The realm of global finance is witnessing a seismic shift as the BRICS consortium steps onto the field, wielding a plan that could significantly alter the dynamics of international credit rating systems. For decades, the United States has held the reins, with its trio of heavyweight agencies—Moody’s, Standard & Poor’s (S&P), and Fitch Group—dictating the financial fate of nations and corporations with their all-powerful assessments. Yet, the tide may be turning. The BRICS nations, feeling the sting of what they perceive as biased evaluations that often overshadow their economic achievements, are gearing up to launch their own credit rating entity. This bold move aims to dismantle the longstanding monopoly and redefine the criteria for financial health and creditworthiness on a global scale.

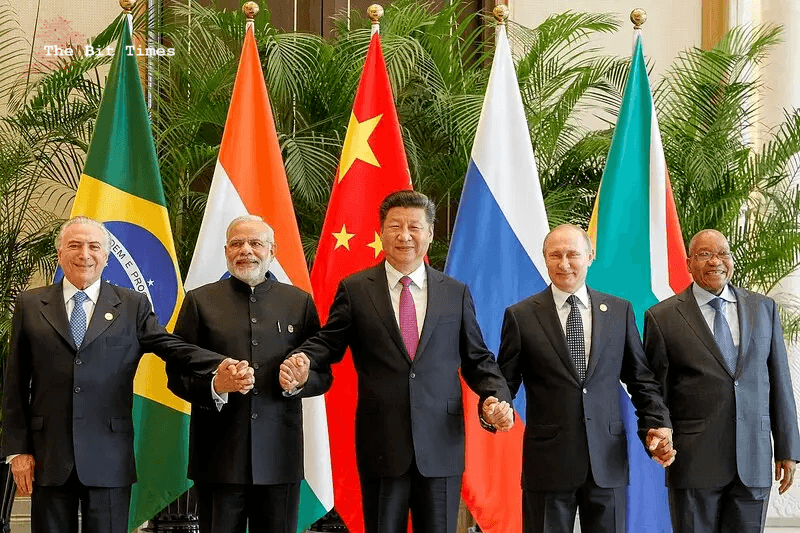

BRICS: A New Dawn for Global Finance

Within the corridors of power in the BRICS nations, there’s a palpable sense of urgency to recalibrate the world order of financial assessments. Spearheaded by Russia’s Central Bank Governor, Elvira Nabiullina, the initiative is more than just a clapback at perceived injustices. It’s a strategic play to establish a “supranational” rating agency that promises to be faster, more pragmatic, and devoid of the alleged bias that currently clouds the judgment of the established agencies. Nabiullina’s vision is for a system that truly reflects the economic realities and potentials of all countries, not just those within the BRICS bloc but globally.

The groundwork for this ambitious venture is expected to be a key topic at the upcoming 16th BRICS summit, hosted by Russia. The agenda is brimming with transformative ideas, including the creation of an internet service that bypasses U.S. data channels, symbolizing a broader push for autonomy and resistance against Western hegemony in digital and financial spheres. This summit, beyond its conventional expectations, could mark a pivotal moment in the quest for a more balanced and inclusive global governance structure.

Expanding Horizons and Shifting Alliances

The recent enlargement of the BRICS bloc, with the inclusion of Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates (UAE), underscores a strategic diversification that transcends mere economic cooperation. South Africa’s Minister of International Relations and Cooperation, Naledi Pandor, highlighted this expansion as a testament to the bloc’s growing influence and appeal. However, it’s not just about adding numbers; it’s a calculated effort to weave a more intricate tapestry of geopolitical relationships and economic partnerships that challenge the traditional dominance of Western powers.

The refusal of Argentina to join the BRICS fold, following a change in its political leadership, illustrates the complex interplay of national interests and ideological alignments that influence such global alliances. It’s a reminder that the BRICS endeavor is not a monolithic anti-Western crusade but a nuanced strategy aimed at fostering a multipolar world where diverse voices and perspectives can thrive.

This expansion and the bold move to establish an independent credit rating agency are indicative of BRICS’ growing confidence and its commitment to reshaping the global order. The initiative is not just about providing an alternative to the U.S.-dominated credit rating system; it’s about challenging the status quo and offering a new paradigm that values fairness, transparency, and inclusivity.