Celer Network Price Prediction 2023-2032

- Celer Network Price Prediction 2023 – up to $0.033

- Celer Network Price Prediction 2026 – up to $0.10

- Celer Network Price Prediction 2029 – up to $0.30

- Celer Network Price Prediction 2032 – up to $0.98

Celer Network has shown that it can make a decentralized, off-chain scaling platform with strong security properties. The project comes from several Stanford researchers and is backed by venture capital firms like FBG Capital, Global Brain, Zhenfund, and DFund.

Celer Network crypto has proven to be a profitable investment for those who joined in the early stages of the token, with an ROI of 337.54%. Celer is the future of Esports and MicroPayments on Ethereum Layer 2; think Matic but is it better?

Take a look at what’s currently happening:

We’ll look at past Celer Network (CELR) pricing and see what experts have to say about its price movements in the future. Remember that these predictions should be taken just as some market experts/analysts suggest.

How much is CELR worth?

Today’s Celer Network price is $0.019081 with a 24-hour trading volume of $9,545,370. Celer Network is down 8.61% in the last 24 hours. The current CoinMarketCap ranking is #195, with a live market cap of $135,200,333. It has a circulating supply of 7,085,488,367 CELR coins and a max. supply of 10,000,000,000 CELR coins.

Also Read:

- Celer Network suffers probable DNS hijack of cBridge frontend

- Celer Network going ahead with the release of cBridge mainnet

What is Celer?

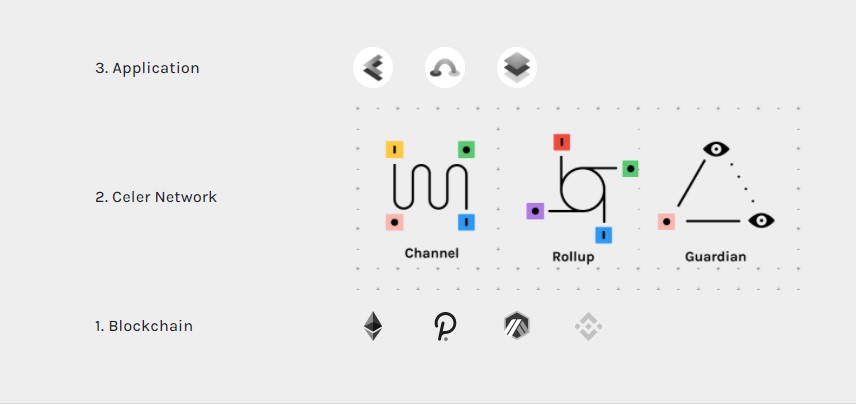

Celer Network is a second-layer, off-chain scaling platform. It is designed to address blockchains’ scalability trilemma by offering strong security guarantees, low development costs, and high performance. The network consists of both an off-chain operating network and various developer tools:

- CelerX: An SDK for trustless off-chain dApps.

- Celer SDK: A high-level abstraction layer that allows developers to build scalable, secure, and privacy-preserving decentralized applications (dApps).

- Channel transfers: Enables bi-directional off-chain of digital assets without any settlement delay.

Unlike most scaling projects that address scalability through sharding or Layer 2 techniques, Celer Network is designed to solve the problem differently. The project uses a layered architecture that separates state channel logic from off-chain operating networks and smart contract processing.

Celer Network was developed by researchers at Stanford, UC Berkeley, and Princeton, working on layer two infrastructure for blockchains. They have gone beyond theoretical research and built working prototypes of their models – the first implementation was developed as early as 2016 when it was used to solve a privacy layer on Ethereum.

An off-chain scaling solution is necessary because today’s blockchains are slow and expensive. For example, a simple payment from A to B in a dApp can require up to 22 blockchain confirmations (~30 minutes) and cost over $1 when using the Ethereum mainnet.

Celer Network Overview

Celer Network’s vision is to be the cryptoeconomically-driven, Internet-scale computer that will power all decentralized applications. Over the past year, the price change has been about 2249.9%, with the price rising from a minimum price of $0.04023 to a maximum average price of $0.1987 during that period. Celer Network has demonstrated a positive development. We believe that similar segments of the market were viral at that time. According to the most recent data available, Celer Network’s trading volume has risen over the last four months. The trading volume is an essential indicator in determining its price.

The Celer Network Architecture

The Celer Network architecture (cStack) is built on four elements:

- ccOS: The core of the network that provides the workflow.

- cRoute: A mechanism that increases operations capacity by streamlining routes within the network.

- cChannel: Channels for transmitting transactions within the network.

- cApps: An ecosystem application layer used for scaling and user privacy.

The platform uses a Proof-of-Stake (PoS) consensus variation called Delegated Proof of Stake (DPoS). With this algorithm, participants may stake their coins for a reward while transferring the responsibility of validating transactions to “delegates.”

CELR holders will provide tokens for liquidity and will receive a reward for doing so. The key point of Celer is that the platform allows layer-2 scaling for any blockchain. Thus, the project covers a wide spectrum of the market, multiplies the liquidity potential, and increases the product’s reliability, coverage, and adaptation.

Who Created The Celer Network?

Celer Network was founded in 2018 by a strong team of engineers with incredibly technical and specialized experience. All four co-founders of Celer hold PhDs in Computer Science from universities like MIT and UC Berkely, and all have a work history with high-profile tech companies.

- Dr. Mo Dong is a bonified expert in applying algorithmic game theory and protocol development. He also teaches comprehensive courses on smart contracts. He previously worked as a development engineer and product manager at Veriflow.

- Dr. Junda Liu graduated from UC Berkeley and worked with Google in 2011 to create the infrastructure for their data center. In 2014, he became one of the founders of the Project Fi mobile service. After that, he took the position of technical manager at Android Tech.

- Dr. Xiaozhou Li received his education at Princeton. Li interned at Microsoft before working at Barefoot Networks as a software engineer. Today, his published and widely-read academic works span distributed systems, networks, storage, and data management.

- Dr. Qingkai Liang holds a degree from MIT. As a software engineering intern, he has worked for the MIT Laboratory for Information and Decision Systems (LIDS), Bell Labs, and Google. His research focuses on learning and controlling problems in networked systems, namely online learning algorithms in adversarial networks.

What makes Celer Network (CELR) unique?

Celer is a networked system and not a separate blockchain. The platform instead runs on top of existing and future blockchains. The developers focused on scalability to improve the throughput of crypto blockchains. The founders are confident that in-house solutions will not bring results to future decentralized blockchains (globally). Instead, they propose to solve the problem with their off-chain platform.

The four levels of the cStack architecture are evenly partitioned to provide several unique benefits. The advantages include reduced transaction delays, decreased commission for micropayments; zero commission in working off-chain smart contracts; horizontal scaling in joining new nodes; availability of an off-chain model of cryptoeconomics; an optimal routing algorithm for transactions; and support for various blockchains.

The cEconomy is a unique cryptoeconomic model responsible for maintaining stable liquidity and availability for the ecosystem while creating a network effect. The mining algorithm doesn’t require the use of Proof-of-Work (PoW). Users only need to install the software and keep CELR in their accounts to receive income as a reward for providing liquidity.

How many CELR are in circulation?

CELR has a maximum supply of 10 billion tokens, which is distributed as follows: 25% – PoLC mining reward and Off-chain ecosystem building; 20% – Team (18.3%) and Advisors (1.7%); 17% – Foundation; 5% – Marketing & Ecosystem; 33% – Sale.

CELR is an ERC-20 standard token built upon the Ethereum blockchain. It’s used to manage the network economy – cEconomy and has several uses:

- Paying commission fees for service and transactions to off-chain providers and covering additional costs.

- Staking CELR in the State Guardian Network (SGN) and acquiring the status of State Guardian. State Guardians have access to status monitoring, respond to disputes, and provide security and network efficiency.

- CELR tokens maintain a large liquidity pool in a Proof of Liquidity Commitment (PoLC) process.

- CELR tokens can be useful in a Liquidity Backing Auction (LiBA) to increase the priority of applications for liquidity support and, as a consequence, increase the payment of interest on liquidity.

How Is the Celer network secured?

The SGN (State Guardian Network) is a decentralized L2 service infrastructure that keeps the Celer L2 platform running smoothly. It securely stores the user state on the Celer State Channel Network and responds to L1 calculations when users are offline. Moreover, the technology allows users to protect their savings before going offline. SGN also acts as a decentralized block producer level for the Celer Rollup, thus maintaining a high level of viability and providing additional security. Users are required to stake CELR to join the SGN. And CELR holders facilitate the protection of the network as a whole.

Where can you buy CELR?

The top exchanges for Celer Network (CELR) trading are currently Binance, Gate.io, Bithumb, OKEx, Crypto.com Exchange, WazirX, AscendEX, (Bitmax), CoinDCX, MXC.com, BitPay, DigiFinex, BKEX, AEX, BiKi, Hotbit, HitBTC, TOKOK, Uniswap V2, TOCENCAN, DragonEX, ZT.

In March 2019, CELR tokens were sold on the IEO platform, Binance Launchpad. As of June 2021, the most liquid trade pairs for CELR on Binance are CELR/USDT, CELR/BTC, CELR/BUSD, and CELR/BNB.

How does Celer work?

An overview of the Celer Network architecture

Celer Network contains two main components: an off-chain operating network and developer tools. The Ethereum blockchain powers them through smart contracts (Economic) and cTokens (Gas). The platform is blockchain agnostic; it will start with integration for Ethereum, but additional blockchains can be added later.

The Celer Network platform is maintained and supported by the Celer team. The project’s goal is to be decentralized as much as possible so that third parties can maintain specific components or upgrade them without disrupting service delivery.

CelerX: An SDK for trustless off-chain dApps

Most blockchain applications require users to sign transactions to prove they have permission for specific actions. For example, when Alice wants to send 1 Ether from an A account, she needs to ask for B and have B send her an authorization token in signed data. After that, Alice can use the Ethereum network’s proof-of-work algorithm to secure funds transfer.

A transaction on the Ethereum blockchain specifies that Alice has permission to withdraw 1 Ether from account A.

- This introduces several challenges:

- The process is slow and expensive (it requires paying gas fees and waiting for multiple confirmations).

- The signing process is complex, requiring expensive development time due to security reasons.

- The platform can be limited by architecture – for example, when Alice wants to use the same token on another blockchain, she has to redeploy it there, which introduces even more challenges.

Celer Network solves these problems through off-chain transactions. Users sign a transaction off-chain that represents the intention of withdrawal. This proposal is then submitted to the operating network, where it’s put on hold until the transaction is completed (i.e., funds are sent).

The Celer network architecture shows two types of settlement transactions. The first one sends 1 Ether from A account to B account; settlement costs $5 and takes ~10 minutes due to blockchain confirmations. The second transaction sends 1 Ether from A to B, the accommodation cost is $0.5, and it takes ~1 minute.

People are waiting for A and B, a simplified example of off-chain transactions on top of Celer Network for sending funds between two parties. After creating a payment channel, Alice signs a transaction authorizing the withdrawal of 1 Ether from account A and sends it to Celer Network.

The amount is then locked in an escrow contract valid for the next 24 hours; the funds will be made available once Alice and Bob send their authorization tokens (signed data). After both parties sign a revocation transaction, which enables refunding of all funds in the channel to their initial state, they can make a withdrawal from the track.

Celer Network New Development

The year 2023 seems to have started on a high note for the Celer Network community, with the introduction of new tokens and NFT bridging support, new DeFi integrations, and multiple Ask Me Anything (AMA) sessions with various projects and partners. These developments highlight the ongoing growth and expansion of the network and its continued commitment to providing innovative and seamless solutions to its users. The community can look forward to further exciting advancements in the coming months.

Celer Network Technical Analysis

Upon examining the 4-hour price chart of Celer Network, it is evident that the token is currently trading below its fair market value. This is confirmed by the bearish crossover of the MACD line below the signal line, indicating a negative trend.

Furthermore, the Relative Strength Index (RSI) of 38.30 reinforces the oversold condition of the token. The RSI is a technical indicator that measures the strength of a coin’s price action, with an RSI value below 30 indicating an oversold market. With CELR facing selling pressure, it presents an opportunity for traders to capitalize on a potential price dip and accumulate the token at a discounted rate.

Based on the summary of the technical analysis, the moving average indicators for Celer Network (CELR) show a strong sell signal, which points to a downward trend. Conversely, the oscillators are currently neutral, indicating that the asset’s momentum is evenly balanced. The overall technical analysis presents a mixed outlook for CELR, with strong bearish signals from the moving average indicators and neutral momentum indicators. Investors are advised to conduct comprehensive research and consider various technical indicators before making any investment decisions.

Celer Network Price Predictions by Cryptopolitan

Celer Network (CELR) has performed well in the early part of 2023, along with other cryptocurrencies. However, market conditions caused an 18.30% decline in late February 2023. Despite having solid underlying fundamentals, it is uncertain if CELR will achieve a $1 price point in the near future. To gain a better understanding of the potential future value of CELR, our price predictions spanning from 2023 to 2032 may be useful.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2023 | 0.027 | 0.029 | 0.033 |

| 2024 | 0.040 | 0.042 | 0.048 |

| 2025 | 0.059 | 0.061 | 0.070 |

| 2026 | 0.086 | 0.088 | 0.10 |

| 2027 | 0.12 | 0.12 | 0.15 |

| 2028 | 0.18 | 0.19 | 0.21 |

| 2029 | 0.26 | 0.27 | 0.30 |

| 2030 | 0.39 | 0.40 | 0.45 |

| 2031 | 0.56 | 0.58 | 0.67 |

| 2032 | 0.82 | 0.85 | 0.98 |

Celer Network (CELR) Price Prediction 2023

The forecast for Celer Network’s price in 2023 suggests that the maximum price of CELR could reach $0.033 if there is a constant demand for it. The projected lowest price is expected to be $0.027, and the average trading price is estimated to be approximately $0.029. Nevertheless, this is only a forecast, and several factors such as an increase in demand for the coin, a surge in the general cryptocurrency market, and progress in the Celer Network network could have a favorable impact on its price.

Celer Network Price Prediction 2024

Based on our Celer Network price prediction for 2024, it is anticipated that the upward trend of CELR will continue, leading to a potential maximum value of $0.048. The expected average price is predicted to be around $0.042, with a minimum valuation of $0.040.

Celer Network (CELR) Price Prediction 2025

Our analysis of the Celer Network price forecast for 2025 indicates that the maximum value of CELR could potentially reach $0.070. The coin’s minimum price is expected to be around $0.061, and its average market value is expected to be $0.059.

Celer Network Price Prediction 2026

Our Celer Network price prediction for 2026 suggests that the coin’s value could potentially reach a maximum of $0.10, with a predicted minimum price of $0.086. The average forecast price for the year is estimated to be around $0.088. These predictions depend on the successful implementation of key developments and partnerships that could lead to more people using CELR, which could increase its value to the levels predicted.

Celer Network Price Prediction 2027

Based on the analysis and predictions of our experts, it is anticipated that the value of CELR will increase significantly in 2027, potentially reaching a maximum price of $0.15. The average trading price for the year is predicted to be around $0.12, while the minimum price value is projected to be $0.12. These estimates are based on several factors, including market demand, adoption rates, and technological advancements in the Celer Network platform.

Celer Network Price Prediction 2028

In our forecast for the Celer Network price in 2028, we anticipate that CELR could potentially achieve a maximum value of $0.21. The coin’s average trading price for the year is estimated to be around $0.19, while the lowest price is projected to be $0.18.

Celer Network Price Prediction 2029

According to our Celer Network price forecast for 2029, we anticipate that the coin will have an average trading price of $0.27, with a potential maximum price of $0.30. The projected lowest price for CELR in 2029 is expected to be around $0.26.

Celer Network Price Prediction 2030

Based on our Celer Network price prediction for 2030, we anticipate that the price of CELR may potentially reach a maximum value of $0.45. Additionally, the coin is expected to trade at a minimum price of $0.39 and an average price of $0.40 throughout the year.

Celer Network Price Prediction 2031

In our Celer Network price prediction for 2031, we anticipate that the cryptocurrency may experience various price fluctuations throughout the year, with a potential minimum value of $0.56 and a maximum value of $0.67. On average, we estimate that the coin could trade at around $0.58. The projected increase in value is largely based on the growing acceptance of CELR in various industries as well as its increasing popularity among institutional investors who may choose to invest in the coin.

Celer Network Price Prediction 2032

Our Celer Network price prediction for 2032 suggests that the coin may potentially reach a maximum value of $0.93, with an average projected price of $0.81 and a minimum expected value of $0.79. However, it’s crucial to remember that these are just estimates and should not be taken as investment advice. It’s essential to conduct thorough research and analysis of the market and other relevant factors before making any investment decisions. Market conditions can be volatile, and various unpredictable factors can impact the price of CELR.

Celer Network Network Price Prediction by Wallet Investor

According to Wallet Investor’s analysis of the cryptocurrency market and algorithm for predicting its future price, Celer Network (CELR) is not a good long-term investment. Based on their findings, it appears that CELR’s value could drop by as much as 89.45 percent by 2024. This may cause the price of one unit to drop to about $0.002024.

Celer Network Network price forecast by Technewleader

According to Technewleader’s analysis, Celer Network (CELR) is expected to experience significant price growth in the coming years. By the end of 2023, the projected price ceiling for CELR is $0.035. The forecast for 2024 indicates a price range of $0.045 to $0.052. Moving forward, Technewleader predicts a minimum price of $0.067 and a maximum of $0.080 for 2025. Should the current upward trend continue, CELR’s maximum trading price could reach $0.17 in 2027. By 2032, the expected price range for CELR is projected to be between $0.94 to $1.12.

Celer Network Price Prediction by Digitalcoinprice

According to Digitalcoinprice’s analysis, the future outlook for Celer Network (CELR) is optimistic, with predictions of substantial growth. By the end of 2023, CELR is projected to reach a maximum price of $0.0419. By 2025, the anticipated price range is forecasted to be as high as $0.0693. Looking even further ahead, the team predicts that by 2032, the average price of CELR may reach $0.37, with a maximum value of $0.38, indicating a potentially valuable long-term investment opportunity.

Celer Network Price Prediction By Industry Experts

Moon333 analyzes the price movement of Celer Network, its recent breakout of the resistance level, and its current movement within a rising channel. The target to the upside is around 0.046 USD, and if there are further upsides, prices could go as high as 0.20 USD.

Conclusion

Numerous developments back Celer Network. But its long-term price prediction is somewhat contradictory. Wallet Investor predicts it is a bad investment, while other experts say investors stand a chance to benefit from the project if they hold it long-term. Even though we predict this cryptocurrency is a good investment, we advise investors to do their own research before investing in this token.

The Celer Network company is not the only one that specializes in level-2 scaling solutions. Regardless of the organization’s pricing projection, the job CELR accomplishes is crucial. Still, before choosing whether CELR is the best option, observing other, somewhat dissimilar systems to see how they are performing and acting would be useful.

The cost of Celer Network will rise in the future! By 2026, Celer Network is anticipated to surpass the $0.10 threshold, according to our price prediction! The market capitalization of Celer Network will rise in the future as its worth rises.

Future growth is contingent on various factors, including announcements, new technology solutions generated by Celer Network activities, the crypto ecosystem in general, legal status, and so on. As a result, we’d advise you to do your homework before investing in any cryptocurrency.