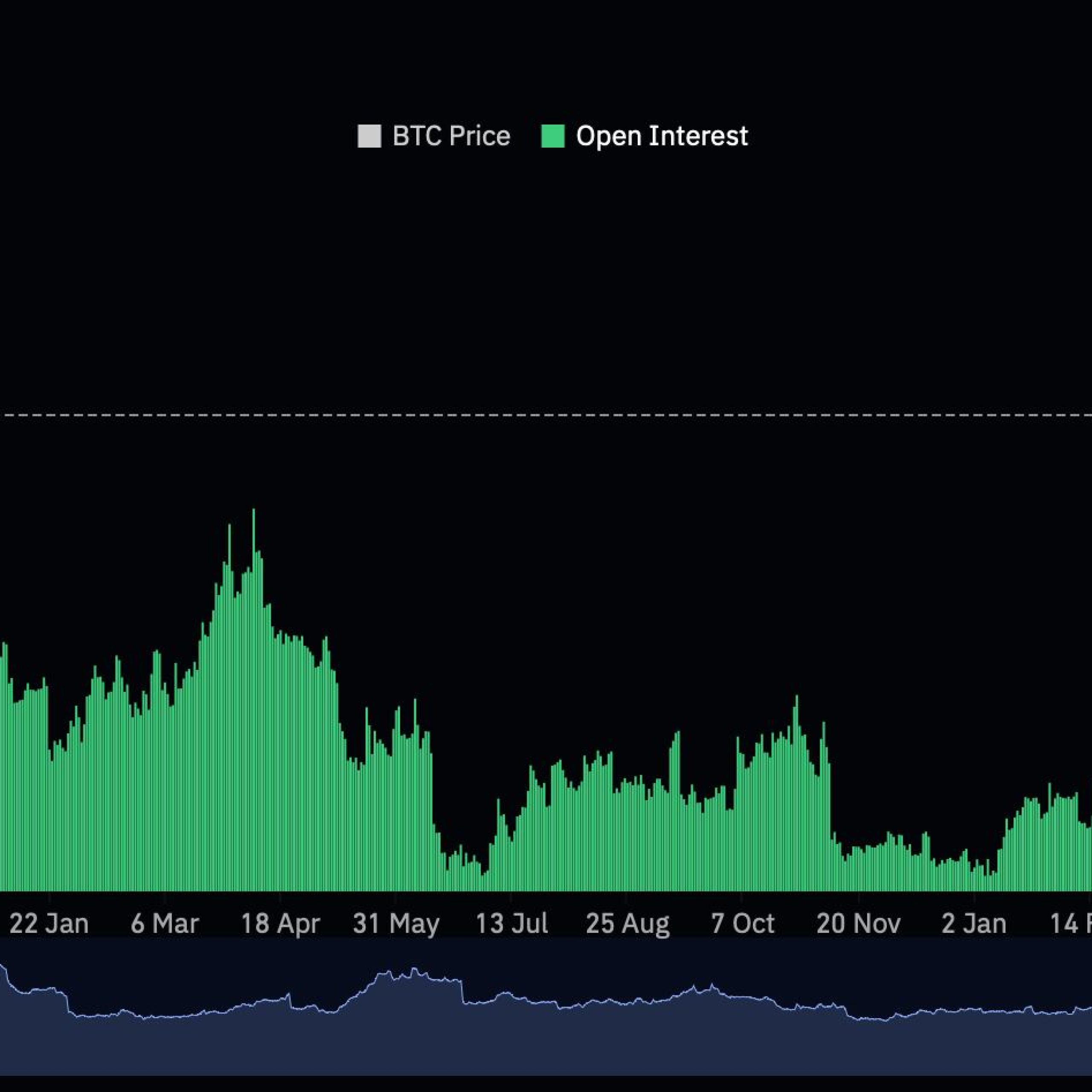

The cryptocurrency market has witnessed a significant milestone as open interest for Bitcoin futures on centralized exchanges soared to a new annual high, reaching levels last observed in November 2021. According to data from CoinGlass, the aggregated open interest in Bitcoin futures escalated to $22.9 billion this Monday, closely approaching the historical peak of approximately $24 billion recorded during the final quarter of 2021. This surge in open interest, representing more than a 30% increase since the onset of 2024, coincides with Bitcoin’s impressive price rally to $52,300, marking a 23% rise year-to-date and revisiting its December 2021 levels.

Open interest is a critical metric in cryptocurrency, reflecting the total value of all outstanding futures contracts across exchanges. It serves as a key indicator of market activity and trader sentiment, suggesting a growing interest and engagement in the market. This uptick in open interest and Bitcoin’s price rally underscores a robust trading environment and heightened investor optimism toward the largest cryptocurrency by market capitalization.

Ether futures also witness remarkable growth

Similarly, the Ether futures market has experienced remarkable growth, with total open interest reaching $10.5 billion, which signifies a 50% increase since the beginning of 2024. Ether’s trading price has also seen a significant uptick, rising to $2,900 and reflecting a gain of over 27% year-to-date. This increase in both price and open interest for Ether futures highlights a broader trend of growing investor confidence and activity within the cryptocurrency markets.

The escalation in open interest for Bitcoin and Ether futures can be partially attributed to major financial firms’ introduction of Bitcoin spot exchange-traded funds (ETFs), including BlackRock and Fidelity. These ETFs have attracted more than $4 billion in inflows in a relatively short period, indicating strong investor interest in crypto-based derivatives markets and contributing to the overall bullish sentiment in the crypto ecosystem.

Market sentiment

The recent surge in open interest for Bitcoin and Ether futures highlights the growing maturity and sophistication of the cryptocurrency market. It also reflects an increasing trader involvement and a positive market sentiment driven by retail and institutional investors. The launch of spot ETFs has further buoyed this sentiment, providing investors with more avenues to gain exposure to cryptocurrencies in a regulated and familiar format.

The rise in open interest and the associated price rallies for major cryptocurrencies like Bitcoin and Ether indicate the sector’s resilience and appeal. This trend showcases the market’s capacity for recovery and highlights the increasing acceptance of cryptocurrencies as a legitimate and valuable asset class among a broad spectrum of investors. As market dynamics continue to unfold, the open interest in futures contracts will remain a critical barometer for assessing market sentiment and trader engagement in cryptocurrency.