Bitcoin mining companies Marathon Digital and Riot Platforms witnessed a remarkable surge in trading volume, surpassing some of the world’s leading tech giants in trading activity. On January 8, 2024, these mining firms collectively recorded a trading volume exceeding $3.55 billion, with Marathon Digital emerging as the most traded stock in the United States.

Grayscale’s Bitcoin Trust (GBTC) also demonstrated significant trading activity, approaching half a billion dollars on the same day, reinforcing investors’ growing interest in cryptocurrencies. This surge in trading volume comes amid heightened anticipation for spot Bitcoin Exchange-Traded Funds (ETFs) approval by the Securities and Exchange Commission (SEC).

Bitcoin miners lead trading activity

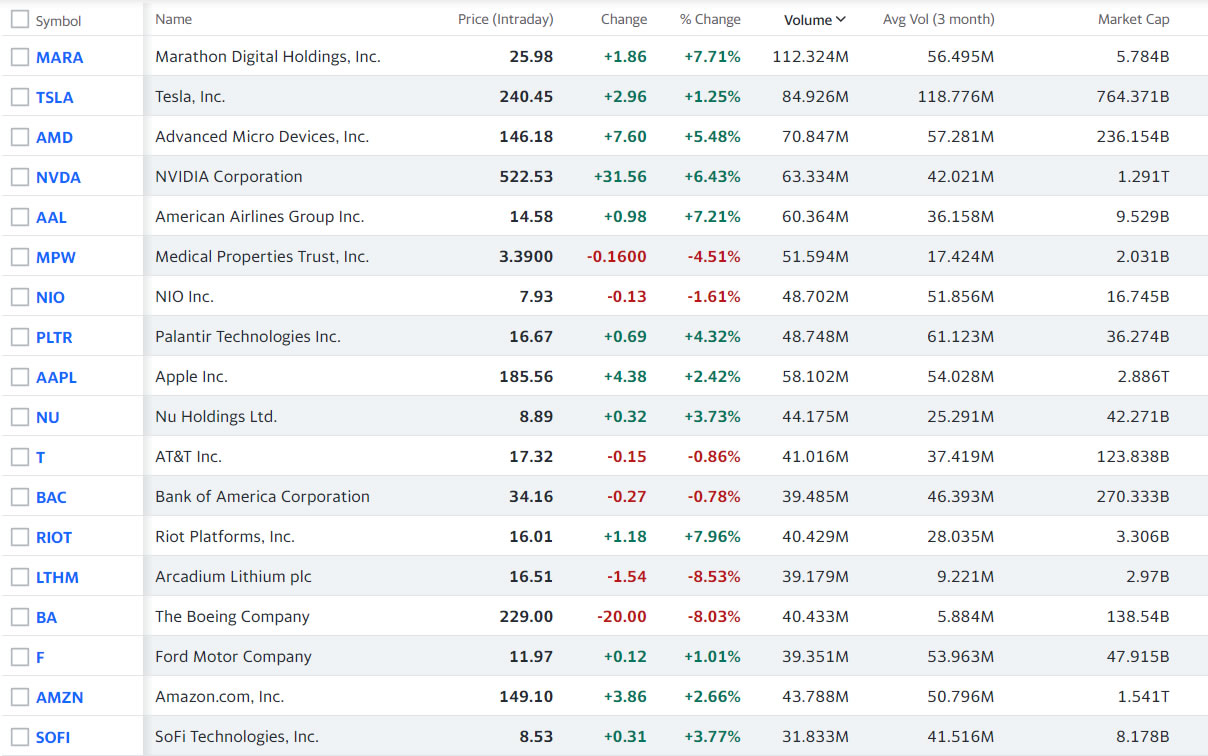

Bitcoin mining firms, notably Marathon Digital and Riot Platforms, experienced an extraordinary surge in trading volume on American stock exchanges, overshadowing some of the world’s prominent tech giants. On January 8, 2024, data from Yahoo Finance revealed that these two Bitcoin mining companies collectively accounted for a trading volume of $3.55 billion.

Marathon Digital, trading under the ticker symbol MARA, secured the position as the most traded stock in the United States on that day. The company recorded an astounding 112 million total shares traded, marking a significant achievement ahead of renowned tech companies such as Tesla, AMD, Nvidia, and Apple.

Tesla, the second most traded stock in the U.S. on that Monday, had a daily trading volume of approximately 85 million traded shares. This stark contrast underlines the surging interest in cryptocurrency-related stocks and the growing presence of Bitcoin miners in the financial markets.

Grayscale’s Bitcoin trust sees remarkable trading activity

Further contributing to the cryptocurrency frenzy in the financial markets, Grayscale’s Bitcoin Trust (GBTC) also experienced a surge in trading volume on January 8, 2024. The trust recorded a trading volume nearing half a billion dollars, a remarkable feat that caught the attention of industry experts.

Eric Balchunas, an industry expert, highlighted the exceptional performance of Grayscale’s Bitcoin Trust, stating that it traded more than 99% of the 3,000 current exchange-traded Funds (ETFs). Balchunas emphasized the significance of this achievement, noting that it positions Grayscale as a formidable contender in the potential launch of spot Bitcoin ETFs.

He further alluded to the pending approval of spot Bitcoin ETFs, suggesting that Grayscale’s impressive trading volume could give the company a competitive edge in the evolving cryptocurrency investment landscape.

Grayscale awaits SEC’s green light for spot Bitcoin ETF

Grayscale has expressed its aspiration to “uplist” its Bitcoin Trust to an ETF spot, contingent upon the approval of the Securities and Exchange Commission (SEC). This strategic move aligns with the industry’s eagerness to introduce Bitcoin ETFs, providing investors with more accessible and regulated avenues for cryptocurrency exposure.

As the SEC deliberates on the matter, Grayscale’s notable trading volume and market presence bolster the company’s position and potential for a successful transition to a spot Bitcoin ETF. The anticipation surrounding the SEC’s decision underscores the evolving dynamics of the cryptocurrency market and the interest it has garnered from institutional and retail investors alike.