This week began on a high note, with the Bitcoin price surging beyond $42,000 on Monday, December 4. However, Bitcoin has entered a stage of consolidation and is currently trading at $41,639 with a $814 billion market cap. Bitcoin brushed off a global market decline during a rise to a more than 19-month high, indicating that it is separating from other assets.

Bitcoin’s bull run takes a rest

As of the time of writing, the current value of Bitcoin (BTC) is $41,639.41, accompanied by a 24-hour trading volume of $24,828,806,334.48. This signifies a price surge of 0.30% over the last twenty-four hours and 12.22% over the past seven days.

The current valuation of cryptocurrencies on a global scale is $1.6 trillion, reflecting a change of -1.14% over the last twenty-four hours and 80.67% over the past year. At present, Bitcoin holds a market cap of $814 billion, signifying a dominance of 50.76%.

In contrast, Stablecoins have an 8.1% market cap share of the total crypto market capitalization at $130 billion. The correlation between Bitcoin and assets such as equities and gold has declined in 2023, as crypto-specific factors have contributed to the largest digital asset’s 152% increase.

The anticipation that the United States might approve its first spot BTC exchange-traded funds is a significant factor in the gains, potentially expanding the token’s demand.

Since the beginning of the year, the correlation coefficient between BTC and MSCI Inc.’s index of global shares has decreased from 0.60 to 0.18 over the last 90 days. Based on a comparable analysis conducted on spot and token gold, the value has decreased to approximately zero from 0.36.

On the Deribit derivatives market, open interest in bitcoin perpetual futures has reached a yearly high of $740 million. This level has not been seen since November 2021, when Bitcoin reached an all-time high of more than $69,000.

Crypto investors hope for detailed regulations

Regulation is an additional industry-specific factor. As the United States eases its attack on the crypto industry, executives are growing increasingly optimistic.

Recently, renowned cryptocurrency exchange Binance and its founder Changpeng Zhao have been subjected to hefty penalties for US anti-money-laundering and sanctions violations, while Sam Bankman-Fried was imprisoned for fraud at FTX.

Some technical indicators, such as the 14-day relative strength index, indicate that BTC’s surge has become stretched. The index is currently at 75, which is above the 70 level considered overbought.

Simultaneously, speculative interest is being fueled by rumors that the Securities and Exchange Commission would approve US spot Bitcoin ETFs in January. Bets on the Federal Reserve cutting interest rates next year have also given investors hope.

In a Monday report, online stockbroker Robinhood Markets Inc. stated that its November notional crypto trading volumes were around 75% higher than October levels.

Whether the BTC rise lasts will certainly become clearer once a decision on the spot ETF is reached, according to Kaiko.

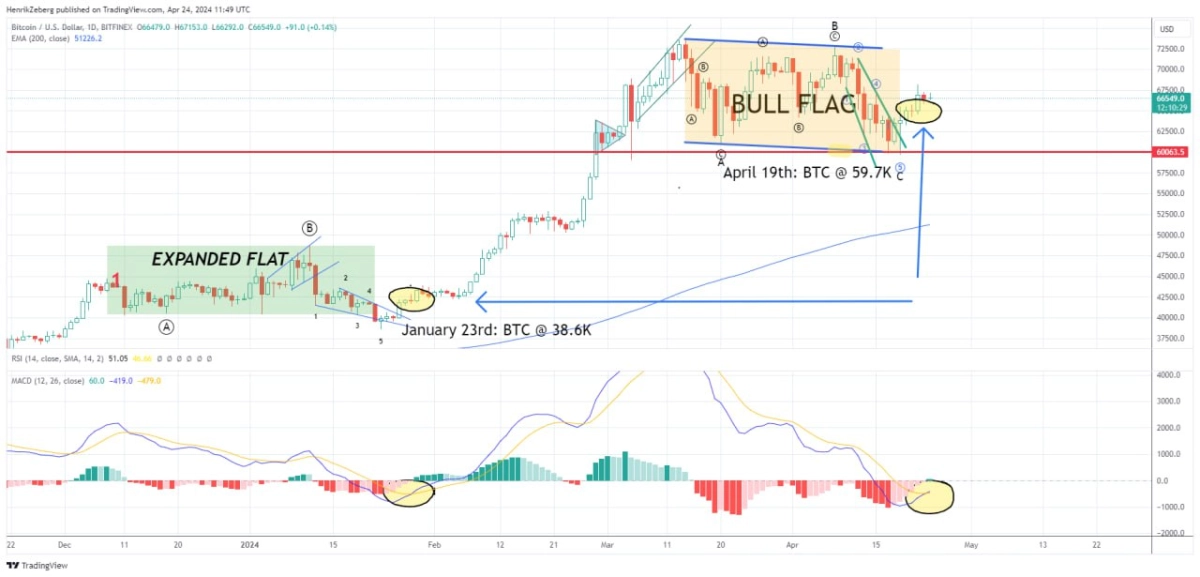

While everyone has been talking about and getting excited about the Bitcoin ETFs coming next month, another big motivator is the Bitcoin halving event in April 2024.

According to historical data, the BTC halving has been a big catalyst for the BTC price to rise. Analysts have already begun making bullish price estimates of up to $500,000 during the next Bitcoin bull run.

The rally’s interruption at $42,000 underscores the importance of a holistic understanding of these variables in interpreting market movements. As the market continues to evolve, staying attuned to these multifaceted influences becomes paramount for investors and enthusiasts alike.