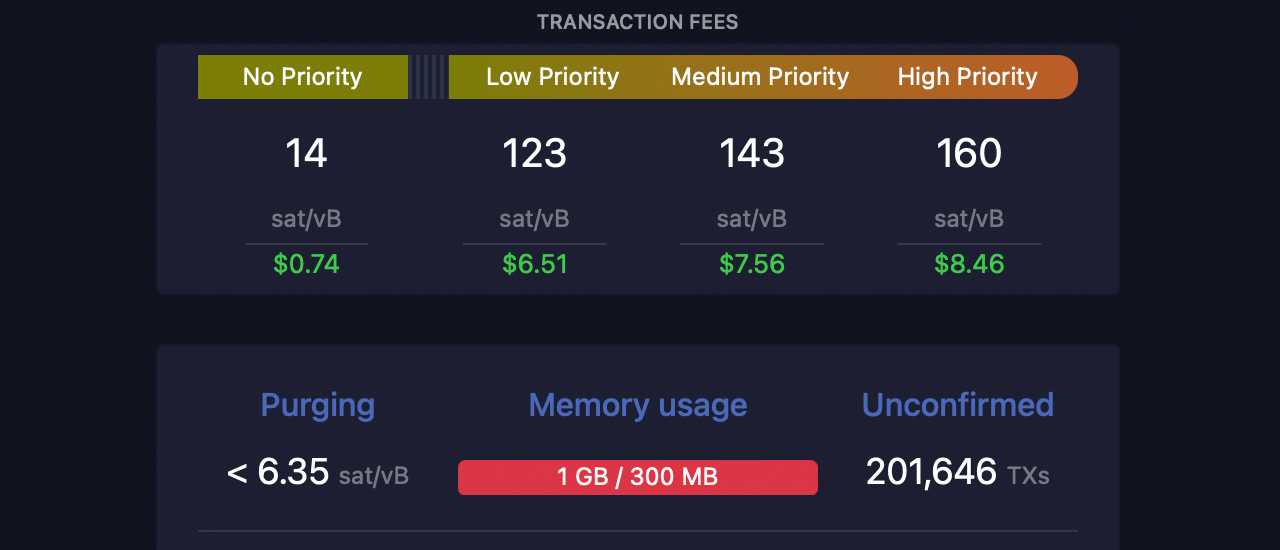

Transaction fees within the Bitcoin network have surged considerably, eclipsing the figures recorded merely three days prior. A transfer deemed high-priority, which formerly cost an average of $3.38, now demands a fee of $8.46. This significant increase was recorded on Thursday, November 9, 2023, at precisely 9:52 a.m. Eastern Time. This upsurge coincides with a backlog exceeding 200,000 pending transactions in Bitcoin’s mempool, a situation attributed to both the escalated fees and a recent spike in Ordinal inscriptions.

Bitcoin Fees Skyrocket in 72 Hours as Users Scramble for Tightening Block Space

The demand for space in Bitcoin’s ledger has witnessed a sharp rise, compelling miners to face a daunting 429 megabytes of data backlog, equivalent to approximately 229 blocks. At block height 815,999, there is a logjam of around 201,646 transactions awaiting confirmation by miners.

Only three days ago, the fee to expedite a transaction with high priority was pegged at $3.38; since then, it has soared over 150% to its present price of $8.46 per transaction. This is in the wake of a staggering 4,000% hike in BTC fees the previous month.

Archived data from mempool.space shows that sending a bitcoin transaction without priority costs $0.74, while a low-priority transaction comes with a $6.51 fee. Medium priority transactions stand at approximately $7.56 as of Thursday.

Bitinfocharts.com reports that the average bitcoin transaction fee is 0.00019 BTC, or $7.17, with the median fee at 0.00011 BTC, or $4.34 per transaction. The spike in costs for block space can be attributed to the recent surge in bitcoin’s value, which approached $38,000 around 9:50 a.m. Eastern Time on November 9.

Increased activity on exchanges and the processing of financial transactions are compounded by a rise in Ordinal inscriptions, which, despite being a last-ditch option for block space, contribute to the growing backlog and the escalating fee market.

Barefoot Mining’s chairman and CEO, Bob Burnett, forecasts a continued increase in BTC transaction fees. On the social platform X, Burnett highlighted the growing expense of bitcoin transactions as the era of cheap, readily available block space draws to a close.

He advises the consolidation of UTXOs and the securement of long-term storage solutions. Burnett asserts, “The current fee rates might seem high but they are still an absolute bargain for access to the ledger securing the world’s most precious asset and the only reliable repository of truth ever created.”

What do you think about Bitcoin’s fees growing by more than 150% in three days’ time? Share your thoughts and opinions about this subject in the comments section below.