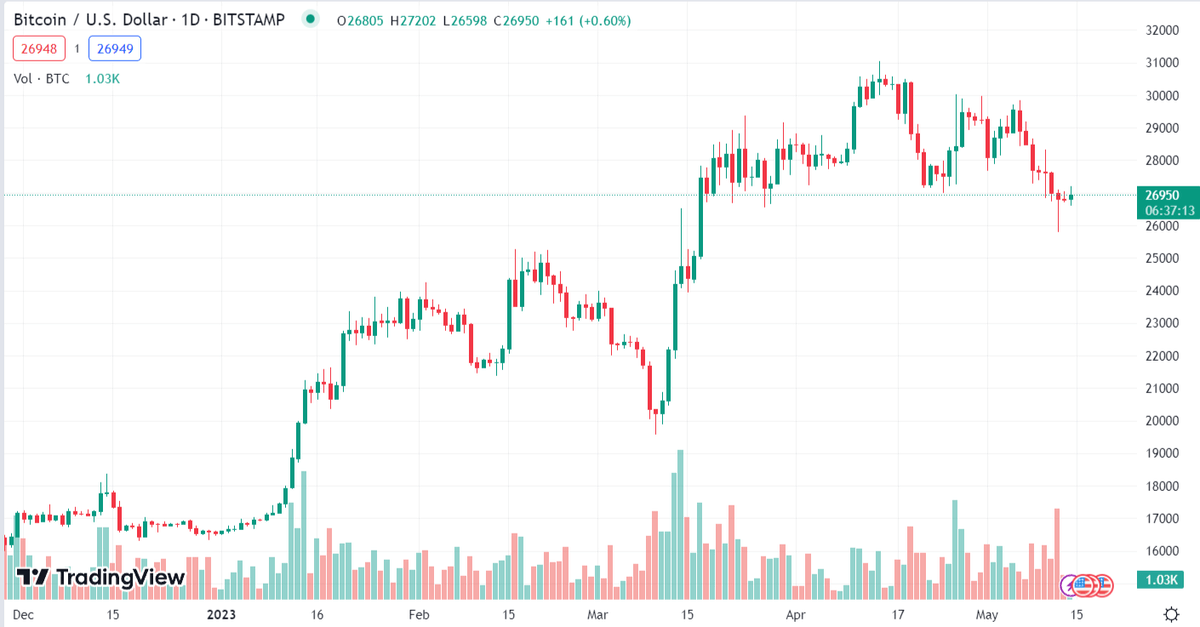

In recent years, Bitcoin has been a hot topic among investors, technologists, and the general public. While some people have hailed Bitcoin as the future of money, others have criticized it as a worthless asset that is bound to crash sooner or later. BTC has seen a recovery from the greatest crypto winter. However, its current deep has investors worried.

Is Bitcoin a bubble waiting to burst?

One of the main criticisms of Bitcoin is that it is a bubble waiting to burst. Critics argue that the current price of BTC, which has skyrocketed from a few cents in 2009 to over $60,000 in 2021, is not justified by its actual usefulness. They point out that BTC is not a widely accepted form of payment, nor is it backed by any tangible asset. Therefore, they argue, BTC is nothing more than a speculative asset that is driven by hype and speculation.

Some experts have gone as far as to call Bitcoin a “fraud” and a “Ponzi scheme”. For instance, Warren Buffet, the legendary investor and CEO of Berkshire Hathaway, has famously referred to Bitcoin as “rat poison squared” and predicted that its value will eventually plummet to zero. Similarly, a well-known economist, has argued that BTC is “the mother of all bubbles” and that its value is purely driven by “mania and hype”.

Bitcoin a revolutionary technology?

Despite these criticisms, many Bitcoin proponents argue that BTC is a revolutionary technology that has the potential to transform the financial industry. They point out that Bitcoin is decentralized, meaning that it is not controlled by any central authority like a government or a bank. This, they argue, makes BTC more resistant to censorship, manipulation, and corruption.

Furthermore, BTC advocates argue that Bitcoin is a more efficient and secure way of transferring value than traditional payment methods. They point out that Bitcoin transactions are faster, cheaper, and more secure than traditional bank transfers, which can take several days to complete and often involve high fees and intermediaries.

Moreover, BTC supporters argue that Bitcoin is a hedge against inflation and economic uncertainty. They point out that Bitcoin has a finite supply of 21 million coins, which means that its value cannot be diluted by inflation like fiat currencies. Additionally, they argue that Bitcoin is a safe haven asset that can protect investors from geopolitical risks, such as trade wars or currency devaluations.

Analysts align investments as BTC stumbles and recover

BTC’s recent recovery has sparked optimism among crypto traders and investors. The world’s largest crypto by market capitalization has seen a steady increase in its price over the past week, and analysts believe that this could trigger buying in four particular altcoins.

Analysts suggest that the increase in BTC’s price could trigger buying in four altcoins, which they believe are set to benefit from the renewed interest in cryptocurrencies. These altcoins include Ethereum, Binance Coin, Cardano, and Dogecoin.

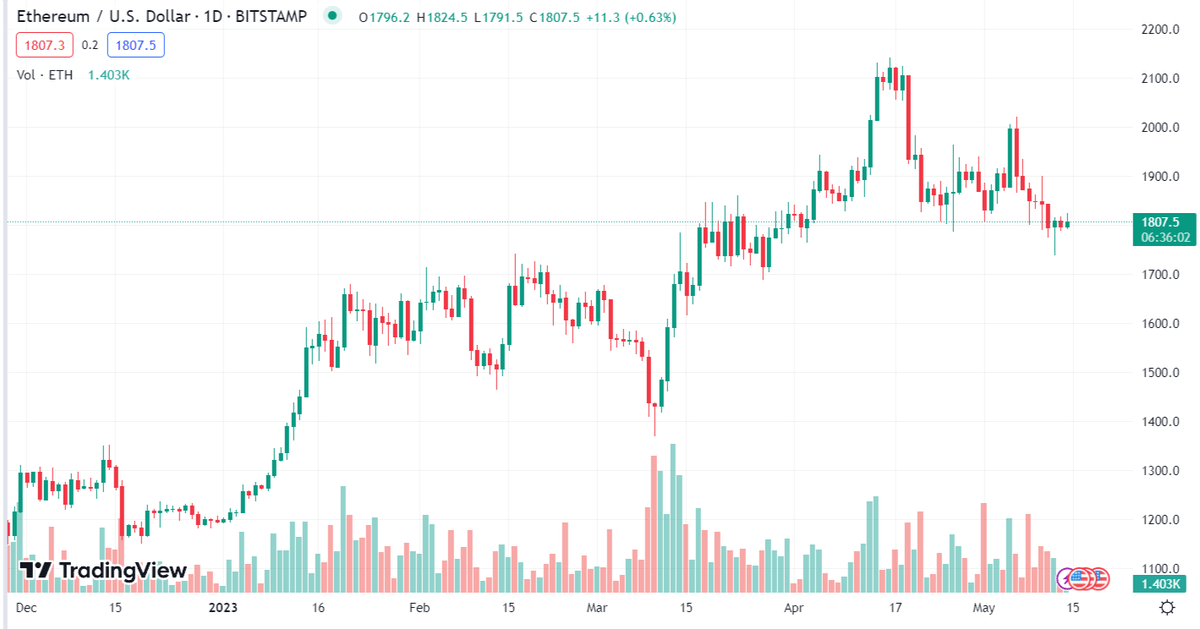

Ethereum, the world’s second-largest cryptocurrency, is currently trading at around $1,800. Analysts believe that if BTC’s price continues to rise, it could trigger a surge in Ethereum’s price as well. Ethereum is often seen as a better investment than BTC by some traders, as it has the potential for more significant returns.

Additionally, analysts believe that if BTC’s price continues to rise, Binance Coin could see even more significant gains. Cardano, a third-generation blockchain platform, has also been touted as an altcoin to watch. Cardano has been gaining popularity among investors due to its sustainable approach to cryptocurrency and the fact that it is environmentally friendly.

Dogecoin, the meme-inspired cryptocurrency, has also been gaining popularity recently. It is currently trading at around $0.40, up from a low of $0.25 just a week ago. Analysts believe that if Bitcoin’s price continues to rise, Dogecoin could see even more significant gains.

Despite the risks associated with investing in cryptocurrencies, many investors remain bullish on the future of the crypto market. They believe that cryptocurrencies could be the future of money and could revolutionize the way we think about finance.