ChainLink price analysis for January 31, 2023, reveals the market following a downward movement, showing decreasing momentum, signifying negativity for the LINK market. Over the previous several hours, ChainLink’s price has stayed negative. From $7.3, the price dropped to $7 on January 30, 2023. But after that, the market’s worth dropped even further, losing value. In addition, ChainLink has dropped and is now $6.9.

Today’s price for Chainlink is $6.98, with a $704.03M 24-hour trading volume, a $3.55B market cap, and market domination of 0.33%. The cost of LINK dropped by 0.81% during the previous 24 hours.

Chainlink’s price peaked on May 10, 2021, when it traded at an all-time high of $52.89, while it peaked at its lowest price on September 23, 2017, when it traded at an all-time low of $0.126297. Since the price peaked, $5.36 was the lowest amount (cycle low). Since the last cycle low, $9.45 has been the highest LINK price (cycle high). Currently, the Fear & Greed Index is at 51, and the Chainlink price forecast attitude is pessimistic (Neutral).

Out of a maximum supply of 1.00B LINK, 508.00M LINK are now in circulation. With an annual supply inflation rate of 8.78%, 40.99M LINK was produced in the previous year. Chainlink is currently ranked #4 in the DeFi Coins category and #7 in the Ethereum (ERC20) Tokens sector in terms of market capitalization.

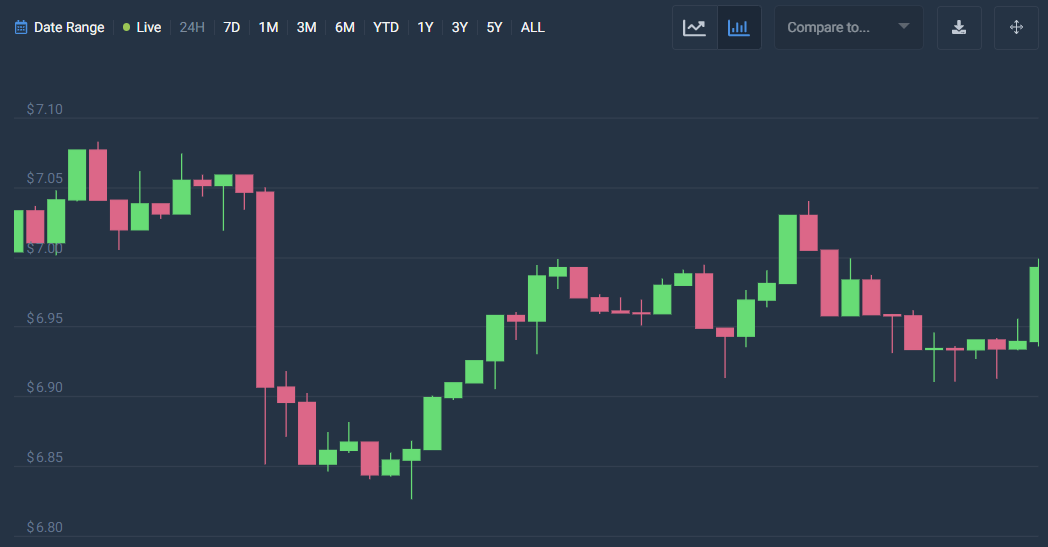

LINK/USD 1-day price analysis: Latest developments

Following a downward swing, ChainLink price analysis demonstrates the market’s instability. This indicates that the price of ChainLink is exhibiting latent dynamics and isn’t growing any less susceptible to a movement toward either extreme. The starting price is $6.98, and it seems like the peak price will be $7. The close price is still $7, while the low price is still at $6.98. The ChainLink market has changed by 0.18%.

The price of LINK/USD looks to be falling below the value of the moving average, indicating a bearish development. The market’s movement appears to be driven primarily by bears. Furthermore, the price of LINK/USD looks to be falling, indicating a contracting market. The possibility of a negative market is apparent right now.

According to ChainLink price analysis, The Relative Strength Index (RSI) is 55, indicating a steady cryptocurrency market. As a result, cryptocurrencies are located in the central-neutral zone. The RSI also seems to be moving upward, which suggests that the market is expanding. The RSI score rises when purchasing actions predominate.

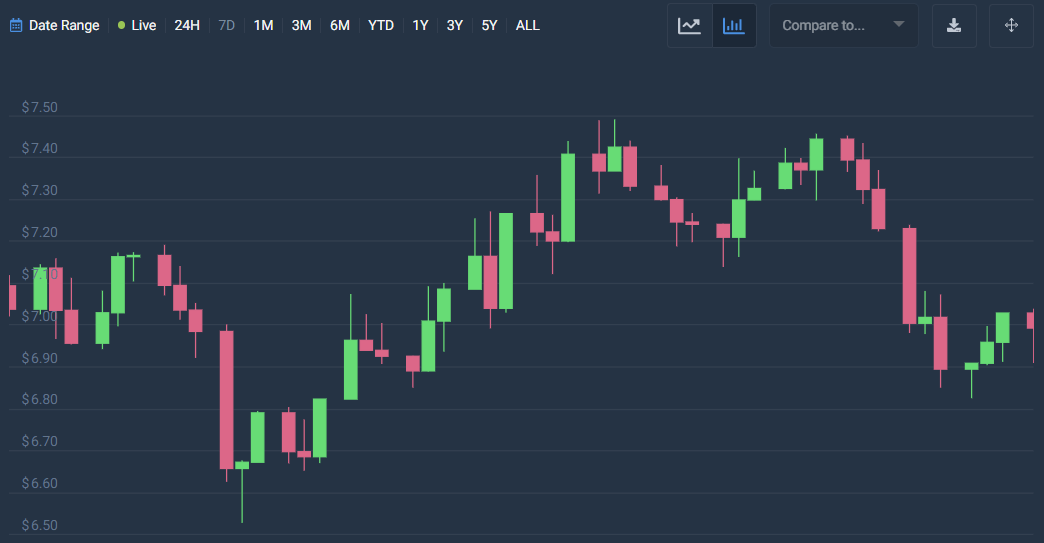

ChainLink price analysis for 7-days

ChainLink price analysis exposes the market’s volatility following a downward movement, indicating that the price is becoming less likely to fluctuate between the two extremes. The high price is evident at $7.04, but the opening price seems to be $7.03. On the other hand, the low price, which has a change of -0.53% and a close price of $6.99, is $6.91.

The Moving Average price looks to be above the price of the LINK/USD, indicating a bullish advance. The market’s trajectory, however, appears to have exhibited negative tendencies during the past several hours. Additionally, the market has chosen to go in a negative direction, which will lower its value and bolster the bearish market control.

The Relative Strength Index (RSI) study of the Chainlink price reveals a steady cryptocurrency with a value of 47. As a result, the LINK cryptocurrency is considered to be below neutral. The RSI path also appears to have changed to a downward movement. The RSI score’s decrease also indicates a predominant selling trend.

ChainLink Price Analysis Conclusion

The cryptocurrency has a lot of room to move toward the negative extreme but is now on a downward trend, per a Chainlink price study. Additionally, it shows that the market is now trending downward and has the potential to do so indefinitely.