The global payments industry is increasingly optimistic about the potential of cryptocurrencies and blockchain to enable faster and cheaper transactions. As a result, Ripple and the Faster Payments Council (FPC) organization recently co-hosted a survey to explore these opportunities, titled “Transforming the Way Money Moves.” This report was based on responses from over 950 FPC subscribers—comprising analysts and CEOs from 45 countries—that answered 25 questions related to blockchain payments use cases, digital asset ownership, and potential usage barriers. The survey was conducted during the first half of 2022.

More than half of payment executives believe most merchants will accept crypto

According to the survey results of FPC subscribers, an overwhelming majority (97%) expressed faith in the potential of cryptocurrency and blockchain technology to revolutionize faster payments over the next three years. This optimism was even more pronounced in Middle East and African payment executives, with 27% expecting most merchants to adopt crypto payments by 2024.

This trend could be primarily attributed to the development of solutions like mobile payments and central bank digital currencies (CBDCs). Over half of the surveyed payment executives also predicted that most merchants would accept crypto payments within one to three years. Ripple and FPC have pointed out this trend as a sign of increasing optimism in these regions.

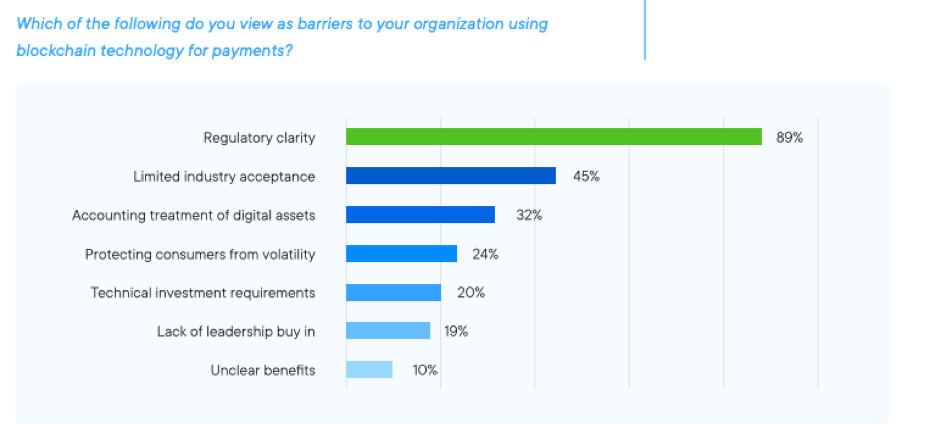

According to the report, 52% of respondents expressed interest in using cryptocurrency for payments, though only 17% had adopted it. In addition, regulatory ambiguity and limited industry acceptance were identified as significant barriers to crypto-enabled payments adoption. Specifically, 90% of respondents cited regulatory clarity as an obstacle, while 45% pointed out a lack of widespread adoption.

Pymnts and Bitpay released a survey in 2022, highlighting that the majority of businesses with annual revenue of $1 billion had adopted cryptocurrency payments to attract new customers. Furthermore, the survey suggested that this trend was likely to continue in the future. Also, the survey highlighted the growing acceptance of digital currencies in the commercial sector. The survey also revealed that businesses were increasingly turning to alternative payment methods, such as crypto payments, due to their potential for cost savings and better customer experience.

According to a report by Ripple, the potential of crypto-related technologies is immense, with as many as 90% of enterprises in the United States, United Kingdom, and China experimenting with blockchain technology by early 2023. In his comments about how long it will take for the XRP lawsuit with the United States Securities and Exchange Commission to be resolved, Ripple CEO Brad Garlinghouse said that he expects a decision “certainly in 2023”. The litigation began almost two and a half years ago, but the company continues pushing for a speedy resolution.