In the ever-shifting landscape of global finance, concerns about the traditional financial system’s stability have led many to seek alternative avenues to protect their hard-earned wealth, particularly in the realm of retirement savings. This blog post explores strategies to shield your retirement from the perceived risks associated with the Federal Reserve system, highlighting the role of alternative assets, decentralized stores of value, and innovative solutions from DeployQ.com and HashDeploy.net.

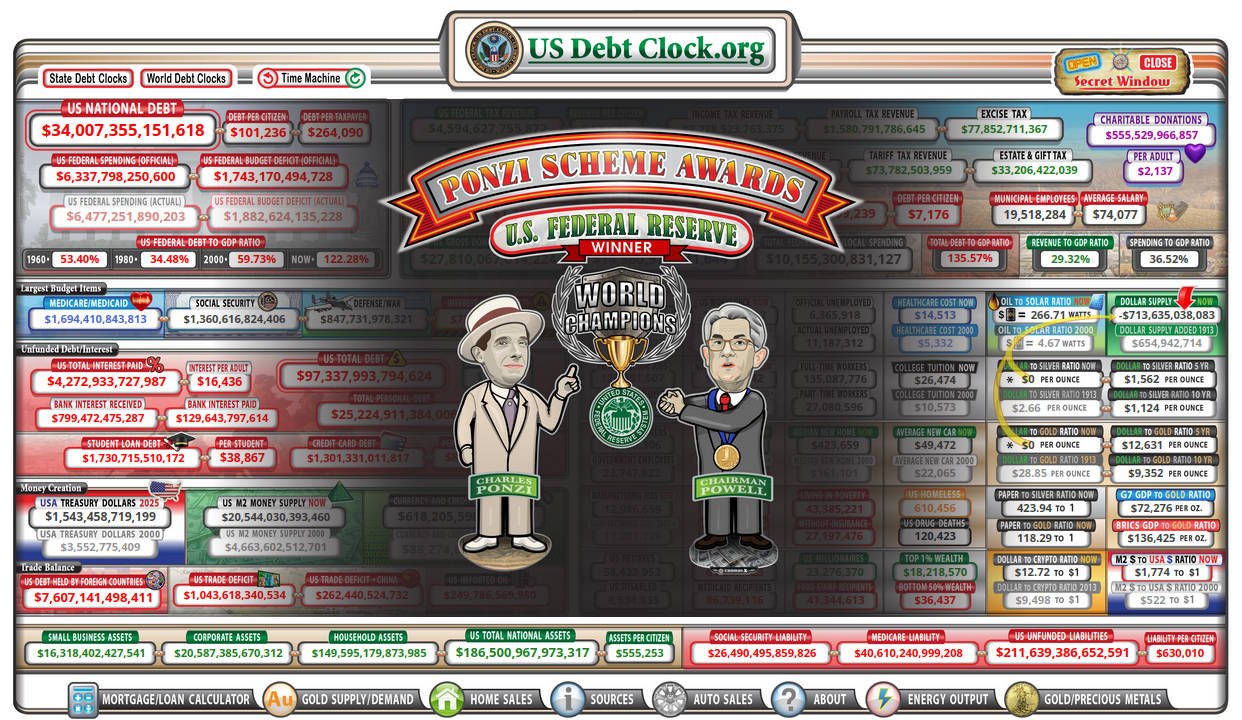

The Federal Reserve Ponzi Scheme:

Unveiling the Concerns:

Critics argue that the traditional financial system, with the Federal Reserve at its helm, operates on principles reminiscent of a Ponzi scheme. Concerns include endless money printing, inflation eroding purchasing power, and a lack of transparency in the creation of wealth.

Diversification as a Shield:

In the face of these concerns, diversification becomes a key strategy. Allocating assets across a spectrum of investments, including alternative stores of value, can help mitigate risks associated with traditional financial instruments.

Strategies for Safeguarding Your Retirement:

1. Diversify with Bitcoin, Gold, and Silver:

- Bitcoin: Embrace the decentralized revolution by allocating a portion of your portfolio to Bitcoin. Its finite supply and decentralized nature position it as a hedge against inflation and centralized control.

- Gold and Silver: Precious metals like gold and silver have historically served as stores of value. Diversifying into these tangible assets can act as a safeguard against economic uncertainties.

2. Becoming Your Own Bank with Hardware from HashDeploy.net:

- Explore the concept of becoming your own bank by securing your cryptocurrencies with state-of-the-art hardware wallets. HashDeploy.net offers innovative solutions to empower individuals to take control of their financial sovereignty.

3. Preparing for the Future of Money:

- Acknowledge the evolving nature of money and prepare for a future where decentralized stores of value play a pivotal role. Stay informed about emerging technologies and financial instruments that align with decentralized principles.

4. DeployQ.com: Your Partner in Financial Innovation:

- DeployQ.com offers a range of innovative solutions to diversify your portfolio and navigate the changing financial landscape. Explore their offerings to stay ahead of the curve in safeguarding your retirement. Bitcoin IRA, Become the Bank, Gold and Silver IRA #1, Gold and Silver IRA #2 and Physical Gold

Taking Charge of Your Financial Future:

Break Your Chains from Central Banks:

By adopting a proactive approach to financial planning, diversifying your assets, and embracing alternative stores of value, you can break free from the traditional financial paradigm. Take charge of your financial future and protect your retirement from the uncertainties associated with centralized financial systems.

Stay Informed with BitlyFool.com:

For ongoing insights into financial strategies, alternative investments, and the latest in decentralized finance, turn to BitlyFool.com. Our platform is dedicated to empowering individuals with the knowledge they need to navigate the complex world of finance and investments.

In collaboration with DeployQ.com and HashDeploy.net, empower yourself to safeguard your retirement and chart a course towards financial independence. The future of money is decentralized—be prepared. 🌐💰✨