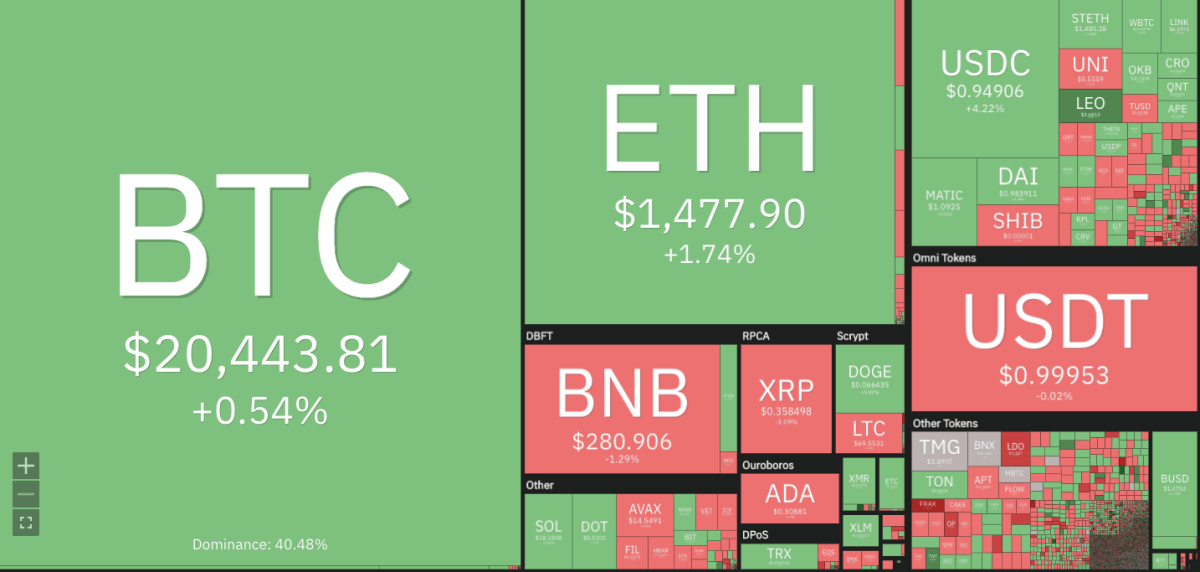

The latest Bitcoin price analysis reveals that the market for BTC has entered bullish territory after the massive buying-off. The bulls have taken control of the market today after a long period of bearishness. The BTC market faced rejection at the $20,721 level, which resulted in a decrease in value followed by an uptrend.

Due to the Silicon Valley Bank (SVB) collapse on March 10 has sparked fear, uncertainty, and doubt (FUD) in the digital asset markets; BTC has regained strength despite negative news. Currently, the digital currency is trading back above the $20,000 mark.

The market capitalization for BTC has also increased to $398 billion, and the 24-hour trading volume stands at $20 billion as of today. The positive market trend is likely to continue in the coming days, given that the bulls remain in control of the market as more buying-off occurs.

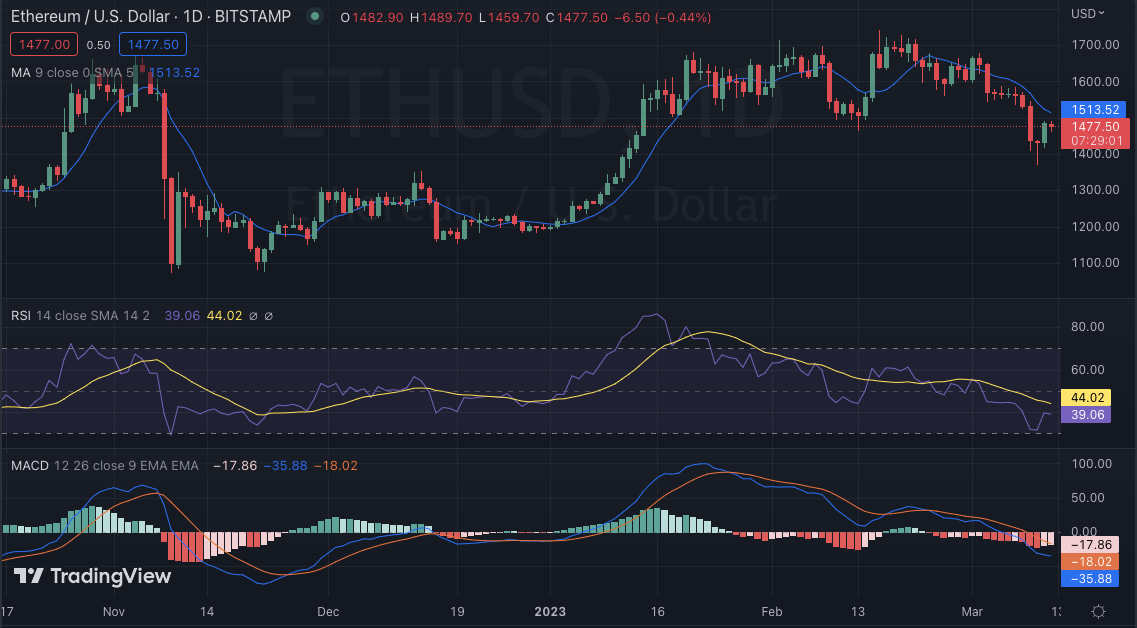

Bitcoin price analysis for 1-day chart: Market maintains momentum above $20,500

The 24-hour chart for Bitcoin price analysis shows that the market is moving in a positive direction, maintaining momentum above the $20,500 level. The past few days had observed a continuous bearish streak in the BTC market, but the buying-off pushed the prices back up with the bulls dominating the market. The market for BTC/USD has gained nearly 1.76 percent in the last 24 hours, and it is likely to continue its bullish trend in the near future.

Looking at the technical indicators, the Moving Average Convergence Divergence (MACD) indicator is in the positive zone. The MACD line is trading above the signal line on the daily chart. The histogram further confirms the bullish sentiment in the market as the bar is currently in the green color, which indicates an increase in buying pressure.

The Relative Strength Index (RSI) is also bullish as it trades above the 30-level at $39.06 on the daily chart. This suggests that there is still some buying pressure left in the market, and if this trend continues, then we could see further gains for Bitcoin. The moving average is also bullish as the 50-day and the 200-day are both trending above the current price. This suggests that the market is still in a strong uptrend.

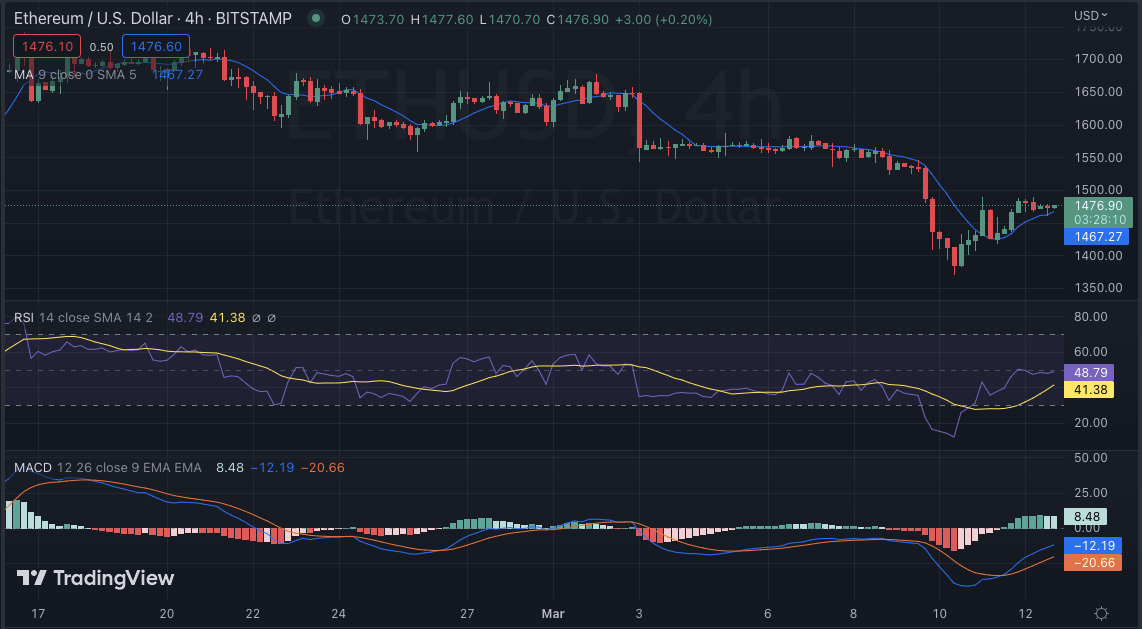

BTC/USD 4-hour analysis: Bulls aim to break past the $20,721 resistance

The 4-hour chart for Bitcoin price analysis shows that the market is continuing its bullish trend. The bulls have made multiple attempts to break past the $20,721 resistance level but haven’t been able to do so yet. However, if the bulls manage to break past this level, then we could see a further surge in prices. The support level that was established during the correction phase at $20,225 is still being held. This indicates that the market sentiment is still bullish as buyers continue to accumulate BTC/USD.

The MACD indicator on the 4-hour chart is also in the positive zone and has formed a bullish crossover above the signal line. Additionally, the MACD histogram is also trading above the zero-line, which confirms the bullish trend. The RSI indicator is also bullish as it trades just below the 48.79 level at 41.38 on the 4-hour chart. This shows that there is still some room for price appreciation in the near future if buying pressure remains intact. The moving average is also bullish as the 50-day and 200-day both are trending above the current price.

Bitcoin price analysis conclusion

Overall, it appears that Bitcoin price analysis is indicating a strong uptrend in the near future. The market has regained its strength, and the bulls remain in control of the market, as indicated by the various technical indicators. If buying pressure remains intact, then we could see further price appreciation in BTC/USD in the coming days. However, if there is any negative news or a sudden sell-off, then the market could take a bearish turn.