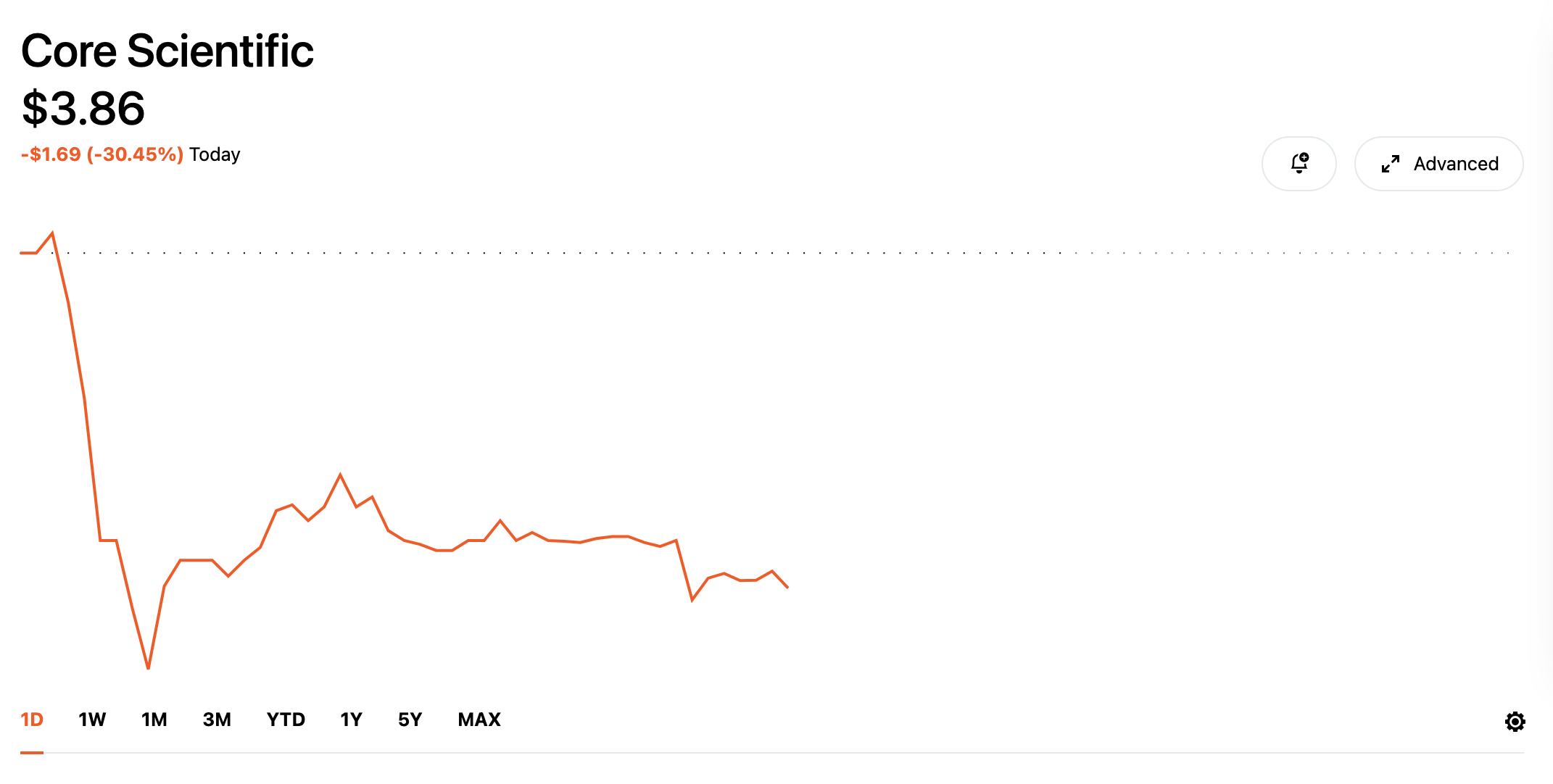

Core Scientific shares plunge 30% on Nasdaq relisting, following a 13-month restructuring process.

Crypto mining firm Core Scientific is facing a turbulent trading session as it relists shares after emerging from bankruptcy. Robinhood data shows Core’s stock, CORZ, declining by over 30% at the time of writing, trading at $3.84.

After undergoing a 13-month restructuring process, the company relisted its shares on the Nasdaq on Jan. 24. In an announcement, Core said it now has a “strengthened balance sheet” after clearing out a $400 million debt.

Core's restructuring plan resulted in converting debt owed to equipment lenders and convertible note holders into equity in the company. Convertible notes are a type of debt that can be converted into stock, and by converting this debt into equity, Core Scientific reduces its financial liabilities.