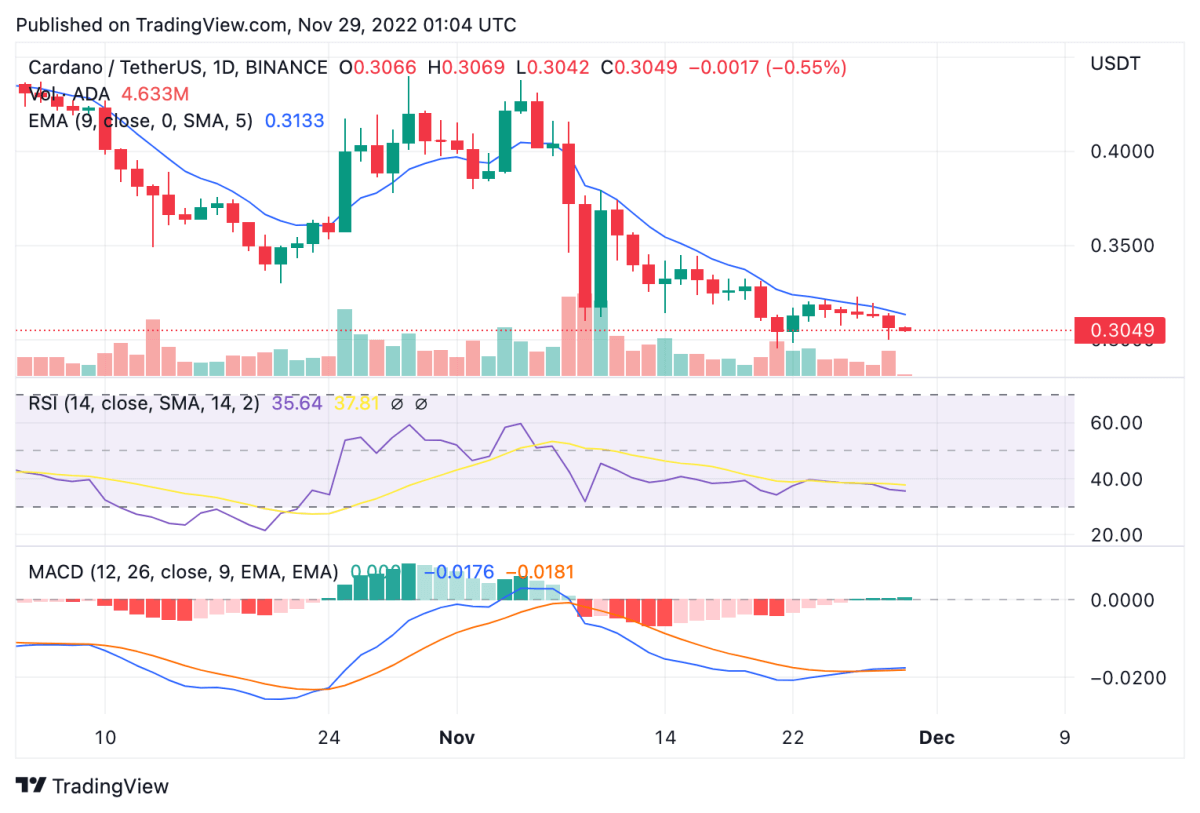

Cardano price analysis shows a continued bearish outlook, which strengthened with a further 3 percent decline over the past 24 hours. Price has failed to break past the $0.30 support zone since November 24, having succumbed down to $0.3006 today in what shows to be a descending triangle on the daily chart. A continuation around the current trend without a breakout could lead price to move down to $0.20 support, but an unlikely bullish intervention could see ADA push up to the immediate resistance point at $0.40.

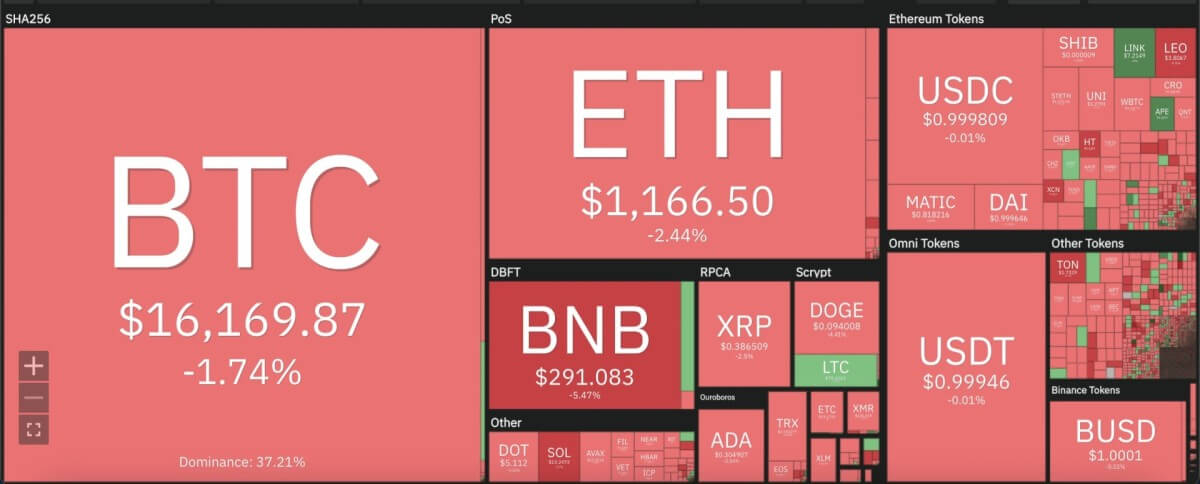

The larger cryptocurrency market showed similar declines carried out across the board over the past 24 hours, as Bitcoin moved down to early $16,000’s with a 2 percent decrement. Ethereum lost 2.5 percent to move down to $1,100, whereas major Altcoins mimicked the same trend. Ripple lost 3 percent to move down to $0.38, whereas Dogecoin moved down to $0.09 with a 5 percent drop. Binance Coin also lost 6 percent to move down to $291.08, while Solana moved down 6 percent to sit at $13.24.

Cardano price analysis: RSI stagnates into oversold zone on the daily chart

On the 24-hour candlestick chart for Cardano price analysis, price can be seeing a descending edge over the past 24 hours after residing in a horizontal trend for much of last week. ADA price has pivoted around the previous support zone at $0.30, and hasn’t been able to form a breakout past this point. Trading volume picked up over 58 percent over the past 24 hours, suggesting some seller action taking place in the market. Price over the past 24 hours remained below the 9 and 21-day moving averages, along with the 50-day exponential moving average (EMA) at $0.314.

The 24-hour relative strength index (RSI) seems to be going down as well after a brief sideways trend. Currently at 35.64, it could move into the early thirties within the oversold zone unless price breaks past the current trend. Meanwhile, the moving average convergence divergence (MACD) curve shows a tied pattern with the neutral zone with a bearish divergence in place currently.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.