Chainlink price analysis shows a Bearish trend setting up after a continuous bullish momentum for the past few days. Bulls were in the lead from yesterday’s high of $7.07 to the present low of $6.89. The downtrend was confirmed with a break below the support at $6.83 and a failure to hold on to the short-term LINK is likely to face more bearish pressure in the coming days.

The key resistance to watch out for will be at $7.07, as this level represents a crucial Fibonacci retracement level from the previous LINK rally and could signal a reversal if breached. The LINK/USD has a trading volume of around $269 million and a market capitalization of $3.5 billion.

LINK/USD 1-Day price chart: Bears pulling the price below the $7.07 resistance level

In the 1-day chart, the Chainlink price analysis shows prices are going down for the cryptocurrency due to continuous bearish pressure from the last few hours. Still, as is seen in the charts, volatility is also increasing by a significant margin, indicating uncertainty and may favor bears further. Though the bulls provided some competition, bears are winning the lead as of now.

The Bollinger bands indicate a volatile situation as the higher end of the band stands at the $7.22 mark while the lower end stands at the $5.44 mark. The relative strength index (RSI) index is 60.62, which is already near the overbought figures. The MA indicator shows a bearish crossover as the price is currently at $6.73 and is likely to move down further.

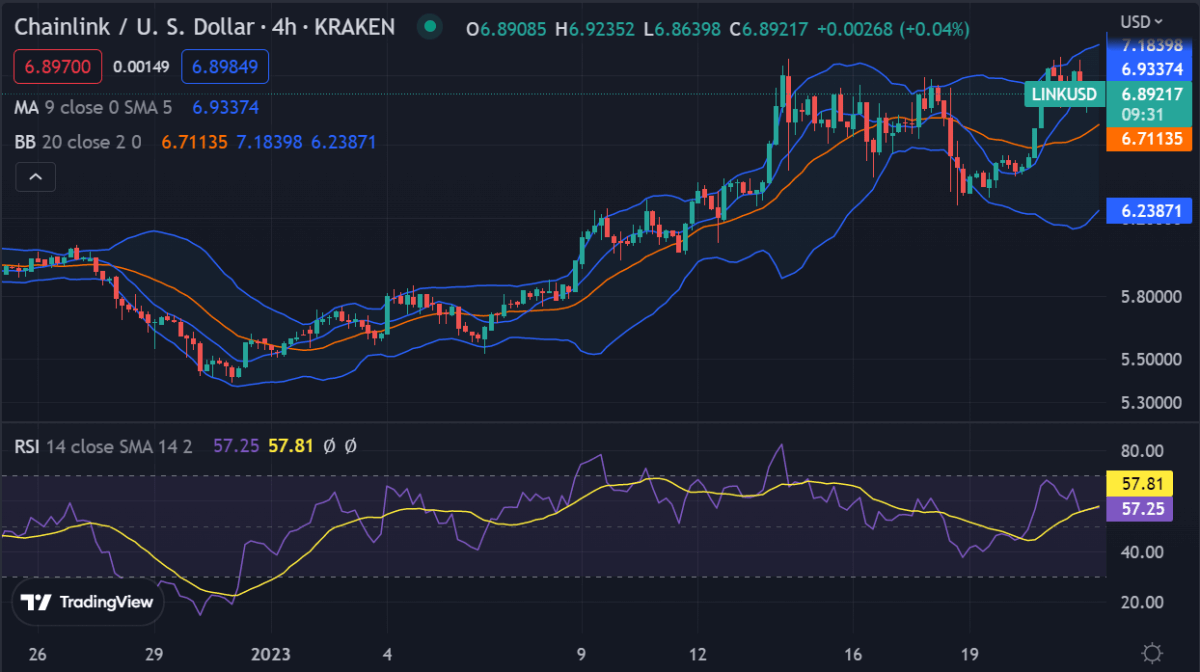

Chainlink price analysis: Bearish trend prevailing amid limiting volatility

The 4-hour Chainlink price analysis shows that bears are providing tremendous resistance to the surging price due to the previous bullish momentum by decreasing the price to $6.89, respectively. The volatility is still there but seems to be on a limiting trend again at this time, as can be seen in the 4-hour chart, which may also provide some cushion to the bulls in the near future.

The Bollinger bands’ values are as follows; the upper Bollinger band is touching the $7.18 mark whereas the lower band is at the $6.23 mark. The RSI index is also receding towards a neutral range, and the figure is 57.81 as per the Dogecoin price analysis. The Moving Average (MA) has been $6.93 but it is likely to move up soon.

Chainlink price analysis conclusion

From the above Chainlink price analysis, we can say that sellers dominated the market, proved by the incredible bearish momentum dictating the price movement. The bearish trend is expected to continue in the near future, and LINK may see further price drops unless it can recapture its bullish momentum.