Data shows Bitcoin miner revenues have been coming under stress recently as they are now making 61% less than the average during the last year.

Bitcoin Miner Revenues Come Under Pressure As Puell Multiple Sharply Drops

As per the latest weekly report from Glassnode, the miner income contraction right now is greater than during the Great Migration of May-July 2021.

The “Puell Multiple” is an indicator that measures the ratio between the daily Bitcoin miner income in USD, to the 365-day moving average of the same.

When the value of this metric is high, it means miner revenues are higher than the past year’s average at the moment.

During such periods, miners may choose to expand their mining rig capacity and sell some of their reserves to take advantage of the current high profitability.

On the other hand, low values of the ratio suggest the daily coin issuance is lesser than the yearly average right now.

Related Reading | Glassnode: $7B In Bitcoin Losses Realized In Just Three Days, Highest In BTC History

Some miners may react to low income periods like these by taking off their machines offline in order to save on electricity costs.

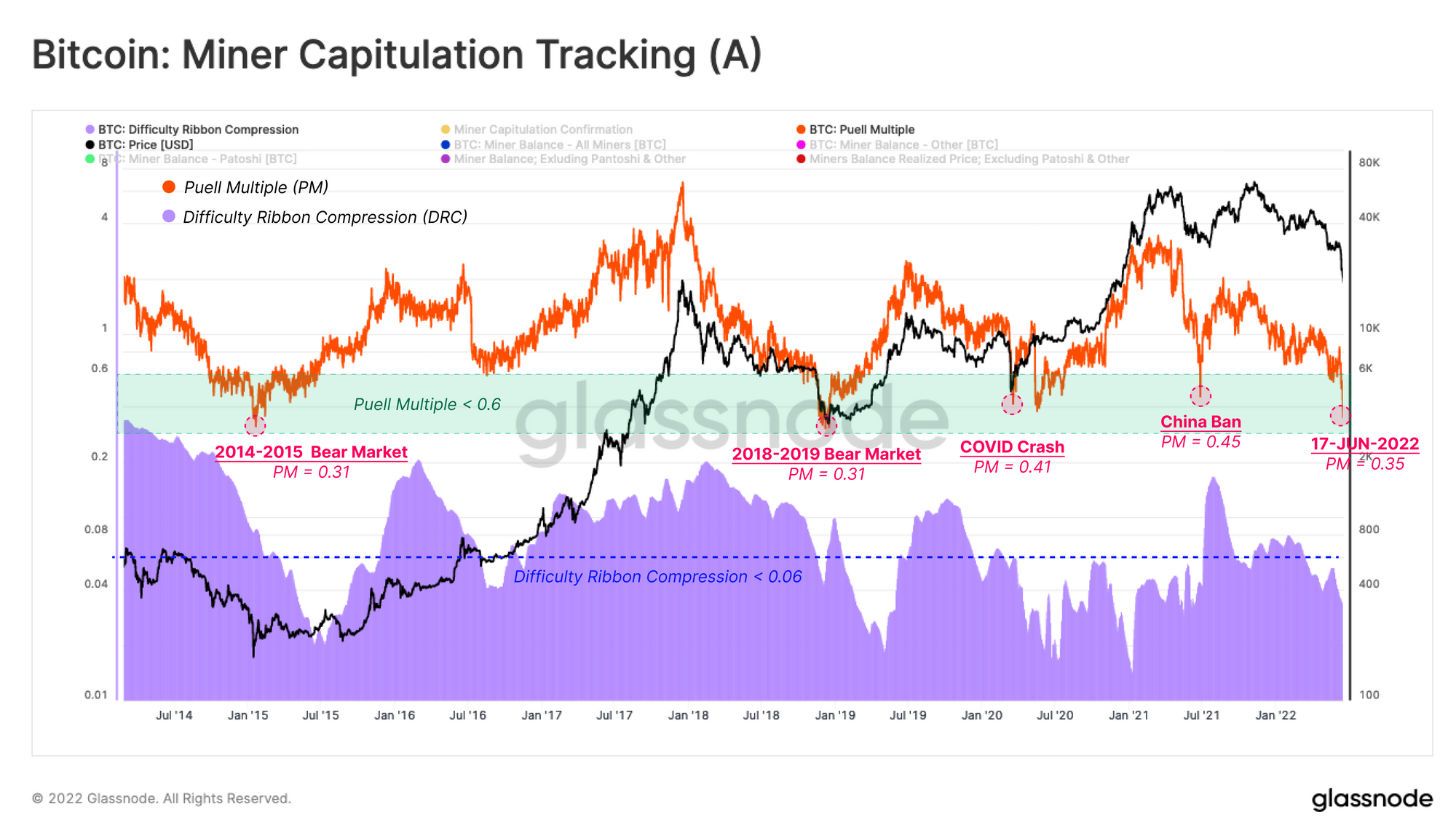

Now, here is a chart that shows the trend in the Bitcoin Puell Multiple over the last few years:

The value of the indicator looks to have dropped down recently | Source: Glassnode's The Week Onchain - Week 25, 2022

As you can see in the above graph, the Bitcoin Puell Multiple’s value has observed some sharp decline in recent days, hinting that miner revenues have been coming under stress.

Right now, the value of the metric suggests miners are earning 61% less than the average during the last 365 days.

Related Reading | Profit From Bitcoin’s Collapse? New ProShares ETF Makes It Possible

The chart also includes data for another indicator, the difficulty ribbon compression. This metric tells us about how the mining difficulty is changing right now.

This indicator suggests the cost of Bitcoin production has gone up recently, providing further evidence for the shrinking miner revenues.

The current miner income stress has already surpassed that during the Great Migration in May-July 2021, where China’s mining ban forced miners out of the country.

The revenue contraction is also worse than during the COVID-19 crash, but Bitcoin miners still had it worse in the 2014-15 and 2018-19 bear markets.

BTC Price

At the time of writing, Bitcoin’s price floats around $21k, down 4% in the last seven days. Over the past month, the crypto has lost 28% in value.

The below chart shows the trend in the price of the coin over the last five days.

Looks like the value of the crypto has been climbing up over the last few days | Source: BTCUSD on TradingView

Featured image from Mariia Shalabaieva on Unsplash.com, charts from TradingView.com, Glassnode.com