Digital Realty Trust, Inc. (NYSE: DLR), a leading global data center real estate investment trust, has been making waves in the investment world, offering investors a unique opportunity to profit from the AI revolution while enjoying a steady 4% dividend yield. In this article, we will delve into why Digital Realty Trust is considered a solid investment during both good and bad times, its growth prospects, and the potential risks associated with this investment.

Robust Growth in the Data Center Market

Digital Realty Trust has positioned itself as a formidable data center player, boasting favorable supply-demand dynamics. The construction of data centers requires significant capital investment, creating a high barrier to entry. Digital Realty Trust leverages this barrier by raising rents and expanding its real estate footprint. As the IT revolution continues to evolve, the demand for processing and computing power, especially with the advent of artificial intelligence, is expected to increase exponentially. This favorable backdrop bodes well for a broadly positioned data center REIT like Digital Realty Trust.

Digital Realty Trust is poised to benefit from the accelerating adoption of generative artificial intelligence (AI). According to Bloomberg estimates, generative AI sales are projected to surge tenfold between 2023 and 2032. As computing-intensive AI applications drive the need for more powerful data centers, Digital Realty Trust stands to gain from this trend. The trust’s alignment with underlying innovation trends makes it a compelling long-term investment in the data center market.

Recession-Proof investment

One key aspect that makes Digital Realty Trust an attractive investment is its resilience to economic downturns. The increasing reliance on data centers in computer technology, IT, and artificial intelligence positions the trust as a recession-proof investment. These long-term investment themes ensure that demand for data center solutions remains robust, providing stability for funds from operations and dividend growth.

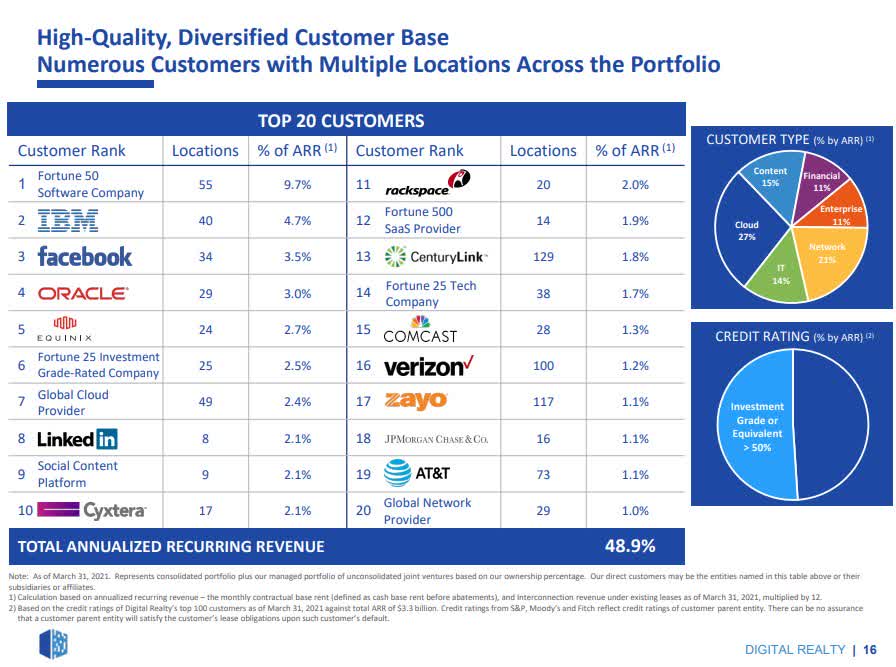

Digital Realty Trust boasts a diverse portfolio of over 5,000 customers, including prominent names in the technology and IT industry. With a presence in 54 metropolitan areas worldwide, the trust covers major cities in the U.S., Europe, Latin America, Africa, and Australia. While the U.S. accounts for approximately 50% of its sales, Europe contributes 24%, making these two geographic regions the primary revenue sources. However, Digital Realty Trust is not resting on its laurels and is expanding into regions beyond its core markets. This international expansion drive is a key reason to invest in the trust.

Aggressive growth through acquisitions

Digital Realty Trust has pursued aggressive growth through acquisitions in recent years, accumulating a portfolio of more than 300 data centers worldwide. Notable tenants include Meta Platforms, IBM, Oracle, Comcast, and AT&T. This expansion strategy strengthens the trust’s market position and revenue streams.

Digital Realty Trust has a track record of steadily increasing its dividend payout, with a compound annual growth rate of 10% since 2005. While the current dividend yield stands at 3.6%, the trust’s consistent growth suggests the potential for passive income investors to see their yields rise over time. If Digital Realty Trust grows its dividend at a 10% annual rate, the yield could increase from 3.6% today to 5.8% in five years. However, it is important to note that dividend growth is not guaranteed, and the trust may choose to adjust its strategy in the future.

FFO Guidance and Valuation

Digital Realty Trust projects core funds from operations (FFO) of $6.58-6.62 per share for the current year. Based on a stock price of $135.23, this equates to a 20.5x FFO multiple. While this valuation may not be considered cheap, it reflects the trust’s history of achieving a 10% compound annual growth rate between 2005 and 2022. This growth potential suggests that passive income investors could experience substantial income growth in the future.

While Digital Realty Trust appears to be a promising investment, there are potential risks. Non-data center REITs may enter the real estate market, posing competition and potentially affecting Digital Realty Trust’s growth. Additionally, as the trust expands, sustaining meaningful growth without costly acquisitions may become increasingly challenging. A slowdown in dividend growth is also a risk that investors should be aware of.

Digital Realty Trust is a rapidly growing data center REIT with a strong international presence and growth potential. The data center industry is operating in a growth-focused environment, and the demand for high-capacity data centers to accommodate innovations in artificial intelligence is expected to drive further growth. The trust’s ability to increase its dividend consistently while maintaining moderate pay-out metrics makes it an attractive option for long-term investors.

Currently offering a 3.6% yield, Digital Realty Trust may not appear as lucrative as some other investments. However, its history of dividend growth suggests the potential for higher yields in the future. As the trust continues to expand globally and capitalize on emerging technology trends, it remains a compelling choice for investors looking to benefit from the data center market’s growth and the AI revolution.