares report concluded that Canada recorded the most crypto activity with $24 million in inflows YTD.

Bitcoin (BTC) Volatility Drops to ATL, to Around 15%, amid Short-Term Crypto Market Uncertainty