Chainlink price analysis shows the token initiating a fresh decline over the past 24 hours, as price dipped 7 percent to move as low as $6.7. LINK moved below the $7 support point with today’s downtrend, moving to the lowest price point since February 14. If the current decline intensifies, Chainlink price could move down to the January low of $5. Despite the 11 percent drop since yesterday, Chainlink carries a market cap of $3,506,488,849, but has dropped its position in the crypto market to 19th.

The larger cryptocurrency market also took a hit on yesterday’s prices, as Bitcoin dropped 5 percent to move below the $22,500 mark, as Ethereum dropped 5 percent itself to $1,500. Among leading Altcoins, Ripple dropped 2 percent to $0.37, whereas Cardano and Dogecoin declined 3 percent and 5 percent, respectively, with the latter moving down to $0.07. Meanwhile, Polkadot also dropped 5 percent to move as low as $6.0.

Chainlink price analysis: RSI makes a sharp downward turn on daily chart

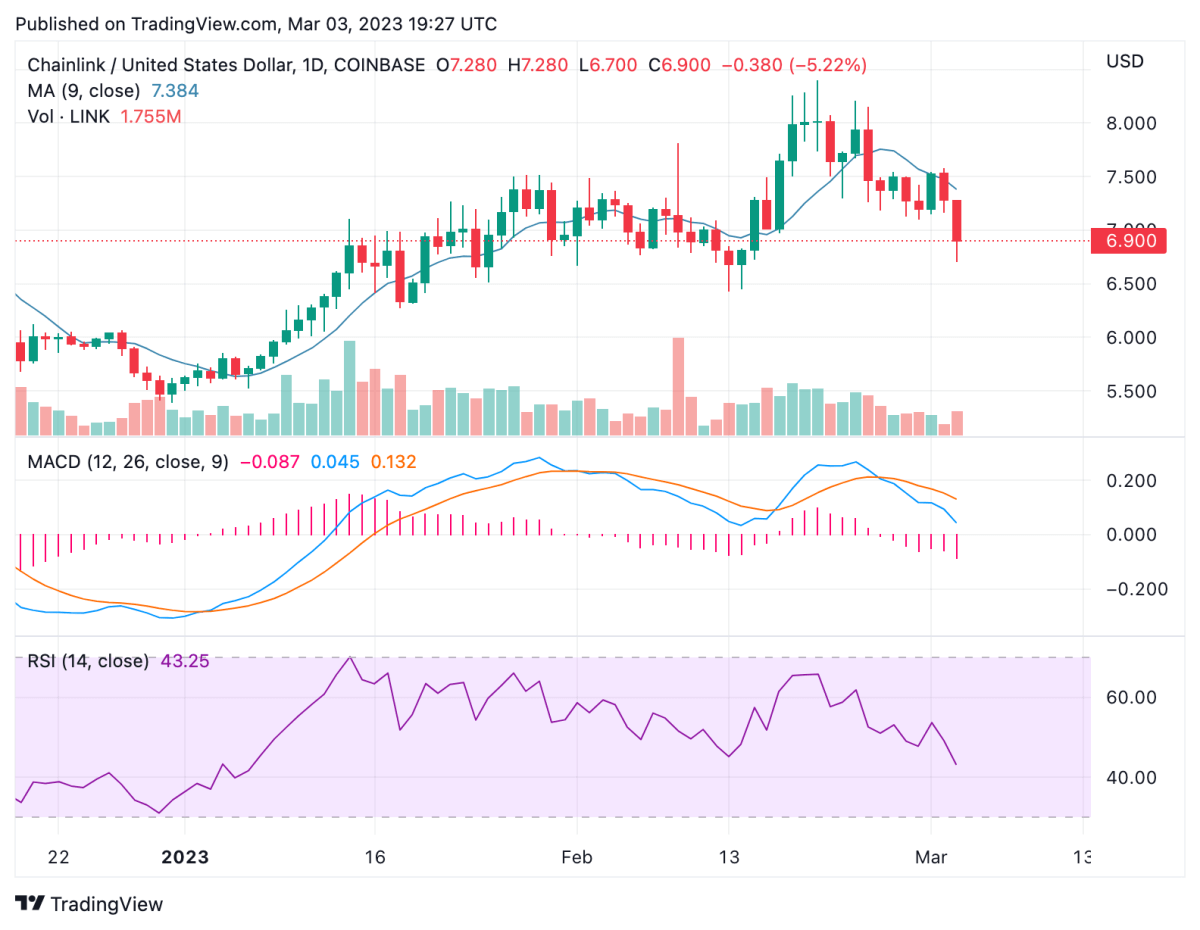

On the 24-hour candlestick chart for Chainlink price analysis, price can be seen forming a steep decline over the past 24-48 hours. Having moved below the previous support point at $7, the next support sits not far from current price at $5. With the current dip in place, LINK has moved below its 9 and 21-day moving averages, along with the crucial 50-day exponential moving average (EMA) at $7.34.

The 24-hour relative strength index (RSI) can also be seen forming a distinct downward trajectory, moving close by to the oversold region. This indicates lowering market valuation for LINK amid the current drop. It is also reminiscent with the 22 percent trading volume increase over the past 24 hours, mostly comprising of selling action. Furthermore, the moving average convergence divergence (MACD) curve also shows a bearish divergences, with the trend line keeping below the signal line.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.